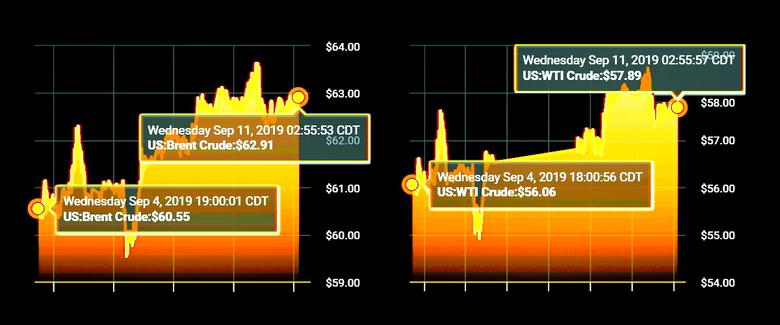

OIL PRICE: NEAR $63

REUTERS - Oil prices traded higher on Wednesday after an industry report said U.S. crude stockpiles fell last week by more than twice the amount that analysts in a Reuters poll had forecast.

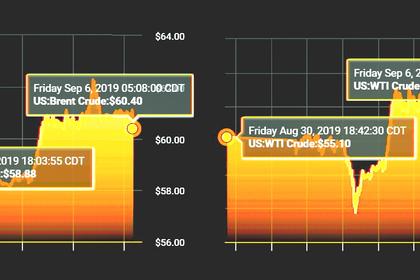

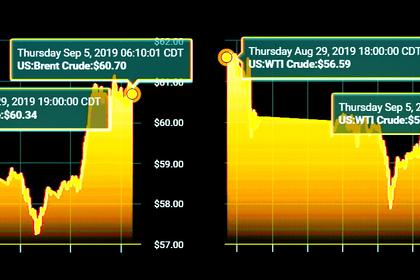

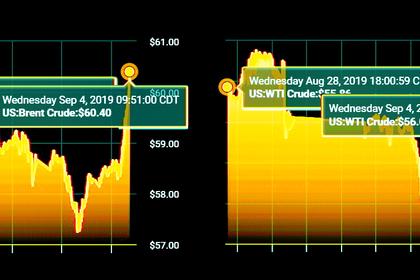

Brent crude futures LCOc1 rose 40 cents, or 0.6%, to $62.78 a barrel by 0643 GMT, while West Texas Intermediate (WTI) futures CLc1 were up 37 cents, or 0.6%, to $57.77 a barrel.

Prices had ended lower on Tuesday, squeezed by speculation of sanctions-hit Iranian crude returning to the market following U.S. President Donald Trump's move to fire national security adviser John Bolton, a noted Iran policy hawk.

But they rebounded after American Petroleum Institute (API) data late on Tuesday showed U.S. crude oil and gasoline stocks fell last week, while distillate stocks built.

The API numbers had U.S. crude inventories down by 7.2 million barrels in the week ended Sept. 6 to 421.9 million, compared with analysts' expectations in a Reuters poll of a decrease of 2.7 million barrels.

Halley said he was expecting a drawdown of 4.8 million barrels when official numbers are released by the Energy Information Administration (EIA) later on Wednesday.

Crude stocks at the Cushing, Oklahoma, delivery hub fell by 1.4 million barrels, the API said, while refinery crude runs rose by 208,000 barrels per day.

Gasoline stocks fell by 4.5 million barrels, the industry group said, compared with analysts' expectations of an 847,000-barrel decline in a Reuters poll.

Prices had risen sharply before Bolton's removal, boosted after Prince Abdulaziz bin Salman, Saudi Arabia's new energy minister, said the kingdom's oil policy would not change and a deal with other producers to cut output by a combined 1.2 million barrels per day would be maintained.

Iran's oil exports were slashed by more than 80% due to re-imposed sanctions by the United States after Trump last year exited the 2015 nuclear deal between Tehran and world powers.

-----

Earlier: