SAUDIS INVESTMENT FOR INDIA $100 BLN

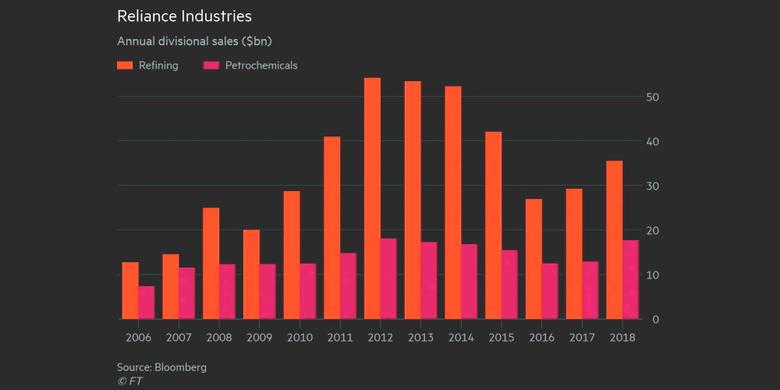

PLATTS - Saudi Aramco will acquire a 20% stake in Reliance Industries' oil-to-chemical business, expanding Saudi Arabia's burgeoning footprint in India's fast-growing refining sector.

The deal, announced by Reliance Chairman Mukesh Ambani at an investors meeting Monday, will see the Saudi state-owned oil giant pay an implied $15 billion for the 20% stake of the oil-to-chemicals division, which Reliance values at $75 billion.

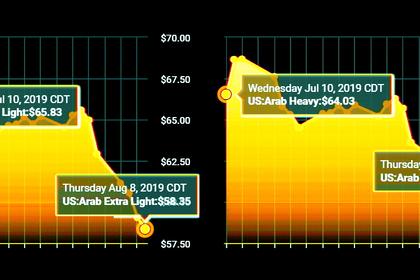

The transaction, which is subject to due diligence, definitive agreements and regulatory approvals, will also see Aramco supply 500,000 b/d of crude on a long-term basis to Reliance's Jamnagar refinery complex.

"This signifies perfect synergy between the world's largest oil producer and the world's largest integrated refinery and petrochemicals complex," Ambani said, calling the acquisition among the largest foreign investments in India.

Saudi Arabia is India's top crude supplier, shipping about 800,000 b/d to the country.

INDIA TOP PRIORITY

Aramco, which is due to hold its first ever earnings call later Monday, has been eying several opportunities in India, with Saudi oil minister Khalid al-Falih saying in February during Crown Prince Mohammed bin Salman's state visit to New Delhi that the country was the kingdom's "No. 1 priority for investment."

Officials unveiled plans to invest $100 billion in India, with the bulk of the funds going toward the infrastructure and energy sectors.

Aramco has already signed an initial agreement to take a stake in the planned Ratnagiri refinery and petrochemicals complex on the western coast with a capacity of 60 million mt/year. The project is being jointly built by state-run refiners Indian Oil Corp., Hindustan Petroleum Corp. and Bharat Petroleum Corp.

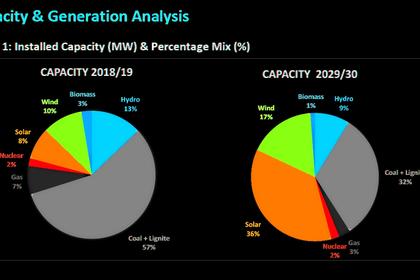

The India projects are part of Aramco's overall strategy of doubling its global refining capacity to some 10 million b/d by 2030, primarily in the growth economies of Asia, to lock in supply outlets for its crude.

Aramco, which is aiming to publicly list shares in 2020 or 2021, pumps about 10 million b/d and says it has the capacity to produce up to 12.5 million b/d.

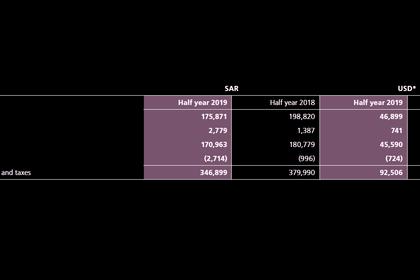

Ahead of its earnings call, the Saudi national oil company announced net income for the first half of 2019 of $46.9 billion, down from $53.2 billion for the same period last year, as it suffered from lower oil prices.

The year-on-year slump aside, Aramco remains the world's most profitable company by far.

-----

Earlier: