ARAMCO SELLS LNG

НОВАТЭК - Москва, 24 июля 2019 года. ПAO «НОВАТЭК» сегодня опубликовало консолидированную промежуточную сокращенную финансовую отчетность по состоянию на и за три и шесть месяцев, закончившихся 30 июня 2019 г., подготовленную в соответствии с Международными стандартами финансовой отчетности (МСФО).

Основные финансовые показатели деятельности по МСФО

(в миллионах российских рублей, если не указано иное)

|

II кв.

2019 г.

|

II кв.

2018 г.

|

|

1П

2019 г.

|

1П

2018 г.

|

|

215 789

|

194 818

|

Выручка от реализации нефти и газа

|

446 973

|

373 303

|

|

2 724

|

1 004

|

Прочая выручка

|

5 646

|

1 922

|

|

218 513

|

195 822

|

Итого выручка от реализации

|

452 619

|

375 225

|

|

(157 507)

|

(135 606)

|

Операционные расходы

|

(332 647)

|

(266 643)

|

|

-

|

-

|

Прибыль от выбытия долей владения в дочерних

обществах и совместных предприятиях, нетто

|

308 578

|

1 645

|

|

(247)

|

(621)

|

Прочие операционные

прибыли (убытки), нетто

|

(1 161)

|

(519)

|

|

60 759

|

59 595

|

Прибыль от операционной деятельности нормализованная*

|

118 811

|

108 063

|

|

69 193

|

68 958

|

EBITDA дочерних обществнормализованная*

|

134 917

|

125 379

|

|

115 835

|

101 339

|

EBITDA с учетом доли в EBITDA

совместных предприятий нормализованная*

|

233 777

|

177 645

|

|

(277)

|

7 380

|

Доходы (расходы) от финансовой деятельности

|

(6 298)

|

12 782

|

|

23 282

|

(18 215)

|

Доля в прибыли (убытке) совместных

предприятий за вычетом налога на прибыль

|

94 255

|

(17 052)

|

|

83 764

|

48 760

|

Прибыль до налога на прибыль

|

515 346

|

105 438

|

|

69 175

|

32 041

|

Прибыль, относящаяся к

акционерам ПАО «НОВАТЭК»

|

450 971

|

75 162

|

|

64 296

|

54 289

|

Прибыль, относящаяся к акционерам

ПАО «НОВАТЭК», нормализованная**

|

130 026

|

101 199

|

|

21,35

|

18,01

|

Прибыль на акцию нормализованная** (в руб.)

|

43,17

|

33,57

|

|

31 203

|

22 052

|

Денежные средства, использованные

на оплату капитальных вложений

|

73 679

|

31 764

|

* Без учета эффекта от выбытия долей владения в дочерних обществах и совместных предприятиях.

** Без учета эффектов от выбытия долей владения в дочерних обществах исовместных предприятиях и от курсовых разниц.

Выручка от реализации и EBITDA

Во втором квартале 2019 года наша выручка от реализации составила 218,5 млрд руб., а нормализованный показатель EBITDA с учетом доли в EBITDA совместных предприятий составил 115,8 млрд руб., что представляет собой увеличение на 11,6% и 14,3% соответственно по сравнению с аналогичным периодом 2018 года. За шесть месяцев, закончившихся 30 июня 2019 г., наша выручка от реализации и нормализованный показатель EBITDA с учетом доли в EBITDA совместных предприятий составили 452,6 млрд руб. и 233,8 млрд руб., увеличившись на 20,6% и 31,6% соответственно по сравнению с отчетным периодом прошлого года.

Рост выручки и нормализованного показателя EBITDA в основном связан с запуском производства СПГ на второй и третьей очередях завода «Ямала СПГ» во втором полугодии 2018 года.

Прибыль, относящаяся к акционерам ПАО «НОВАТЭК»

Прибыль, относящаяся к акционерам ПАО «НОВАТЭК», выросла до 69,2 млрд руб. (22,97 руб. на акцию), или на 115,9%, во втором квартале 2019 года и до 451,0 млрд руб. (149,73 руб. на акцию), или в шесть раз, в первом полугодии 2019 года по сравнению с аналогичными периодами 2018 года. На прибыль Группы значительное влияние оказало признание в марте 2019 года прибыли от продажи 10%-ной доли участия в проекте «Арктик СПГ 2» в размере 308,6 млрд руб., а также признание в обоих отчетных периодах неденежных курсовых разниц по займам Группы и совместных предприятий, номинированным в иностранной валюте.

Без учета эффекта от выбытия долей владения в дочерних обществах и совместных предприятиях и эффекта от курсовых разниц, нормализованная прибыль, относящаяся к акционерам ПАО «НОВАТЭК», составила 64,3 млрд руб. (21,35 руб. на акцию) во втором квартале 2019 года и 130,0 млрд руб. (43,17 руб. на акцию) в первом полугодии 2019 года, увеличившись на 18,4% и 28,5% соответственно по сравнению с аналогичными периодами 2018 года.

Капитальные вложения

Денежные средства, использованные на оплату капитальных вложений, увеличились до 31,2 млрд руб., или на 41,5%, во втором квартале 2019 года и до 73,7 млрд руб., или на 132,0%, в первом полугодии 2019 года по сравнению с аналогичными периодами прошлого года. Значительная часть наших инвестиций в основные средства была направлена на развитие СПГ-проектов (проекта «Арктик СПГ 2» до марта 2019 года и проекта по созданию центра по строительству крупнотоннажных морских сооружений в Мурманской области), освоение Северо-Русского месторождения и разработку нефтяных залежей Восточно-Таркосалинского и Ярудейского месторождений.

Объем добычи и покупки углеводородов

|

II кв.

2019 г.

|

II кв.

2018 г.

|

|

1П

2019 г.

|

1П

2018 г.

|

|

149,0

|

131,8

|

Совокупная добыча углеводородов,

млн баррелей нефтяного эквивалента (млн бнэ)

|

296,1

|

264,3

|

|

1,64

|

1,45

|

Совокупная добыча (млн бнэ в сутки)

|

1,64

|

1,46

|

|

18 910

|

16 418

|

Добыча природного газа с учетом доли в

добыче совместных предприятий (млн куб. м)

|

37 570

|

32 926

|

|

9 935

|

10 562

|

Добыча природного газа в дочерних обществах

|

20 034

|

20 925

|

|

7 909

|

4 420

|

Покупка природного газа

у совместных предприятий

|

16 830

|

12 007

|

|

1 971

|

1 708

|

Прочие покупки природного газа

|

4 190

|

3 437

|

|

19 815

|

16 690

|

Итого добыча природного газа дочерних обществ и покупка (млн куб. м)

|

41 054

|

36 369

|

|

3 035

|

2 928

|

Добыча жидких углеводородов с учетом доли в добыче совместных предприятий (тыс. тонн)

|

6 022

|

5 864

|

|

1 607

|

1 650

|

Добыча жидких углеводородов

в дочерних обществах

|

3 207

|

3 278

|

|

2 366

|

2 322

|

Покупка жидких углеводородов

у совместных предприятий

|

4 679

|

4 622

|

|

51

|

56

|

Прочие покупки жидких углеводородов

|

107

|

100

|

|

4 024

|

4 028

|

Итого добыча жидких углеводородов дочерних обществ и покупка (тыс. тонн)

|

7 993

|

8 000

|

Объем добычи природного газа с учетом нашей доли в добыче совместных предприятий во втором квартале и в первом полугодии 2019 года вырос на 15,2% и 14,1% соответственно, а объем добычи жидких углеводородов увеличился на 3,7% и 2,7% соответственно по сравнению с аналогичными периодами 2018 года. Основным фактором, оказавшим положительное влияние на рост добычи, стал запуск производства СПГ на второй и третьей очередях завода «Ямала СПГ» во второй половине 2018 года.

Объем реализации углеводородов

|

II кв.

2019 г.

|

II кв.

2018 г.

|

|

1П

2019 г.

|

1П

2018 г.

|

|

18 764

|

15 149

|

Природный газ (млн куб. м)

|

40 959

|

35 412

|

|

|

|

в том числе:

|

|

|

|

15 114

|

14 496

|

Реализация в Российской Федерации

|

33 888

|

33 801

|

|

3 650

|

653

|

Реализация на международных рынках

|

7 071

|

1 611

|

|

4 130

|

4 273

|

Жидкие углеводороды (тыс. тонн)

|

8 106

|

8 050

|

|

|

|

в том числе:

|

|

|

|

1 841

|

2 028

|

Продукты переработки стабильного

газового конденсата

|

3 638

|

3 594

|

|

1 214

|

1 148

|

Сырая нефть

|

2 341

|

2 271

|

|

674

|

658

|

Сжиженный углеводородный газ

|

1 351

|

1 307

|

|

396

|

436

|

Стабильный газовый конденсат

|

768

|

872

|

|

5

|

3

|

Прочие нефтепродукты

|

8

|

6

|

Во втором квартале и в первом полугодии 2019 года объем реализации природного газа составил 18,8 млрд и 41,0 млрд куб. м, увеличившись на 23,9% и 15,7% соответственно по сравнению с аналогичными периодами 2018 года, в результате роста объемов реализации СПГ, приобретаемого у наших совместных предприятий OАO «Ямал СПГ» и OOO «Криогаз-Высоцк». По состоянию на 30 июня 2019 г. наши остатки природного газа составили 1,4 млрд куб. м по сравнению с 1,3 млрд куб. м на 30 июня 2018 г. и в основном относились к остаткам природного газа в подземных хранилищах. Остатки природного газа формируются в зависимости от потребности Группы в отборе природного газа для реализации в последующих периодах.

Во втором квартале 2019 года объем реализации жидких углеводородов уменьшился на 3,3% до 4,1 млн тонн по сравнению с 4,3 млн тонн в аналогичном периоде прошлого года главным образом за счет изменения остатков. При этом объем реализации жидких углеводородов в первом полугодии 2019 года по сравнению с первым полугодием 2018 года незначительно увеличился на 0,7%. По состоянию на 30 июня 2019 г. совокупный объем жидких углеводородов, отраженный как «Остатки готовой продукции и товары в пути», составил 852 тыс. тонн по сравнению с 806 тыс. тонн по состоянию на 30 июня 2018 г. Остатки наших жидких углеводородов изменяются от периода к периоду и, как правило, реализуются в следующем отчетном периоде.

Выборочные статьи консолидированного отчета

о финансовом положении (в миллионах рублей)

|

|

30.06.2019 г.

|

31.12.2018 г.

|

|

Активы

|

|

|

|

Долгосрочные активы

|

1 229 888

|

923 050

|

|

в т.ч. основные средства

|

455 605

|

408 201

|

|

в т.ч. инвестиции в совместные предприятия

|

451 844

|

244 500

|

|

в т.ч. долгосрочные займы выданные

и дебиторская задолженность

|

256 555

|

232 922

|

|

Текущие активы

|

381 807

|

293 320

|

|

Итого активы

|

1 611 695

|

1 216 370

|

|

ОБЯЗАТЕЛЬСТВА И КАПИТАЛ

|

|

|

|

Долгосрочные обязательства

|

219 905

|

222 752

|

|

в т.ч. долгосрочные заемные средства

|

144 777

|

170 043

|

|

Текущие обязательства

|

109 675

|

107 023

|

|

Итого обязательства

|

329 580

|

329 775

|

|

Итого капитал, относящийся

к акционерам ПАО «НОВАТЭК»

|

1 264 340

|

868 254

|

|

Доля неконтролирующих

акционеров дочерних обществ

|

17 775

|

18 341

|

|

Итого капитал

|

1 282 115

|

886 595

|

|

Итого обязательства и капитал

|

1 611 695

|

1 216 370

|

-----

ARAMCO SELLS LNG

AB - The biggest oil exporter is stepping up its efforts to become a major force in natural gas.

Saudi Aramco, the world's most profitable company, is trying to break into the fledgling market for liquefied natural gas trading. To do so, the state-owned company is tapping its decades-old network of oil-trading contacts, selling its first two cargoes to longstanding crude customers in South Korea and India.

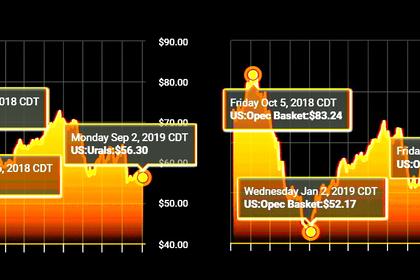

Aramco is joining oil companies from Royal Dutch Shell to BP in increasingly focusing on liquefied natural gas, the fastest-growing fossil fuel. That comes as production soars with the start of multibillion-dollar liquefaction plants across the world, creating a glut that may last until the middle of the next decade.

"They're going to friends first" to look for gas deals, said Iman Nasseri, managing director for the Middle East at London-based researcher FGE. "It will be a buyers' market for the next couple of years, so it's a good time for traders to get into the market."

Just as energy consumers are diversifying the type of fuels they burn, producers are seeking to provide natural gas and renewables on top of crude. The Saudis, who have been dispatching tankers across the globe since the 1940s, are looking for gas supplies at home and abroad and seeking to turn crude into chemicals for consumer goods.

Aramco sees that as creating an opportunity for its traders to find cargoes and sell them to companies that have historically bought its crude. Aramco didn't comment.

That strategy, which has so far focused on selling in Asia, has had limited success. Aramco has sold two LNG cargoes - one each to Indian Oil Co and to S-Oil Corp of South Korea, according to people with knowledge of the matter. Aramco is also in talks to provide a term deal with numerous buyers, including Pakistan.

The LNG overtures come on the back of one of the kingdom's most important supply lines. The Saudis have sold nearly 800,000 barrels of crude a day on average to India over the past two years and Aramco this year agreed to partner with the country's biggest refiner. In South Korea, the company is the biggest investor in S-Oil and it enhanced energy ties with Pakistan after a state visit there by Saudi Crown Prince Mohammed bin Salman in February.

The Saudis have also started building a portfolio of LNG production assets and export infrastructure that will provide them with fuel to sell and potentially use domestically. Aramco agreed in May to a buy a 25 percent stake in Sempra Energy's Texas LNG terminal, its first foray into producing hydrocarbons outside Saudi Arabia.

The kingdom is looking for additional gas projects in areas including the US, Russia's Arctic and Australia to supply global markets and meet demand at home, Saudi Energy Minister Khalid Al-Falih said earlier this year. Buying internationally will augment Aramco's domestic exploration plans as the company seeks to become a "major player" in gas, CEO Amin Nasser told reporters in Riyadh in April.

Aramco is following in the footsteps of international trading houses including Vitol Group, Trafigura Group, Glencore and Gunvor Group, which used their oil market knowledge to become some of the biggest LNG traders, according to Giles Farrer, research director for global gas and LNG supply at Wood Mackenzie.

"Aramco is just starting to get into the market to understand its dynamics and build a portfolio of supply in small steps," he said. "There are advantages to having multiple sources of supply which provide opportunities for arbitrage and the possibility to sell into different markets. Aramco isn't there yet."

Russia's state-backed Rosneft secured deals to sell cargoes to Egypt over the last three years even while it lacked LNG facilities by taking advantage of oil cooperation and ties between the two governments. The Russian company now has stakes in the giant Zohr gas field in Egypt's Mediterranean Sea waters.

"Periods of abundant LNG give traders more options to procure supply, and greater opportunities for new entrants," James Taverner, a London-based analyst at IHS Markit, said by email. "However, the market is becoming increasingly competitive, and trading margins are likely to be squeezed. Players with flexible portfolios, economies of scale, and/or existing relationships with buyers will be in a stronger position to compete."

Traders will be talking about the growing LNG market next week in Singapore as they gather for meetings and receptions on the sidelines of the annual Asia Pacific Petroleum Conference. Aramco's Nasser is set to talk about the company's approach to markets when he addresses the World Energy Congress in Abu Dhabi next week.

At the moment, Aramco's got its size and its Rolodex and, until the company develops its own supplies, has to compete to buy spot cargoes along with everyone else. The company's balance sheet gives it more leeway to navigate its way around LNG trading and the ability to sustain losses if some deals don't make money, said FGE's Nasseri.

"If you have deep pockets and some time to learn the ropes of trading, both of which Aramco has, it makes a lot of sense for them," he said.

-----

Earlier:

2019, September, 3, 13:10:00

RUSSIA, SAUDI ARABIA PARTNERSHIP

“OPEC can no longer ignore Russia because of its importance as an oil exporter and its economy,” said Elina Ribakova, deputy chief economist at the Institute of International Finance in Washington. “The Russians will continue doing just enough to engage with the Saudis on oil production.”

2019, August, 13, 13:30:00

SAUDIS INVESTMENT FOR INDIA $100 BLN

Saudi Arabia's officials unveiled plans to invest $100 billion in India, with the bulk of the funds going toward the infrastructure and energy sectors.

2019, August, 12, 12:50:00

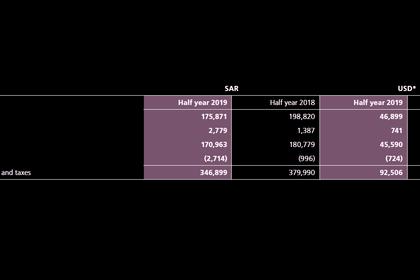

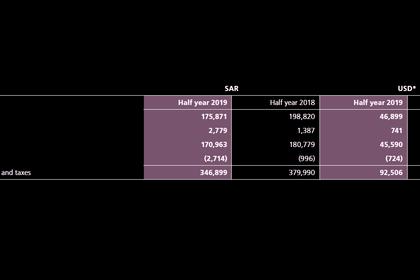

ARAMCO NET INCOME $46.9 BLN

Brent crude futures were at $57.80 a barrel by 0854 GMT, up 42 cents from their previous settlement. West Texas Intermediate (WTI) futures were at $52.80 per barrel, up 26 cents.

All Publications »

Tags:

ARAMCO,

SAUDI,

ARABYA,

LNG