U.S., CHINA ESCALATION: $550 BLN

PLATTS - The US will raise the tariff on $250 billion worth of Chinese imports from 25% to 30% on October 1, and raise the current 10% tariff on another $300 billion of Chinese imports to 15% on September 1, President Trump tweeted late Friday.

"Sadly, past Administrations have allowed China to get so far ahead of Fair and Balanced Trade that it has become a great burden to the American Taxpayer," Trump tweeted. "As President, I can no longer allow this to happen!"

Trump's plan to raise these tariffs by five percentage points was in response to China's announcement early Friday that it planned to levy a 5% tariff on US crude imports from September 1, part of a new round of tariffs on $75 billion worth of US goods imports that will be implemented in two batches from September 1 and December 15.

Renewed concerns over spiraling US-China trade tensions caused oil futures to plunge. NYMEX October WTI settled down $1.18 at $54.17/b and ICE October Brent was 58 cents lower on the day at $59.34/b. Following Trump's announcement, ICE Brent slipped further, trading around $58.87/b at 2138 GMT.

"The weakness in oil prices now are almost totally dependent on the daily trade war narrative," Joe McMonigle, an analyst with Hedgeye Risk Management, said Friday.

While the ongoing trade war continues to weigh on prices, analysts said that the 5% tariff on US crude imports will not have a significant impact on the global market.

Paul Sheldon, chief geopolitical adviser with S&P Global Platts Analytics, said that if China ultimately moves forward with the US crude tariff, the impact on US pricing would likely be limited.

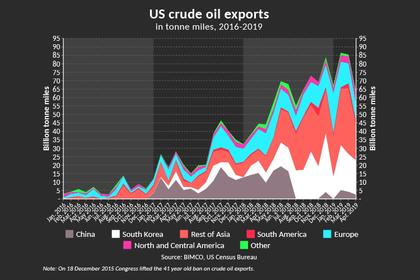

"US sales are already well-diversified, and Chinese refiners are not particularly well suited to US light sweet," Sheldon said Friday. "Moreover, the fear of crude tariffs already changed buying patterns over a year ago."

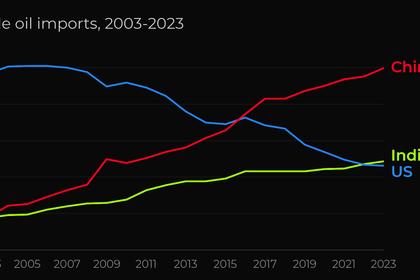

After climbing to a high of 510,000 b/d in June 2018, China imported no US crude in August, September, and October of 2018 and none in January 2019, as trade tensions between the two countries mounted. China imported 247,000 b/d of US crude in May, according to the latest US Energy Information Administration data.

-----

Earlier: