OPEC EXPORT REVENUES $711 BLN

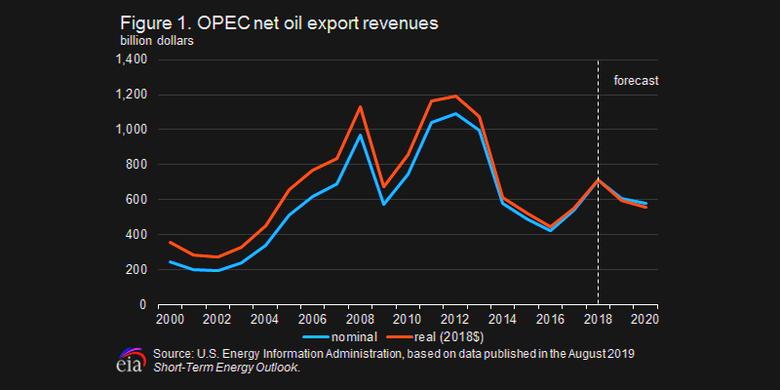

U.S. EIA - The U.S. Energy Information Administration (EIA) estimates that members of the Organization of the Petroleum Exporting Countries (OPEC) earned almost $711 billion in net oil export revenues in 2018 (Figure 1). The estimate is up 29% from 2017, but about 40% lower than the record high of almost $1,200 billion in 2012. The 2018 earnings increase is mainly a result of higher crude oil prices. The Brent spot price rose from an annual average of $54 per barrel (b) in 2017 to $71/b in 2018. However, EIA forecasts annual OPEC net oil export revenues will decline to $593 billion in 2019 and to $556 billion in 2020. Decreasing OPEC revenues are primarily a result of decreasing production among a number of OPEC producers.

EIA estimates net oil export revenues based on oil production—including crude oil, condensate, and natural gas plant liquids—and total petroleum consumption estimates, as well as crude oil prices forecast in the August 2019 Short-Term Energy Outlook (STEO). EIA's net oil export revenues estimate assumes that exports are sold at prevailing spot prices and adjusts the prices for benchmark crude oils forecast in STEO (Brent, West Texas Intermediate, and the average imported refiner crude oil acquisition cost) with historical price differentials among spot prices for the different OPEC crude oil types. For countries that export several different varieties of oil, EIA assumes that the proportion of total net oil exports represented by each variety is the same as the proportion of the total domestic production represented by that variety. For example, if Arab Medium represents 20% of total oil production in Saudi Arabia, the estimate assumes that Arab Medium also represents 20% of total net oil exports from Saudi Arabia.

Although OPEC net export earnings include estimated Iranian revenues, they are not adjusted for possible price discounts that trade press reports indicated Iran may have offered its customers after the United States announced its withdrawal from the Joint Comprehensive Plan of Action in May 2018. The United States reinstated sanctions targeting Iranian oil exports in November 2018. Similarly, EIA does not adjust for Venezuelan crude oil exports to China or India for volumes that are sent for debt repayments to China and Russian energy company Rosneft, respectively, and thus do not generate cash revenue for Venezuela.

If the $711 billion in net oil export revenues by all of OPEC is divided by total population of its member countries and adjusted for inflation, then per capita net oil export revenues across OPEC totaled $1,416 in 2018, up 26% from 2017 (Figure 2). The increase in per capita revenues likely benefited member countries that rely heavily on oil sales to import goods, fund social programs, and otherwise support public services.

In addition to benefiting from higher prices, some OPEC member countries have increased export revenues by reducing domestic consumption and consequently exporting more. For example, Saudi Arabia has significantly reduced the amount of crude oil burned for power generation. Limiting crude oil burn allowed Saudi Arabia to export more crude oil and to maximize revenues.

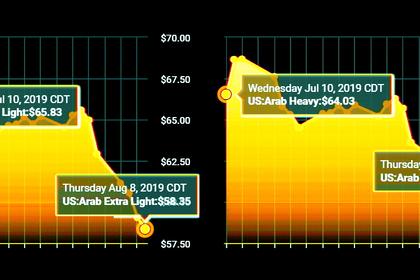

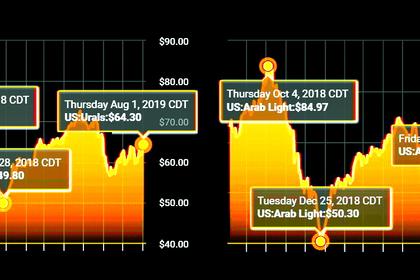

Others have been able to charge higher premiums based on the quality of their crude oil streams. As the global slate of crude oil has changed with more light crude oil production (with higher API gravity), OPEC members have benefited from a narrowing price discount for their heavy crude oils, which are typically priced lower than lighter crude oils because of quality differences. Smaller discounts for OPEC members' heavier crude streams contributed to higher spot prices for the OPEC crude oil basket price, which incorporates spot prices for the major crude oil streams from all OPEC members (Figure 3).

Despite the increase in annual average crude oil prices in 2018, OPEC revenues fell during the second half of 2018, mainly because of lower production and export volumes from Iran and Venezuela (Figure 4). EIA estimates that OPEC total petroleum liquids production decreased slightly in 2018 when increased production in Saudi Arabia, Iraq, and Libya could not offset significant declines in Iranian and Venezuelan production. Combined crude oil production in Iran and Venezuela fell by almost 800,000 barrels per day (b/d), or 14%, in 2018 and again by over 1.0 million b/d in the first seven months of 2019. Although Iranian net oil export revenues increased by 18% from 2017 to 2018, a year-to-date comparison indicates a significant decrease in revenues in 2019 (Figure 4). EIA estimates that from January to July 2018, Iran received about $40 billion in export revenues, compared with an estimated $17 billion from January to July 2019. Further decreases in OPEC members' production beyond current EIA assumptions would further reduce EIA's OPEC revenue estimates for 2019 and 2020.

----

Earlier: