2020: WORLD OIL DEMAND WILL UP BY 1.08 MBD

OPEC - Monthly Oil Market Report, 11 September 2019

Oil Market Highlights

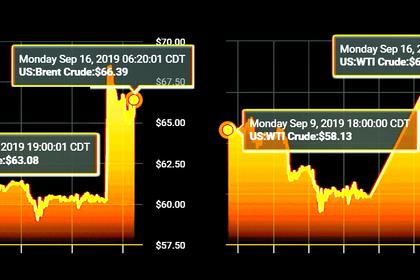

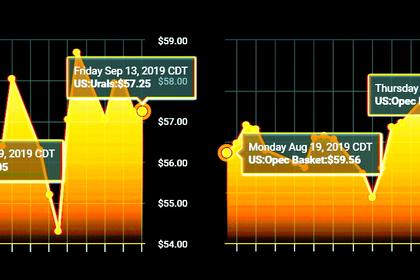

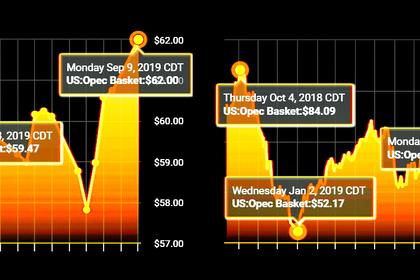

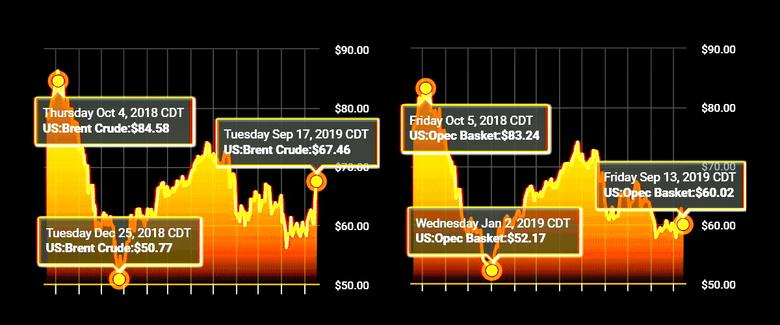

Crude Oil Price Movements

The OPEC Reference Basket (ORB) declined $5.09, or 7.9%, to average $59.62/b. Crude oil futures prices also declined in August compared to the previous month. ICE Brent fell $4.71, or 7.3%, to average $59.50/b in August, and NYMEX WTI dropped by $2.70, or 4.7%, to average $54.84/b. Year-to-date, ICE Brent was $6.94, or 9.6%, lower compared to the same period last year, averaging $65.05/b, while NYMEX WTI declined by $9.31, or 14.0%, to average $57.12/b over the same period. All crude benchmark structures were in backwardation in August, with Brent and Dubai price structures steepening further. Hedge funds and other money managers slightly raised their net long positions for NYMEX WTI, but cut them for ICE Brent.

World Economy

The global economic growth forecast was revised down to 3.0% for 2019 and to 3.1% for 2020, compared to the previous forecast of 3.1% and 3.2%, respectively, in last month's report. This was triggered by the ongoing slowdown in the US and the Euro-zone, lower-than-expected 1H19 growth in India, rising sovereign debt issues in Argentina, and the continuation of the US-China trade dispute, among other factors. US economic growth was revised down to 2.3% for 2019 and 1.9% for 2020. The forecast for Euro-zone growth in 2019 remains at 1.2%, while 2020 was revised down to 1.1%. Japan's 2019 growth was revised up to 0.9% due to a stronger-than-expected 1H19, although there was a downward revision to 0.3% in 2020. China's 2019 growth forecast remains at 6.2% and is expected to slow to 5.9% in 2020. India's growth forecast was revised down to 6.1% for 2019 and 6.7% for 2020. Brazil's 2019 growth forecast was revised down to 0.8%, but is then projected to reach 1.4% in 2020. After low 1Q19 growth, Russia's growth forecast for 2019 was revised down to 1.1%, and is forecast at 1.2% in 2020.

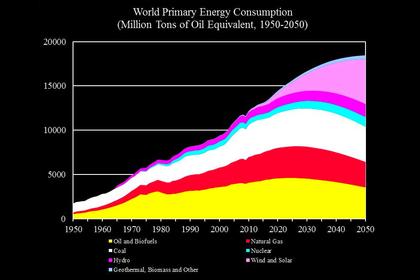

World Oil Demand

World oil demand in 2019 is expected to grow by 1.02 mb/d, which is 0.08 mb/d lower than last month's projection. The drop can be attributed to weaker-than-expected data in 1H19 from various global demand centres and slower economic growth projections for the remainder of the year. Both OECD and non-OECD demand growth forecasts were revised lower, by 0.03 mb/d and 0.05 mb/d, respectively. In 2020, world oil demand is projected to increase by 1.08 mb/d. This also represents a downward adjustment of 0.06 mb/d from the previous month's assessment, mainly to accommodate changes to the world economic outlook for 2020.

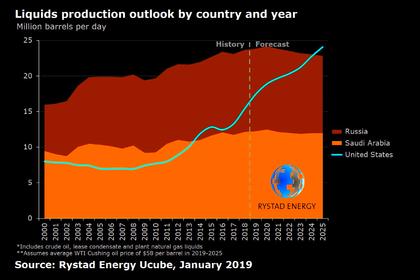

World Oil Supply

Non-OPEC oil supply growth for 2019 was revised up by 10 tb/d from last month's projections to 1.99 mb/d. Upward revisions to oil production from Russia, Kazakhstan, Australia and Canada outpaced a downward revision to the US oil supply forecast. The main drivers for growth in 2019 are the US with growth of 1.8 mb/d, along with Brazil, China, the UK, Australia and Canada. Mexico and Norway are projected to see the largest declines. In contrast, non-OPEC oil supply growth in 2020 was revised down by 136 tb/d from last month's assessment to 2.25 mb/d. This is mainly due to a large downward revision to US oil supply, which is now expected to grow by 1.54 mb/d. The forecast for next year remains subject to many uncertainties, mainly relevant to capital spending discipline and a slowdown in drilling and completion activity in the US. OPEC NGLs production in 2019 and 2020 is expected to grow by 0.07 mb/d and 0.03 mb/d, respectively, to average 4.84 mb/d and 4.87 mb/d. In August, OPEC crude oil production increased by 136 tb/d to average 29.74 mb/d, according to secondary sources.

Product Markets and Refining Operations

Product markets globally witnessed a notable downturn in the naphtha and fuel oil markets in August, although overall market performance was mixed. In the US, product markets suffered significant losses, as all products across the barrel weakened. The sharpest decline was felt at the top and bottom of the barrel, on the back of higher product output in the region, which, in general, placed product prices under pressure over the month. In Europe, middle distillates continued to perform positively supported by healthy demand amid higher product imports over the month. This offset the weakening at the top and bottom of the barrel and provided a slight improvement in refining margins. Asian product markets lost ground, affected by a deterioration in high sulphur fuel oil (HSFO) markets, and pressured by weaker fundamentals as buying interest from the bunker sector declined in August, weighing on HSFO prices, and ultimately refining margins.

Tanker Market

Dirty vessel spot freight rates were broadly flat in August as gains in VLCCs were outweighed by declines in average rates for Aframax and Suezmax. A pick up in tonne-mile demand and reduced newbuilding deliveries supported the VLCC market at the start of the month, before slowing activities allowed availability lists to build, capping rates. In the clean tanker market, spot freight rates remained under pressure with declines West of Suez offsetting some improvement East of Suez.

Stock Movements

Preliminary data for July showed that total OECD commercial oil stocks fell by 10.5 mb m-o-m to stand at 2,944 mb. This was 108 mb higher than the same period a year ago, and 36 mb above the latest five-year average. Within the components, crude stocks fell by 41.3 mb m-o-m to stand at 20 mb below the latest five-year average, while product stocks rose by 30.8 mb m-o-m to 55 mb above the latest five-year average. In terms of days of forward cover, OECD commercial stocks declined by 0.1 days m-o-m to stand at 60.9 days, which was 2.2 days above the same period in 2018, but 0.6 days below the latest five-year average.

Balance of Supply and Demand

Demand for OPEC crude in 2019 was revised down from the previous report to stand at 30.6 mb/d, which is 1.0 mb/d lower than the 2018 level. Demand for OPEC crude in 2020 remains unchanged from the previous report, to stand at 29.4 mb/d, around 1.2 mb/d lower than the 2019 level.

-----

Earlier: