ENERGY CHANGES CLIMATE

MEOG - The energy industry is undergoing many shifts, and has always been subject to disruption and volatility. For leaders in the energy industry, learning to deal with and capitalise upon these disruptions could boost their success in the 2020s. "We have seen data that this volatility has intensified over the last 10 years, and there are three main levers which will make or break energy companies in terms of their competitive advantage," says Björn Ewers, managing director & partner at Boston Consulting Group (BCG).

These three levers, each with their own potential to disrupt the market and offer new growth opportunities to the companies that leverage them, are often discussed in the energy industry: Digital technology, climate change, and dealing with risk. "With all these changes and shifts, how do we deal with risk in general as a corporation or institution in the energy sector?" Ewers asks the gathered audience of oil and gas producers, utilities heads, and technology providers, among other industry leaders.

Digitalisation with purpose

Companies are trying to digitalise their operations, with an eye on maximising efficiency, growing operations, and keeping costs low. "Digital is a game changer for the industry," says Michael Buffet, managing director and partner at BCG. "It is a critical lever for oil and gas operators, and for power and utilities to ensure sustainability of their core business, manage their energy transition, and to develop new technologies and capabilities."

Because the energy sector is reliant upon engineering, digital could reduce man hours. Buffet says it could bring significant operational improvements and a boost to production. Yet, companies face challenges in realising that transition and capturing value from digital. BCG says that those challenges fit within a 70/20/10 percent rule—around 70% of issues are surrounding business transformation, 20% are IT and data challenges, and a mere 10% involve difficulties with algorithms and other technical hurdles.

"Digital technology challenges typical ways of working and work processes, across all layers of the business," Buffet says. "It also challenges traditional, established governance." As such, energy companies need a strong business case for applying a particular digital technology—one of the classic errors made by firms in this sector is diving into digital without a clearly quantified ambition. "Often, it is not grounded on fact, and the value, if at all estimated, is a bit vague," he says. To build a more effective digital strategy, Buffet says that companies need to do less. "Start with very little, focusing on use cases that create value," he says.

Another issue arises when digitalisation is driven by technical functions, rather than business. "There is a weak overlap between what technical functions are putting into their digital strategies, and what businesses actually struggle with now, and what they expect to struggle with in the future," Buffet says, adding that use cases should drive IT/technology choices, not the reverse. "It is important to look at the core processes of the company, and not think about digital in isolation," he adds. "In isolation, many use cases have potential, but they need to address fundamental core processes to capture the full potential of digital."

Keeping in mind selected use cases, and selecting those technologies based on use cases, companies should also consider how they can scale them up to realise value within the business. Even when all these considerations are met, companies often face challenges with integrating digital technologies into their daily systems and workflow. "On a day-to-day basis, in their work processes and culture, people are not used to working in the way that is needed to roll out digital," says Buffet. "It is very structurally challenging to scale up, both in terms of ways of working, and IT & technology."

Part of that means breaking siloes in the workplace, so data is more easily shared and work processes occur in iterations, not simply in sequence. Governance should also be adapted to the magnitude of the challenge that accompanies business transformation. "There is no digital transformation possible without ownership at the highest level of governance," Buffet says. "Top management needs to take full ownership."

Climate change vs. the economy?

Worries about climate change are only rising, but Patrick Herhold, managing director and partner at BCG, says that it is important to consider it more holistically. "Last week, a client at the CEO level told me that 'climate change is the new digital,'" says Herhold. "He meant it in terms of the scale, the disruption, the risk, but also the opportunity space that you see."

The term 'disruption' seems like an understatement, with worrying climate projections floating around media headlines. But Herhold says there is also room for opportunity. While the public debate has generally pitted climate protection measures against economic gain, seeing the two as mutually exclusive, Herhold says they can work in tandem.

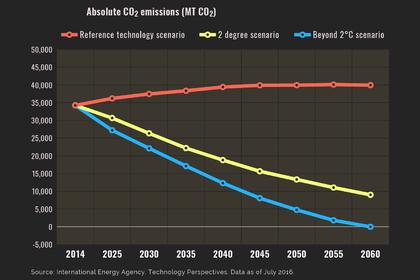

"Most countries actually have an economic case to invest heavily in climate protection," he says. "That includes many countries in the region, which have a business case for investing heavily in the energy transition." Yet challenges remain in decarbonising and meeting the goals set by the Paris Agreement—limiting global temperature rise to two degrees Celsius above pre-industrial levels, and trying to limit it even further to 1.5 degrees Celsius. "A two degree world, for most developing countries, would mean the complete decarbonisation of all relevant sectors by 2050," he says. "Given how ambitious this target is, it might seem unlikely that world is moving in this direction, and that it is a good idea, practically, to shift."

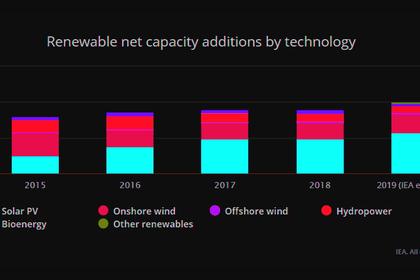

He recalls talks with European utilities companies almost 10 years ago, where sceptics said renewables would never top four percent market share, and would face trouble in gathering investments. But the past 10 years have seen immense shifts, and Herhold says there are key indicators that a two degree scenario is more likely than many might think. Government support is one of the first indications—The Paris Agreement has 195 signatories, with governments having committed to work towards its outlined targets, and policymakers are working to regulate carbon emissions.

Public sentiment is also shifting, with young people looking to work at companies that have a purpose and stand for causes that they support. Herhold says that this trend seems to have an upward trajectory. Increasing transparency also means that companies will be pushed towards climate-friendly practices because of investor pressure—with organisations like the Task Force on Climate-related Financial Disclosures making sure that relevant information is available to investors, who are increasingly concerned with sustainability.

Herhold outlines three important steps to integrating climate change considerations into a company's business strategy; make climate part of the CEO and top management's agenda; be prepared for disclosures related to climate change; and start seriously considering the two degree world and how the business will fit in that scenario.

Integrating risk

The impact of digitalisation and climate change, among other factors, is disruption on a global level, and as the world continues to rapidly shift, companies must learn to integrate risk into their operations and their strategies, says Raad Alkadiri, senior director at the BCG Centre for Energy Impact. "Risk is often looked at as due diligence, as something that needs to be checked off," Alkadiri says. "But what you miss are the big trends and trajectories that not only create challenges for your business, but can, in a period of disruption, create opportunities if you have anticipated them and you have made your organisation robust enough to deal with them."

Instead, risk should be integrated into the constant reassessment of policy and decisions. It should be seen as a potential drain on profitability, but also a way to create more business opportunity. "In terms of the organisation and process, risk should be a live, organic function that exists in symbiosis with other functions of the business, so it can not only inform the business and help it understand opportunity, but also provide analysis of insight of what the risk delivers, and can evolve with the business and its needs," he says. But this exists against a backdrop of rapid change, and with the future uncertain, executives are facing more pressure to have a robust view of the future.

To Alkadiri, that means more than simply outlining a few scenarios. "It is not just projecting scenarios that are most likely, least likely, or business as usual," he says. "It is a process that focuses on some of the fundamental challenges and decision points that risk brings about, and then builds an organisational plan and strategy developed around taking advantage of those points, and mitigates risks in all of those eventualities, rather than focusing on one future scenario."

The pace of technological innovation is another factor, as the amount of accessible data, news, information and opinion increases, and businesses become more capable of handling that massive flow of data. "We have the capacity through data analytics and a variety of functions on the technology side to collect data and synthesise it," Alkadiri says. "We can create networks within the organisation to make sure they have the right access.

"It can diminish the noise, and give decision-makers in different parts of the organisations exactly the risk output they need to make their decisions," he adds.

Ultimately, companies will have to adapt to a shifting landscape, whether that means digital transformation, climate transition, or simply finding a better way to identify and integrate risk into the organisation.

"The companies who can navigate, and compete in, a disruptive environment, will be successful," Alkadiri says.

-----

Earlier: