OIL PRICES 2019-20: $60-$62

U.S. EIA - SHORT-TERM ENERGY OUTLOOK

Forecast Highlights

Global liquid fuels

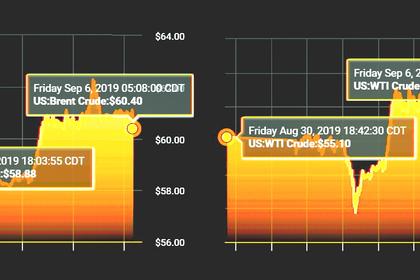

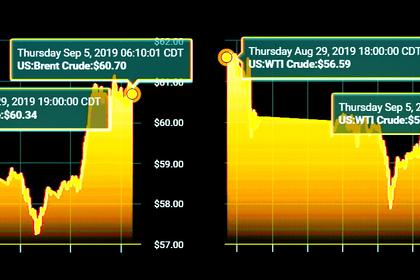

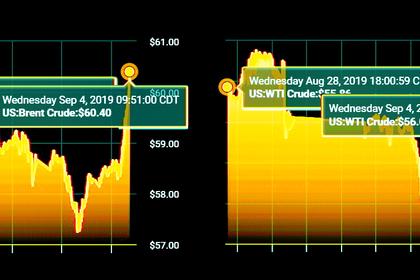

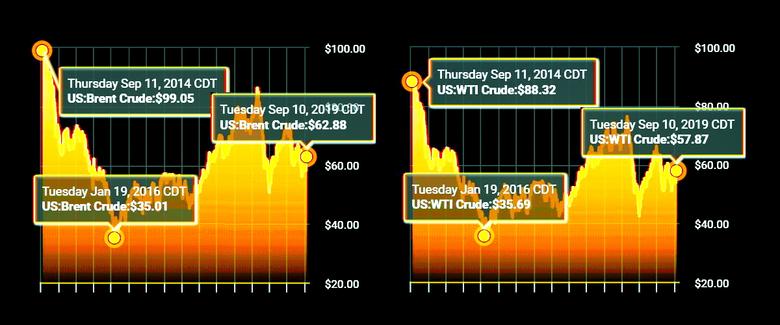

Brent crude oil spot prices averaged $59 per barrel (b) in August, down $5/b from July and $13/b lower than the average from August of last year. EIA forecasts Brent spot prices will average $60/b in the fourth quarter of 2019 and $62/b in 2020. EIA forecasts that West Texas Intermediate (WTI) prices will average $5.50/b less than Brent prices in 2020.

EIA forecasts that global liquid fuels consumption will increase by 0.9 million barrels per day (b/d) in 2019, down from year-over-year growth of 1.3 million b/d in 2018. The slowing liquid fuels demand growth reflects EIA's assumption (based on forecasts from Oxford Economics) of decelerating growth in global oil-weighted gross domestic product (GDP). EIA expects that global liquid fuels demand will increase by 1.4 million b/d in 2020 as a result of an expected increase in global GDP growth.

EIA forecasts U.S. crude oil production will average 12.2 million b/d in 2019, up by 1.2 million from the 2018 level. Forecast crude oil production then rises by 1.0 million b/d in 2020 to an annual average of 13.2 million b/d. The slowing rate of crude oil production growth reflects relatively flat crude oil price levels and slowing growth in well-level productivity.

Natural gas

The Henry Hub natural gas spot price averaged $2.22 per million British thermal units (MMBtu) in August, down 15 cents/MMBtu from July. This summer, prices have declined amid rising natural gas production, despite high levels of both natural gas exports and consumption in the electricity generation sector. Based on recent price movements and EIA's assessment that natural gas production will be sufficient to meet expected demand and export levels at a lower price than previously forecasted, EIA lowered its Henry Hub spot price forecast for 2020 to an average of $2.55/MMBtu, 20 cents/MMBtu lower than the August forecast.

EIA forecasts that U.S. dry natural gas production will average 91.4 billion cubic feet per day (Bcf/d) in 2019, up 8.0 Bcf/d from 2018. EIA expects monthly average natural gas production to grow in late 2019 and then decline slightly during the first quarter of 2020 as the lagged effect of low prices in the second half of 2019 reduces natural gas-directed drilling. However, EIA forecasts that growth will resume in the second quarter of 2020, and natural gas production in 2020 will average 93.2 Bcf/d.

Natural gas storage injections have outpaced the five-year (2014–18) average so far during the 2019 injection season as a result of rising natural gas production. At the beginning of April, the natural gas inventory injection season started with working inventories 28% lower than the five-year average for the same period. By the week ending August 30, working gas inventories were 82 billion cubic feet (Bcf), or 3%, lower than the five-year average of 3,023 Bcf. EIA forecasts that natural gas storage levels will be 3,769 Bcf by the end of October, which is slightly higher than the fiveyear average and 16% higher than October 2018 levels.

Electricity, coal, renewables, and emissions

EIA expects the share of U.S. total utility-scale electricity generation from natural gas-fired power plants will rise from 34% in 2018 to 37% in 2019 and 38% in 2020. EIA forecasts that the share of U.S. generation from coal will average 25% in 2019 and 22% in 2020, down from 28% in 2018. EIA's forecast nuclear share of U.S. generation remains at about 20% in 2019 and in 2020. Hydropower averages a 7% share of total U.S. generation in the forecast for 2019 and 2020, similar to 2018. Wind, solar, and other nonhydropower renewables together provided 10% of U.S. total utility-scale generation in 2018. EIA expects they will provide 10% in 2019 and 12% in 2020.

EIA forecasts generally lower wholesale electricity prices in 2019 compared with 2018. The lower forecast prices reflect lower natural gas fuel costs. The first half of 2019, the average U.S. cost of natural gas delivered to power generators was 9% lower than the same period in 2018. EIA expects the delivered cost of natural gas during the second half of 2019 to be 31% lower than last year. Forecast electricity prices in the southeast are less than 1% lower than 2018, while prices in New England are 28% lower.

EIA forecasts that U.S. coal production in the second half of 2019 will be 328 million short tons (MMst), or 59 MMst (15%) less than in the second half of 2018. EIA expects that coal exports will continue to fall during the projection period as international demand for U.S. coal is dampened by high Atlantic freight costs in the near term and increased uncertainty in the metallurgical coal market in the longer term. EIA forecasts that U.S. coal consumption will total 593 MMst in 2019 and 548 MMst in 2020, a decline of 14% in 2019 and 8% in 2020.

EIA forecasts that utility-scale renewable fuels, including wind, solar, and hydropower, will collectively produce 18% of U.S. electricity in 2019 and 19% in 2020. EIA expects that annual generation from wind will surpass hydropower generation for the first time in 2019 to become the leading source of renewable electricity generation and that it will maintain that position in 2020.

EIA expects electric power sector generation from renewables other than hydropower—principally wind and solar—to grow from 409 billion kilowatthours (kWh) in 2019 to 467 billion kWh in 2020. In EIA's forecast, Texas accounts for 19% of the U.S. nonhydro renewables generation in 2019 and 21% in 2020. California has a share of 15% in 2019 and 14% in 2020. Regionally, the Midwest and Central power regions each have shares in the 16% to 17% range of the U.S. generation total from renewables other than hydropower.

EIA forecasts that, after rising by 2.7% in 2018, U.S. energy-related carbon dioxide (CO2) emissions will decline by 2.5% in 2019 and by 1.0% in 2020. In 2019, EIA forecasts that space cooling demand (as measured in cooling degree days) will be lower than in 2018, when it was 13% higher than the previous 10-year (2008–17) average. In addition, EIA expects U.S. CO2 emissions in 2019 to decline because the forecast share of electricity generated from natural gas and renewables is increasing while the forecast share generated from coal, which is a more carbon-intensive energy source, is decreasing.

-----

Earlier: