WORLD OIL DEMAND WILL UP BY 1.14 MBD

OPEC - Monthly Oil Market Report, 16 August 2019

Oil Market Highlights

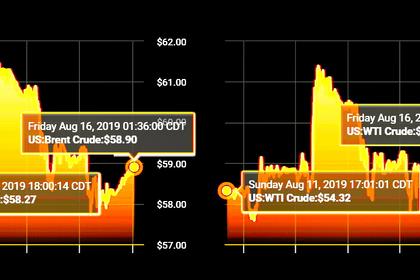

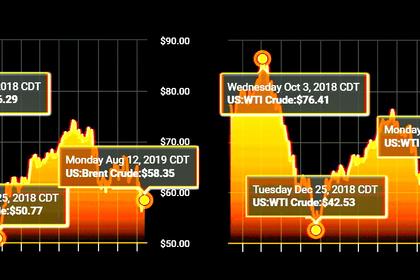

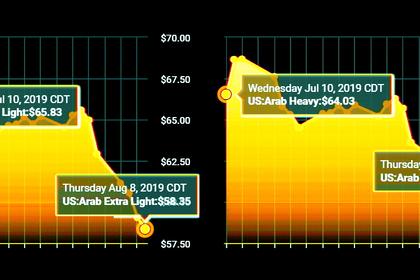

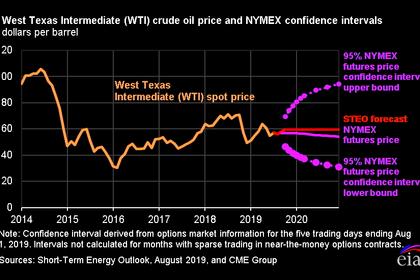

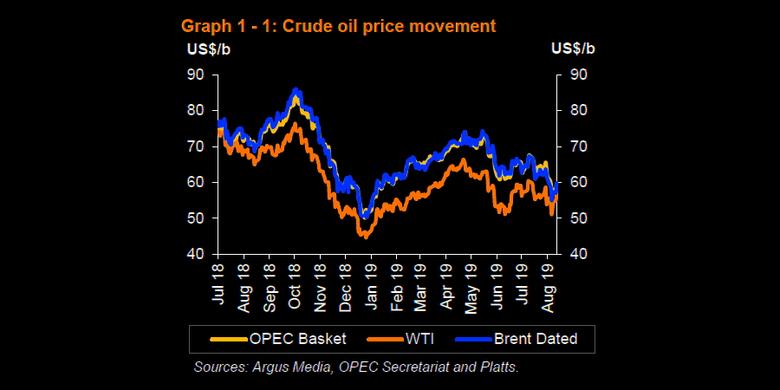

Crude Oil Price Movements

The OPEC Reference Basket (ORB) averaged higher in July, up by $1.79, or 2.8%, m-o-m reaching $64.71/b, supported by a pick-up in Asian crude demand. Crude oil futures prices also rose from their low levels registered a month earlier as escalating geopolitical tensions offset bearish sentiment in global oil demand. In July, ICE Brent was $1.18, or 1.9%, m-o-m higher, averaging $64.21/b, while NYMEX WTI rose m-o-m by $2.84, or 5.2%, averaging $57.55/b. Year-to-date (y-t-d), ICE Brent was $5.85, or 8.2%, y-o-y lower at $65.87/b, while NYMEX WTI declined by $8.74, or 13.2%, to $57.46/b. The backwardation in both Brent and Dubai price structures flattened in July due to higher availability in the Atlantic Basin and softer crude demand in the first half of the month. Meanwhile, the contango structure of WTI flattened somewhat on significant declines in US crude oil stocks. Hedge funds and other money managers slightly raised their bullish positions on crude oil in July, with net long positions ending the month marginally higher compared to the low levels recorded in late June.

World Economy

The global GDP growth for 2019 is now forecast at 3.1%, a slight downward revision from the previous month's report, while growth remains forecast at 3.2% for 2020. The US economic growth forecast for 2019 is revised down by 0.2 pp to 2.4%, after significant data revisions by the US statistical office. GDP growth for 2020 remains at 2.0%. The Euro-zone's growth estimate remains at 1.2% for 2019 and is also forecast at 1.2% in 2020. Japan's unchanged low growth of 0.5% in 2019 is forecast to continue at the same level in 2020. China's 2019 growth forecast remains at 6.2% and is expected to slow down to 6.0% in 2020. India's growth forecast remains unchanged at 6.8% for 2019, and is anticipated to pick up in 2020 to 7.0%. Brazil's 2019 growth forecast is unchanged at 0.9%, and is projected to reach 1.7% in 2020. After low 1Q19 growth, Russia's growth forecast for 2019 was revised down by 0.1 pp reaching 1.3%, and remains at 1.4% through 2020. Large uncertainties remain. While the growth forecast currently assumes no further risks until they actually materialise, and, in particular, that trade-related issues do not escalate further, the downside risk to world economic growth is predominant.

World Oil Demand

In 2019, oil demand is anticipated to grow by 1.10 mb/d year-on-year (y-o-y), a downward revision of about 0.04 mb/d from the previous month's projection, mainly due to weaker-than-expected oil demand data from OECD Americas, Other Asia and the Middle East in 1H19. Total oil demand for the year is now anticipated to reach 99.92 mb/d. For 2020, world oil demand is expected to grow by 1.14 mb/d, in line with last month's projection, with total world consumption anticipated to average 101.05 mb/d. This forecast is subject to downside risks stemming from uncertainties with regard to global economic development. The OECD region is estimated to be in positive territory in 2020 as OECD Americas is projected to show growth, while OECD Europe and OECD Asia Pacific are projected to decline. However, non-OECD countries are forecast to continue to account for most of the growth at 1.05 mb/d. China and Other Asia are anticipated to lead demand growth both in the non-OECD region.

World Oil Supply

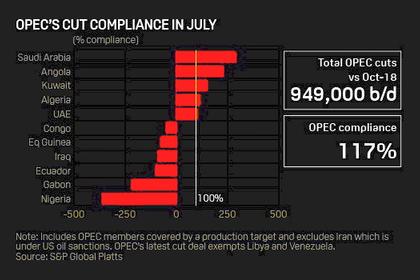

In 2019, non-OPEC oil supply is anticipated to grow by 1.97 mb/d y-o-y, a downward revision of 72 tb/d from the previous month's projection, due to lower-than-expected oil production in the US, Brazil, Thailand and Norway in 1H19, which were partially offset by higher production in Canada in 2Q19. US liquids output in May was up by 53 tb/d, despite a decline in crude oil production. However, US oil supply growth for 2019 was revised down to 1.87 mb/d, on lower revised historical production data. The US, Brazil, China and the UK are the key countries driving y-o-y growth in 2019, with mainly Mexico and Norway showing declines. For 2020, non-OPEC oil supply growth was also revised down by 50 tb/d from the last month assessment, and is now projected to grow by 2.39 mb/d y-o-y for an average 66.78 mb/d, mainly due to a downward revision in the oil supply growth forecast for Brazil. The US, Brazil and Norway are forecast to be the main growth drivers, while Mexico, Indonesia and Egypt are expected to see the largest declines. OPEC NGLs production in 2019 and 2020 is expected to grow by 0.07 mb/d and 0.03 mb/d to average 4.84 mb/d and 4.87 mb/d, respectively. In July, OPEC crude oil production decreased by 246 tb/d to average 29.61 mb/d, according to secondary sources.

Product Markets and Refining Operations

Product markets globally saw solid gains from the previous month, as a positive performance across the barrel in all main trading hubs lifted refinery margins, particularly in Europe and in Asia, where they jumped by more than $3.00/b. In the US, product markets were supported by continued strong demand from the US East Coast due to refining capacity losses, and firm overall domestic demand amid a slight decline in refinery runs. In Europe, product markets strengthened the most compared to other regions, mainly supported by an extension of the sharp recovery seen last month at the top and middle of the barrels, and strong export opportunities to the US Atlantic Coast. Meanwhile, product markets in Asia received support from reduced refined product outputs, amid several refinery outages and healthy export opportunities to the Middle East.

Tanker Market

Average dirty tanker spot freight rates edged lower in July as ample availability remained a hurdle to achieving a sustained recovery in rates, despite refineries returning from seasonal maintenance. In July, dirty tanker freight rates saw mixed movement compared to the previous month, with VLCCs enjoying only a slight 2% gain, while Aframax and Suezmax rates declined 6% each, with routes around the Atlantic Basin showing the worst performance. Meanwhile, clean tanker spot freight rates were unchanged in July due to offsetting developments on the East and West of Suez routes. East of Suez clean spot freight rates weakened due to declines on the Middle East-to-East and Singapore-to-East routes, while rates on the West of Suez route showed gains, particularly around the Mediterranean.

Stock Movements

Preliminary data for June showed that total OECD commercial oil stocks rose by 31.8 mb m-o-m to stand at 2,955 mb, which is 140 mb higher than the same time one year ago and 67 mb above the latest five-year average. Within the components, crude stocks fell by 8.2 mb, while product stocks rose by 40.0 mb, m-o-m. In terms of days of forward cover, OECD commercial stocks rose by 0.6 days m-o-m in June to stand at 60.9 days, which was 2.6 days above the same period in 2018 and 0.1 days below the latest five-year average.

Balance of Supply and Demand

Demand for OPEC crude in 2019 was revised up by 0.1 mb/d from the previous report to stand at 30.7 mb/d, 0.9 mb/d lower than the 2018 level. Demand for OPEC crude in 2020 was revised up by 0.1 mb/d from the previous report to stand at 29.4 mb/d, 1.3 mb/d lower than the 2018 level.

-----

Earlier: