OIL PRICE: ABOVE $62 YET

REUTERS - Oil prices were steady on Friday but headed for a weekly loss, weighed down by slowing Chinese economic growth that dampens the demand outlook and a faster-than-expected recovery in Saudi output.

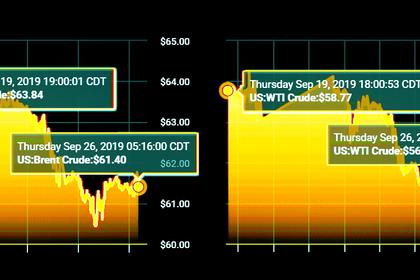

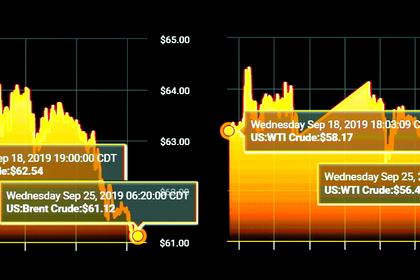

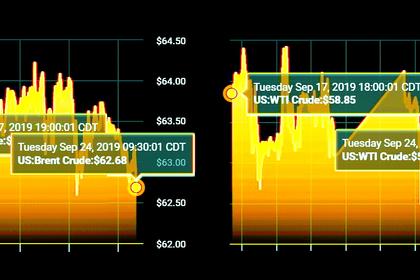

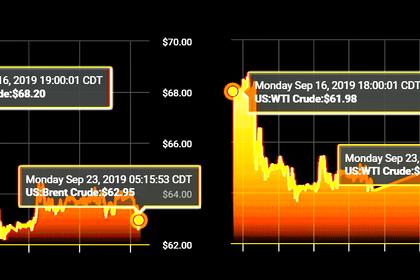

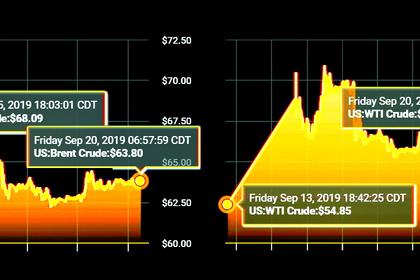

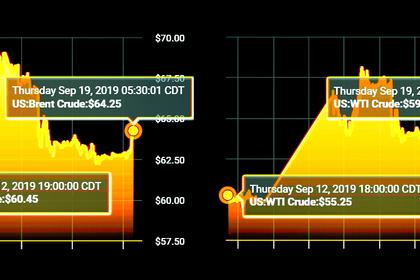

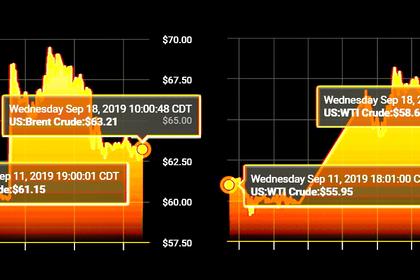

Brent LCOc1 fell 6 cents to $62.68 a barrel by 0919 GMT, while U.S. crude CLc1 rose 18 cents to $56.59 a barrel. But both were down 2.6% on a weekly basis.

Brent, which is on course for its biggest weekly loss in seven weeks, is just above its level before Sept. 14 attacks on Saudi facilities that initially halved the kingdom's production.

Sources told Reuters this week that Saudi Arabia had restored capacity to 11.3 million barrels per day. Saudi Aramco has yet to confirm it is fully back online.

"The political risk premium in crude prices has largely evaporated," Jefferies analysts said in a note.

The International Energy Agency (IEA) said on Friday it might cut its growth estimates for global oil demand for 2019 and 2020 should the global economy weaken further.

"It will depend on the global economy. If the global economy weakens, for which there are already some signs, we may lower oil demand expectations," IEA Executive Director Fatih Birol told Reuters.

In China, the world's second largest economy and top importer of crude, industrial firms reported a contraction in profits in August.

A surprise 2.4 million-barrel build in U.S. crude inventories last week also weighed on prices.

Key oil freight rates from the Middle East to Asia rocketed as much as 28% on Friday in the global oil shipping market, spooked by U.S. sanctions on units of Chinese giant COSCO for alleged involvement in ferrying crude out of Iran.

The COSCO vessels are equal to about 7.5% of the world's fleet of supertankers, Refinitiv data showed.

Emerging details connected to the impeachment inquiry into U.S. President Donald Trump also helped dent demand sentiment, analysts said.

-----

Earlier: