GLOBAL OIL, GAS FINANCES DOWN

РЕЙТЕР -

-----

Раньше:

2018, March, 14, 11:45:00

REUTERS - U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $60.77 a barrel at 0753 GMT, up 6 cents, or 0.1 percent, from their previous settlement. Brent crude futures LCOc1 were at $64.62 per barrel, down just 2 cents from their last close.

|

2018, March, 7, 15:00:00

РЕЙТЕР - К 9.17 МСК фьючерсы на североморскую смесь Brent опустились на 0,85 процента до $65,23 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $62,07 за баррель, что на 0,85 процента ниже предыдущего закрытия.

|

2018, March, 7, 14:00:00

EIA - North Sea Brent crude oil spot prices averaged $65 per barrel (b) in February, a decrease of $4/b from the January level and the first month-over-month average decrease since June 2017. EIA forecasts Brent spot prices will average about $62/b in both 2018 and 2019 compared with an average of $54/b in 2017.

|

2018, March, 5, 11:35:00

РЕЙТЕР - К 9.28 МСК фьючерсы на североморскую смесь Brent поднялись на 0,33 процента до $64,58 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $61,44 за баррель, что на 0,31 процента выше предыдущего закрытия.

|

2018, March, 4, 11:30:00

МИНФИН РОССИИ - Средняя цена нефти марки Urals по итогам января – февраля 2018 года составила $ 65,99 за баррель.

|

2018, February, 27, 14:15:00

РЕЙТЕР - К 9.18 МСК фьючерсы на североморскую смесь Brent опустились на 0,15 процента до $67,40 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $63,80 за баррель, что на 0,17 процента ниже предыдущего закрытия.

|

2018, February, 27, 14:05:00

МИНФИН РОССИИ - Средняя цена на нефть Urals за период мониторинга с 15 января по 14 февраля 2018 года составила $66,26457 за баррель, или $483,7 за тонну.

|

GLOBAL OIL, GAS FINANCES DOWN

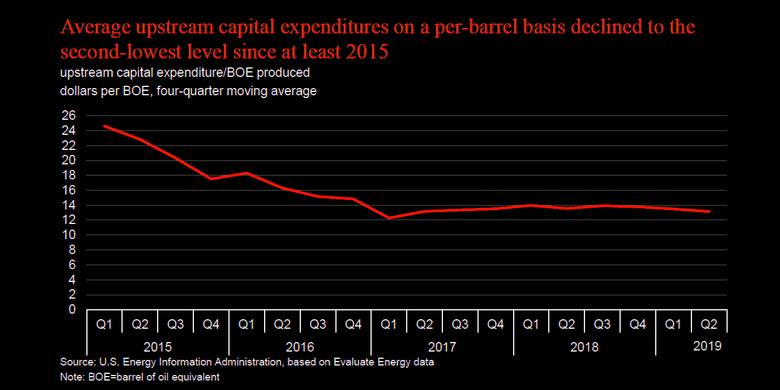

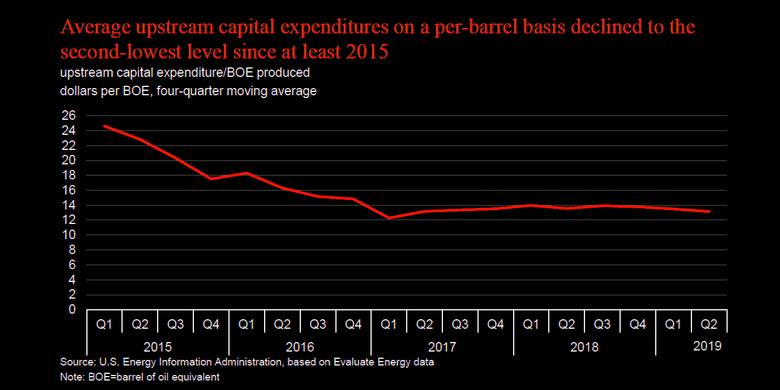

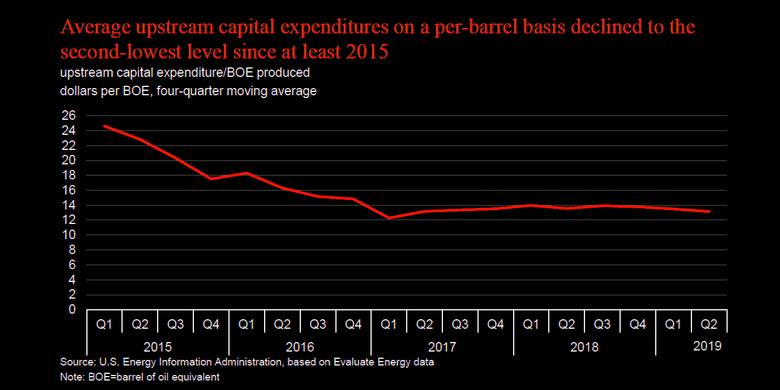

U.S. EIA - Financial Review: Second-Quarter 2019

This analysis focuses on the financial and operating trends of 117 global oil and natural gas companies from 2014 through the second quarter of 2019.

Key findings

Brent crude oil daily average prices were 9% lower in second-quarter 2019 than in second-quarter 2018 and averaged $68 per barrel

The 117 companies in this study increased their combined liquids production 4.6% in second-quarter 2019 from second-quarter 2018, and their natural gas production increased 5.0% during the same period

Nearly half of the companies were free cash flow positive—that is, they generated more cash from operations than their capital expenditures

Dividends plus share repurchases were nearly one-third of cash from operations, slightly lower than the six-year high set in first-quarter 2019

Full PDF version

-----

Earlier:

2019, September, 17, 12:50:00

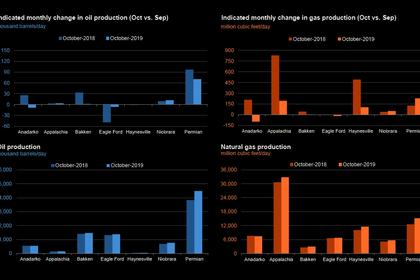

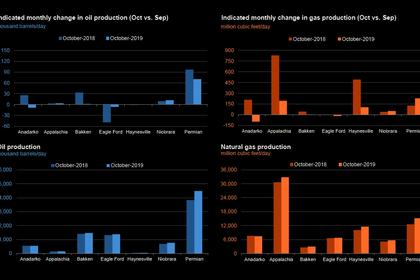

U.S. PRODUCTION: OIL + 74 TBD, GAS + 469 MCFD

U.S. EIA - Crude oil production from the major US onshore regions is forecast to increase 74,000 b/d month-over-month in September from 8,769 to 8,843 thousand barrels/day, gas production to increase 469 million cubic feet/day from 81,893 to 82,362 million cubic feet/day .

2019, September, 16, 14:25:00

6 UNDERVALUED ENERGY STOCKS. SEPTEMBER 2019

Let’s see which companies are still undervalued and which ones are out of my radar. Some of them reached their fair value and some other stopped to satisfy my parameters.

2019, September, 10, 17:45:00

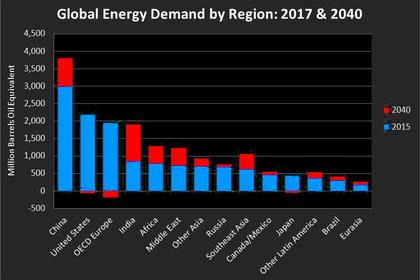

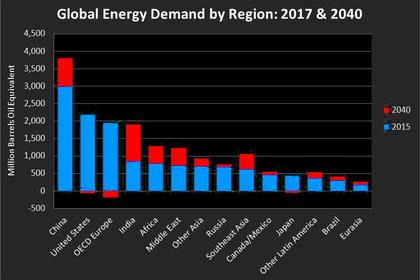

ENERGY NEED INVESTMENT $11 TLN

The chief executive of the Abu Dhabi National Oil Company (ADNOC) said that the long-term outlook for global energy demand was “robust” and that investment of $11 trillion in oil and gas was needed to keep up with projected demand.

2019, September, 6, 13:50:00

U.S. SHALE OIL CUTTING

Bankruptcy filings by U.S. energy producers through mid-August this year have nearly matched the total for the whole of 2018. A stock index of oil and gas producers hit an all-time low in August, a sign investors are expecting more trouble ahead.

All Publications »

Tags:

OIL,

GAS,

FINANCE