U.S. LNG FOR LATIN AMERICA UP

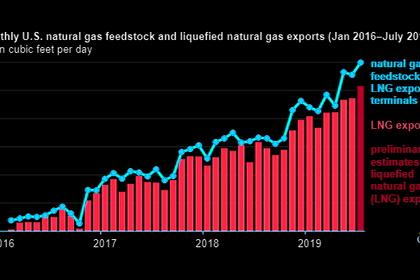

PLATTS - Feedgas flows to US LNG export terminals reached a new record of 6.5 Bcf/d on Friday, subject to revisions, amid robust demand in Latin America and positive netback spreads that are expected to strengthen into October, S&P Global Platts Analytics data show.

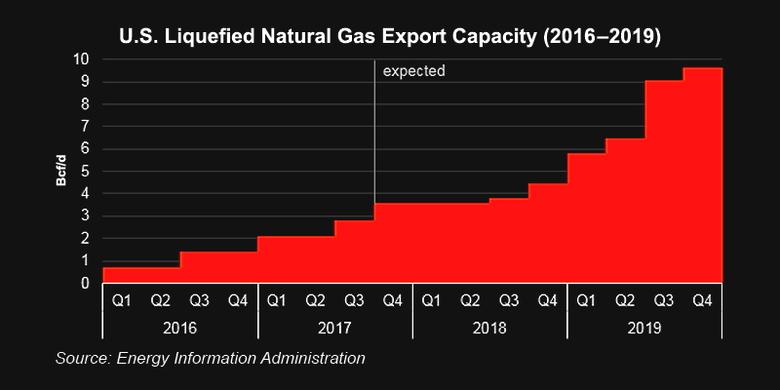

The ramp-up over the past week came as Freeport LNG in Texas became the sixth major US liquefaction facility to begin production, Cheniere Energy finished maintenance at its Sabine Pass facility in Louisiana and Kinder Morgan continued to prepare its first cargo at its Elba terminal in Georgia.

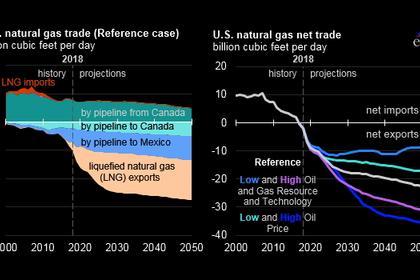

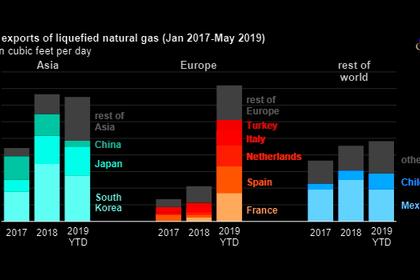

In addition to a supply push from new capacity coming online along the Gulf and Atlantic coasts, there has been a near-term demand pull into secondary markets like Brazil and Mexico. Brazil's Petrobras said recently it was looking to cut Bolivian gas pipeline imports in favor of more economic LNG, while Mexico continues to wait for commercial start-up of the cross-border Sur de Texas-Tuxpan (STT) pipeline.

The preliminary evening cycle US pipeline nominations for Friday were bolstered by Sabine Pass trains 3 and 4 having returned to service after three weeks of scheduled maintenance and Cheniere's export facility near Corpus Christi, Texas, operating at full capacity on trains 1 and 2. Nominations are subject to revision and often change from one day to the next.

Most recently, the market has seen relatively weak netback spreads, which Platts Analytics estimates as only slightly positive from Western Europe and roughly 30 cents/MMBtu from Platts JKM, the benchmark price for spot-traded LNG in Northeast Asia.

But strong contango in the derivatives markets suggest that spreads will open up this fall, with the Dutch Title Transfer index, or TTF, netback opening up to 60 cents/MMBtu in October, while the JKM swaps indicate a spread of over $1.50/MMBtu during the equivalent export period.

As long as there is a positive spread, LNG will flow to those markets.

While further fall maintenances may still be in store for US LNG export facilities, the forward curve suggests that the immediate threat of economic shut-ins may have passed, Platts Analytics data show.

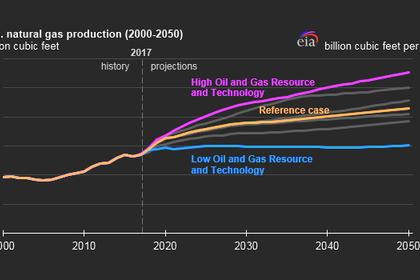

With the startup of Freeport LNG, all of the export facilities that make up the first wave of major US LNG terminals are producing LNG. A dozen or so other export facilities -- the so-called second wave -- are actively being developed for startup in the early to mid-2020s, at a time when the global supply stack could face a shortage. Some are, however, having difficulty securing sufficient offtake contracts to finance construction.

-----

Earlier: