U.S. COAL DOWN

WORLD COAL - Thursday, 22 August 2019 - Moody's expects coal sector EBITDA to decline more than 3% over the next 12 months.

Thermal coal export prices have dropped, while economic, environmental and social factors will continue to weigh on demand from utilities.

Moody's has lowered the outlook for the North American coal industry to negative from stable, the rating agency says in a new report.

"Coal producers' profitability will worsen significantly over the next 12 - 18 months, driven by a substantive decrease in export prices for thermal coal, particularly in Europe, combined with meaningful open contract positions for some producers in 2020," says Benjamin Nelson, a Moody's VP-Senior Credit Officer.

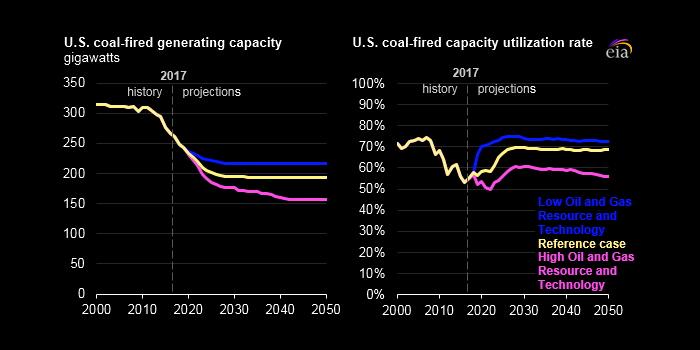

The combination of a now-weakened export market and significant retirement of coal-fired power plants in 2018 is creating an oversupplied domestic market and could drive prices lower, especially if natural gas prices remain very low and coal producers attempt to maintain production near current levels, adds Nelson.

The longer-term outlook for North American thermal coal is also increasingly stressed, as a confluence of economic, environmental and social factors weigh heavily on demand from utilities. Moody's projects thermal coal volumes to drop significantly over the next decade as utilities switch to natural gas and renewable energy, which continues to benefit from government subsidies.

-----

Earlier:

2019, July, 2, 14:30:00

U.S. FOSSIL FUELS UP

Fossil fuels—petroleum, natural gas, and coal—have accounted for at least 80% of energy consumption in the United States for well over a century.

|

2019, June, 24, 12:00:00

COAL PRICES DOWN

Prices for benchmark premium Australian coal out of Newcastle hit their weakest since September 2016 last week at $70.78 per ton and are likely to fall further given a slowing global economy.

|

2019, June, 6, 14:50:00

U.S. COAL IS CHEAPER

The new analysis finds that, on average, the levelised cost of electricity from the coal fleet is less than the levelised cost of new natural gas combined cycle (NGCC), new wind and new solar.

|