BRAZIL'S OIL: $26 BLN

GT - Brazil has announced the rules for an auction of oil drilling rights worth $26bn, setting the stage for Latin America's top crude producer to become an even bigger player in the global market.

The auction, scheduled for November 6, paves the way for foreign explorers like Exxon Mobil Corp and Royal Dutch Shell Plc to unlock Brazil's vast deepwater oil reserves, which are estimated to hold enough crude to meet the entire world's demand for almost six months. Brazil is opening its energy markets to private companies as the nation seeks to pay down debt and compete with Opec for market share.

Bids will be invited for rights to develop the pre-salt region in the Atlantic Ocean, off the coast of Rio de Janeiro, in instalments, according to an official notice published Friday. The announcement is a sign that Brazil is finally poised to develop the region as the government moves toward resolving a years-long dispute with state-controlled oil producer Petrobras over payments related to the pre-salt.

Exxon and Shell have expressed interest in the group of deep-water fields that could hold as many as 15bn barrels of oil. The fields – Atapu, Buzios, Itapu and Sepia – are located in the area where Petrobras obtained the rights to 5bn barrels of oil from the government in 2010. But, as Petrobras explored the region, it found much more crude than it was entitled to in the deal, leaving the government with a surplus that it plans to auction.

The eventual winners would also need to compensate Petroleo Brasileiro SA, as Petrobras is formally known, for investments the company has already made in the areas.

Brazil's government is running against the clock as it seeks to use the $26bn (106bn reais) in fees from the auction to help states and municipalities plug 2019 fiscal deficits.

"There could still be some risks for the auction to meet the deadline," Vicente Falanga, an analyst with Banco Bradesco SA, wrote Monday in a note to clients.

Some hurdles remain: Brazil's audit court, known as TCU, has yet to issue a formal statement authorising the auction. But TCU head Raimundo Carreiro met with Brazilian government ministers last week to discuss the issue.

The major remaining step is a constitutional amendment approved by Congress, which would allow the federal government to share the drilling rights fees with states and municipalities and also facilitate the payment of a $9bn settlement to Petrobras.

-----

Earlier:

2019, July, 25, 19:30:00

BRAZIL'S GDP UP 0.8%

Brazil's GDP growth is projected at 0.8 percent in 2019 and to accelerate in 2020 conditional on the approval of a robust pension reform and favorable financial conditions. The current budget is guided by the federal expenditure ceiling, entailing a minor reduction of the structural primary balance in 2019.

|

2019, July, 1, 11:05:00

BRICS ENERGY SECURITY

"As BRICS participants are leading global consumers and producers of energy, our association could be more actively involved in issues of ensuring global energy security and universal access to energy," Putin said, during a meeting of the leaders of the BRICS countries ahead of the G20 Summit in Osaka. The BRICS group comprises Brazil, Russia, India, China and South Africa.

|

2019, May, 30, 17:45:00

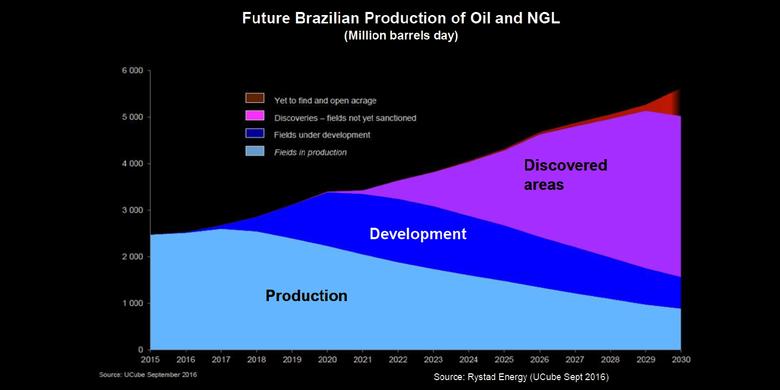

BRAZIL'S OIL UP

Brazil has seen its exports of crude grow from 734,000 b/d in 2015 to 1.3 million b/d in Q1 of this year. In contrast, Mexico, which was once a powerhouse of oil production, has maintained its export status only through curtailment of domestic refining, not increased crude oil output.

|