U.S., CHINA ESCALATION

U.S., CHINA ESCALATION

API - August 23, 2019 - Today, API issued the following statement on China's announcement of retaliatory tariffs on $75 billion worth of U.S. goods, including American crude oil and several other petroleum products.

"This escalation of the U.S.- China trade war is another step in the wrong direction, the consequences of which will be felt by American businesses and families," said Kyle Isakower, API's Vice President of Regulatory and Economic Policy. "In addition to the impacts on the U.S. economy and jobs, U.S. energy leadership and global competitiveness are threatened as U.S. natural gas and oil exports continue to serve as targets for retaliation."

"We urge the Administration to quickly come to a trade agreement with China that would lift all tariffs under Section 301, including the damaging retaliatory tariffs on American energy exports."

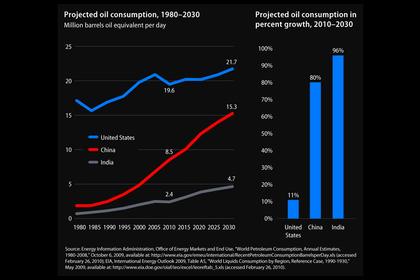

Even before China's formal retaliation against U.S. crude exports, the negative impact of the trade war was already apparent. China's imports of U.S. crude oil fell from 22% (October 2017 to June 2018) to just 3% of total U.S. crude exports after Section 301 tariffs were first implemented.

Additionally, the U.S. natural gas and oil industry is negatively impacted by the Administration's tariffs on over 100 industrial products under Section 301 and by steel tariffs under Section 232, and is subject to a 25% retaliatory tariff on U.S. liquified natural gas (LNG) exports to China.

-----

Earlier:

2019, August, 23, 11:00:00

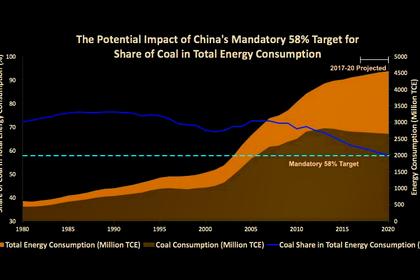

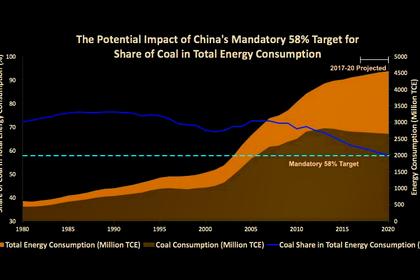

CHINA'S COAL DEMAND UPDOWN

Though the share of coal in the China’s total energy mix fell to 59% last year from 68.5% in 2012, overall consumption in 2018 rose 3% from a year earlier to 3.82 billion tonnes,

2019, August, 21, 12:30:00

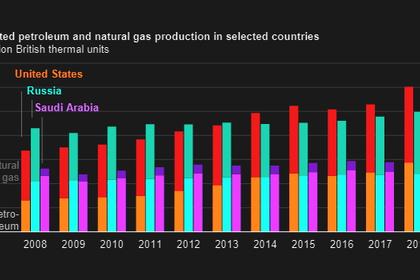

U.S. OIL, GAS PRODUCTION UP

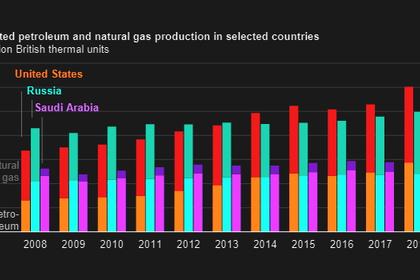

U.S. petroleum and natural gas production increased by 16% and by 12%, respectively, in 2018, and these totals combined established a new production record.

2019, August, 21, 12:25:00

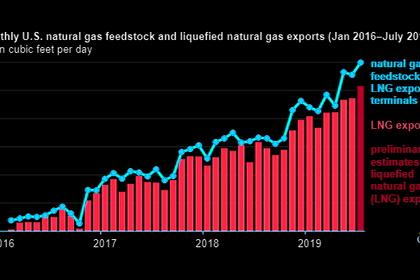

U.S. LNG EXPORTS UP

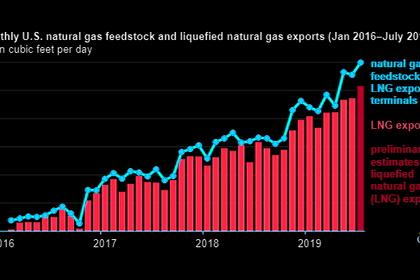

U.S. LNG exports set new records in June and July 2019 at 4.8 Bcf/d and 5.2 Bcf/d, respectively,

2019, August, 19, 11:40:00

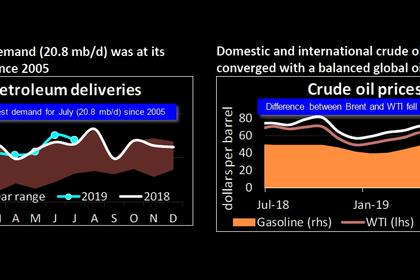

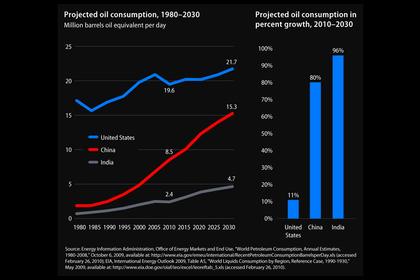

U.S. PETROLEUM DEMAND 20.8 MBD

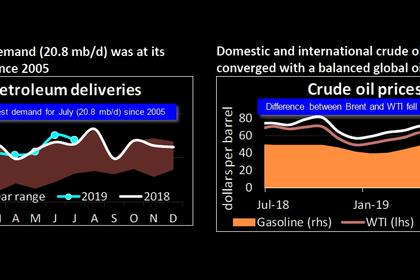

Total U.S. petroleum demand averaged 20.8 million barrels per day (mb/d) in July 2019, which represented a 0.9% year-over-year increase and the highest demand for the month since 2005,

2019, August, 16, 10:25:00

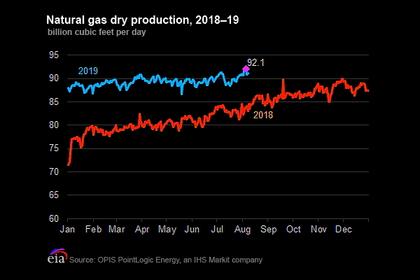

U.S. GAS PRODUCTION UP

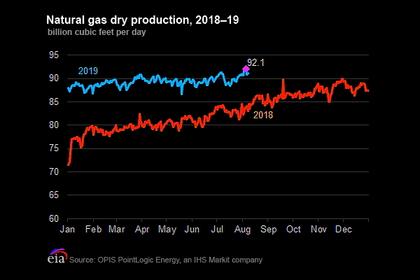

U.S. natural gas production continued to increase in August despite relatively low natural gas spot prices

2019, August, 14, 12:20:00

CHINA'S OIL THROUGHPUT UP 5.6%

For the first seven months of 2019, Chinese crude throughput rose 5.6% from a year earlier to 369.73 million tonnes, or 12.73 million bpd, the NBS reported.

2019, August, 13, 13:25:00

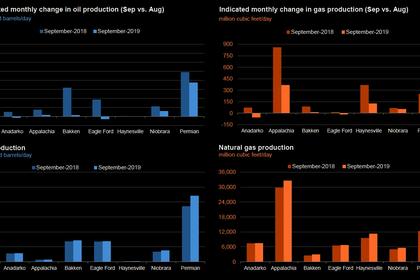

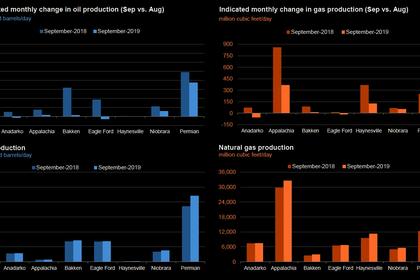

U.S. PRODUCTION: OIL + 85 TBD, GAS + 729 MCFD

U.S. EIA - Crude oil production from the major US onshore regions is forecast to increase 85,000 b/d month-over-month in August from 8,683 to 8,768 thousand barrels/day, gas production to increase 729 million cubic feet/day from 80,866 to 81,595 million cubic feet/day .

All Publications »

Tags:

USA,

CHINA,

TRADE,

WAR