RUSSIA'S RATING 'BBB'

FITCHRATINGS - Fitch Ratings - London - 09 August 2019:

Fitch Ratings has upgraded Russia's Long-Term Foreign- and Local-Currency Issuer Default Ratings (IDRs) to 'BBB' from 'BBB-'. The Outlooks are Stable.

KEY RATING DRIVERS

The upgrade of Russia's IDRs reflects the following key rating drivers and their relative weights

HIGH

Russia has entrenched a credible and consistent policy framework that will deliver improved macroeconomic stability, reduce the impact of oil price volatility on the economy, and support increased resilience to external shocks. Fitch considers that Russia's strengthened policy mix, underpinned by a more flexible exchange rate, a strong commitment to inflation-targeting and a prudent fiscal strategy, and its robust fiscal and external balance sheets will help the sovereign to cope with heightened sanctions' risk. However, the continued threat of sanctions' escalation will weigh on Russia's external financing flexibility, investment and growth prospects.

Inflationary pressures have eased and average inflation will remain close to Russia's inflation target of 4% in 2020-2021. After responding decisively to increased inflationary risks in late 2018, the Central Bank of Russia (CBR) has reversed this monetary tightening through 25bp cuts in June and July, bringing its key rate to 7.25%. Fitch expects the central bank to remain focused on achieving a sustainably low level of inflation through a prudent easing cycle, strengthening transmission mechanisms, cementing institutional credibility and sustainably anchoring expectations.

Increased exchange rate flexibility and compliance with the fiscal rule support the economy's capacity to absorb real, financial and geopolitical shocks, and limit the impact of oil price volatility on the economy. After a sharp 17% depreciation against the US dollar in 2018, the rouble appreciated by 10% in 1H19, reflecting improved investor risk appetite and reduced perceptions regarding sanctions risk and despite lower average oil prices. The correlation between the rouble and oil prices has weakened due to the sterilisation of excess oil revenues and volatile perceptions regarding sanctions risks.

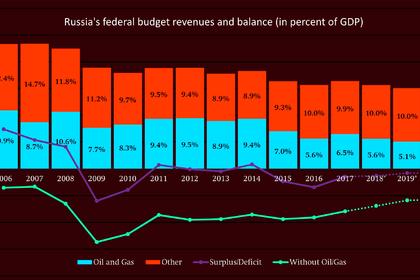

Fitch expects fiscal policy to remain conservative and guided by the fiscal rule, supporting improved macroeconomic stability, continued fiscal surpluses and reduction of the non-oil federal fiscal deficit. After a 2.6% GDP surplus in 2018, the federal budget will remain in surplus in 2019 (1.8% of GDP) and at least through 2021, albeit at a lower level, supported by higher-than-budgeted oil prices, continued non-oil revenue growth, which will accommodate planned expenditure increases related to the National Projects. Russia's prudent fiscal policy has reduced the federal budget breakeven oil price from USD110 in 2013 to USD43 in 2018, while the non-oil budget deficit has declined to 6.0% of GDP from 9.4% over the same period, and will fall further to 5.6% by 2021.

MEDIUM

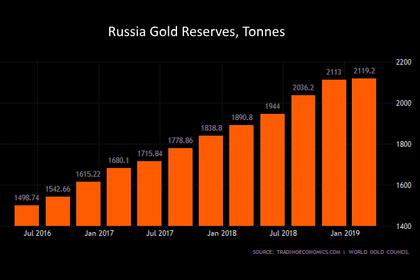

International reserves rose to USD520 billion in July 2019, the highest level since the global financial crisis, and will increase further to USD537 billion in 2019 and USD591 billion by 2021 supported by continued current account surpluses (5.2% of GDP in 2019 easing to 2.5% in 2021) and the sterilisation of above-budgeted oil revenues. Reserve coverage will rise to a robust 13.6 months of CXP by end-2019 and remain close to this level in 2020-2021, at more than double the forecast 'BBB' median. The international liquidity ratio (466% in 2019) is the highest in the 'BBB' rating category.

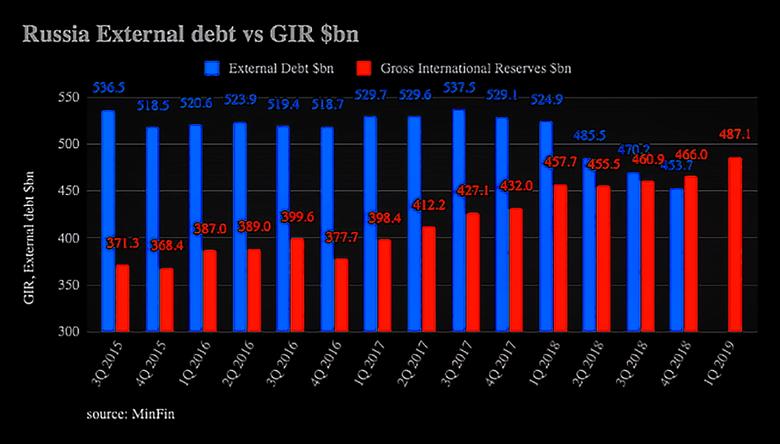

Russia's net external creditor position (forecast at 35% of GDP in 2019) is underpinned by the deleveraging of banks and corporates and greater exchange rate flexibility. External debt service will be in line with the current forecast for the 'BBB' median, averaging 13.5% of current external receipts (CXR) in 2019-2021. The sovereign's net foreign assets will strengthen to 29% of GDP in 2019.

Russia's 'BBB' IDRs also reflect the following key rating drivers

Fitch expects general government debt to reach 14.9% of GDP in 2019 (12.7% at the federal level), the lowest in the 'BBB' category and with relatively lower exposure to currency risk (21% foreign currency-denominated). General government deposits will increase to 16.2% of GDP (including 2.1% of GDP in FX in June 2019 in addition to the liquid portion of the National Wealth Fund (NWF)). Fitch projects that the government will become a net creditor in 2019 and net debt will average -1.5% of GDP in 2020-2021.

Fitch forecasts the NWF liquid portion to surpass 7% of GDP in 2020 (total 10%) from 5.7% in 2019. The fund will then be able to diversify investments towards higher yielding but less liquid FX assets abroad. Discussions are underway regarding the possibility of allocating a portion of these investments to finance projects in Russia. Fitch's base case is that the scale of this domestic investment will not reverse the progress in terms of macro stability gains or the reduced impact of oil price volatility in the economy.

In early August, the US government announced the second round of State Department sanctions under the CBW Act that include 1) the US opposing IFIs financial and technical support for Russia; 2) preventing US banks from participating in sovereign non-rouble primary bond issuance; and 3) restrictions on chemical and biological exports. Russia's strengthened policy mix, the sovereign's low reliance on external financing and robust FX buffers provide the sovereign with flexibility to adjust its external financing strategy to the new sanctions.

Fitch considers that sanctions' risk, including further measures targeting sovereign debt, will remain high and difficult to anticipate due to the increased number of geopolitical flashpoints (Ukraine, Syria, Venezuela), US domestic politics, differences between the Trump administration and the US Congress over sanction policy, and the absence of a sanctions de-escalation path. Evolving versions of sanction legislation aimed at Russia (including targeting state-owned banks and all sovereign debt) and more recently legislation targeting energy projects, including Nordstream II, continue to be discussed in Congress. The exact timing, form and actual execution of further sanctions legislation remain uncertain.

Fitch believes that Russia's twin surpluses, low government debt, fiscal assets and large foreign exchange reserves means that it would be able to withstand sanctions, for example keeping foreign investors from holding and transacting in new sovereign debt, although it would add to the cost of financing. The agency does not believe that US sanctions that prevent the servicing of existing Russian sovereign debt or prevent Russian banks from transacting in US dollars are likely. Nevertheless, current sanctions and uncertainty regarding the potential type and scope of future sanctions will continue to weigh on growth prospects, create risk for sovereign and external financing flexibility and continue to test Russia's macroeconomic and financial sector resilience.

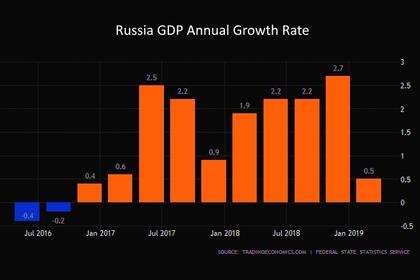

Russia's weak growth outlook is a credit weakness. Growth slowed markedly in 1H19 (0.7% yoy based on Ministry of Economy estimates). While faster budget expenditure execution, recovering private consumption and improved external demand will lift annual growth to 1.2% in 2019, Fitch expects growth to average 1.9% in 2020-2021, below the forecast 3.1% 'BBB' median. Government plans to increase growth by addressing labour market and investment constraints face risks in terms of delays in investment projects' execution, limited progress in increasing private investment, as well as reducing uncertainty and the state's role in the economy. Perceived failure to raise growth and living standards could increase political and social pressures on the policy framework to provide greater support for domestic economic activity.

The effects of financial markets volatility and the risk of sanctions targeting state-owned banks on the banking system have so far been limited in terms of capitalisation (12.1% in May) and asset quality (10.3% NPL, 89% provisioned). The large share of public banks (67% of total assets) represents a contingent liability for the sovereign, given a track record of government and central bank support and the likelihood of continued capitalisation needs, although these are now estimated to be relatively modest. The CBR has further tightened macro-prudential measures, including the introduction of payment-to-income (PTI) ratios, to cool down rapid consumer lending growth given its still fast pace.

Russia's commodity dependence in terms of export receipts and fiscal revenues remains high relative to rated peers, while the country's ranking in the World Bank governance indicators is well below the peer median. The government and president's popularity have come under pressure, especially after the 2018 increase in the retirement age, although they have recovered somewhat in recent months. Increased social activism and willingness to protest have remained localised and have not given shape to a national political movement or strengthened the disorganised opposition.

ESG Considerations

Russia has an ESG Relevance Score of 3 for Demographic Trends as adverse demographic trends contribute to the economy's weak performance and medium-term growth potential, which, in combination with others factors, is relevant for the rating.

Russia has an ESG Relevance Score of 4 for Human Rights and Freedoms as World Bank Governance Indicators have the highest weight in Fitch's Sovereign Rating Model (SRM) and are relevant to the rating and a rating driver. Russia scores poorly relative to peers.

Russia has an ESG Relevance Score of 5 for Political Stability and Rights as World Bank Governance Indicators have the highest weight in Fitch's SRM and are therefore highly relevant to the rating and a rating driver. Russia is exposed to geopolitical risks.

Russia has an ESG Relevance Score of 5 for Rule of Law, Institutional & Regulatory Quality and Control of Corruption as World Bank Governance Indicators have the highest weight in Fitch's SRM and in the case of Russia detract from the business environment; this is highly relevant to the rating and a key rating driver with high weight.

Russia has an ESG Relevance Score of 4 for International and Trade, as geopolitical tensions and heightened sanctions risks is relevant for the rating and a rating driver. Sanctions could constrain future sovereign financing flexibility and negatively affect macroeconomic stability, the business environment and growth prospects.

Russia has an ESG relevance Score of 4 for Creditors Rights as willingness to service and repay debt is relevant to the rating and a rating driver.

SOVEREIGN RATING MODEL (SRM) AND QUALITATIVE OVERLAY (QO)

SRM and QUALITATIVE OVERLAY (QO)

Fitch's proprietary SRM assigns Russia a score equivalent to a rating of 'BBB+' on the Long-Term FC IDR scale.

Fitch's sovereign rating committee adjusted the output from the SRM to arrive at the final LT FC IDR by applying its QO, relative to rated peers, as follows:

- Structural features -1 notch, to reflect geopolitical tensions, the impact of existing sanctions and the high likelihood of new punitive sanctions that could constrain sovereign financing flexibility and private sector access to international financing, and could negatively affect macroeconomic stability, the business environment and growth prospects.

Fitch's SRM is the agency's proprietary multiple regression rating model that employs 18 variables based on three year centred averages, including one year of forecasts, to produce a score equivalent to a LT FC IDR. Fitch's QO is a forward-looking qualitative framework designed to allow for adjustment to the SRM output to assign the final rating, reflecting factors within our criteria that are not fully quantifiable and/or not fully reflected in the SRM.

RATING SENSITIVITIES

The following factors may, individually or collectively, result in positive rating action:

-Higher growth prospects while preserving improved macroeconomic stability;

-Continued strengthening of fiscal and external savings buffers, for example, through sustained high oil prices and windfall revenues;

-Improvement of structural indicators, such as governance standards.

The following factors may, individually or collectively, result in negative rating action:

-Imposition of additional sanctions that undermine macroeconomic and financial stability, or impede debt service payments;

-Changes in the policy framework that undermine policy credibility and macroeconomic stability gains, for example due to sustained low growth prospects;

-Sustained erosion of the sovereign balance sheet, for example derived from the materialisation of contingent liabilities from the large public sector.

KEY ASSUMPTIONS

Fitch assumes that EU and US sanctions remain in place over the long term.

Fitch currently forecasts Brent crude to average USD65/b in 2019, USD62.5/b in 2020 and USD60/b in 2021.

-----

Earlier: