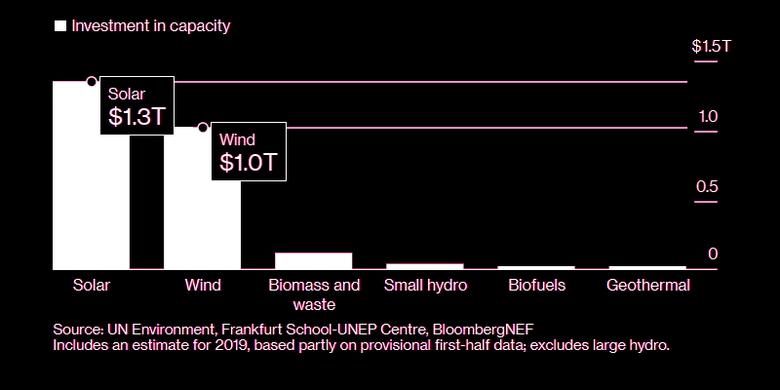

RENEWABLE ENERGY INVESTMENT $2.6 TLN

НОВАТЭК - Москва, 24 июля 2019 года. ПAO «НОВАТЭК» сегодня опубликовало консолидированную промежуточную сокращенную финансовую отчетность по состоянию на и за три и шесть месяцев, закончившихся 30 июня 2019 г., подготовленную в соответствии с Международными стандартами финансовой отчетности (МСФО).

Основные финансовые показатели деятельности по МСФО

(в миллионах российских рублей, если не указано иное)

|

II кв.

2019 г.

|

II кв.

2018 г.

|

|

1П

2019 г.

|

1П

2018 г.

|

|

215 789

|

194 818

|

Выручка от реализации нефти и газа

|

446 973

|

373 303

|

|

2 724

|

1 004

|

Прочая выручка

|

5 646

|

1 922

|

|

218 513

|

195 822

|

Итого выручка от реализации

|

452 619

|

375 225

|

|

(157 507)

|

(135 606)

|

Операционные расходы

|

(332 647)

|

(266 643)

|

|

-

|

-

|

Прибыль от выбытия долей владения в дочерних

обществах и совместных предприятиях, нетто

|

308 578

|

1 645

|

|

(247)

|

(621)

|

Прочие операционные

прибыли (убытки), нетто

|

(1 161)

|

(519)

|

|

60 759

|

59 595

|

Прибыль от операционной деятельности нормализованная*

|

118 811

|

108 063

|

|

69 193

|

68 958

|

EBITDA дочерних обществнормализованная*

|

134 917

|

125 379

|

|

115 835

|

101 339

|

EBITDA с учетом доли в EBITDA

совместных предприятий нормализованная*

|

233 777

|

177 645

|

|

(277)

|

7 380

|

Доходы (расходы) от финансовой деятельности

|

(6 298)

|

12 782

|

|

23 282

|

(18 215)

|

Доля в прибыли (убытке) совместных

предприятий за вычетом налога на прибыль

|

94 255

|

(17 052)

|

|

83 764

|

48 760

|

Прибыль до налога на прибыль

|

515 346

|

105 438

|

|

69 175

|

32 041

|

Прибыль, относящаяся к

акционерам ПАО «НОВАТЭК»

|

450 971

|

75 162

|

|

64 296

|

54 289

|

Прибыль, относящаяся к акционерам

ПАО «НОВАТЭК», нормализованная**

|

130 026

|

101 199

|

|

21,35

|

18,01

|

Прибыль на акцию нормализованная** (в руб.)

|

43,17

|

33,57

|

|

31 203

|

22 052

|

Денежные средства, использованные

на оплату капитальных вложений

|

73 679

|

31 764

|

* Без учета эффекта от выбытия долей владения в дочерних обществах и совместных предприятиях.

** Без учета эффектов от выбытия долей владения в дочерних обществах исовместных предприятиях и от курсовых разниц.

Выручка от реализации и EBITDA

Во втором квартале 2019 года наша выручка от реализации составила 218,5 млрд руб., а нормализованный показатель EBITDA с учетом доли в EBITDA совместных предприятий составил 115,8 млрд руб., что представляет собой увеличение на 11,6% и 14,3% соответственно по сравнению с аналогичным периодом 2018 года. За шесть месяцев, закончившихся 30 июня 2019 г., наша выручка от реализации и нормализованный показатель EBITDA с учетом доли в EBITDA совместных предприятий составили 452,6 млрд руб. и 233,8 млрд руб., увеличившись на 20,6% и 31,6% соответственно по сравнению с отчетным периодом прошлого года.

Рост выручки и нормализованного показателя EBITDA в основном связан с запуском производства СПГ на второй и третьей очередях завода «Ямала СПГ» во втором полугодии 2018 года.

Прибыль, относящаяся к акционерам ПАО «НОВАТЭК»

Прибыль, относящаяся к акционерам ПАО «НОВАТЭК», выросла до 69,2 млрд руб. (22,97 руб. на акцию), или на 115,9%, во втором квартале 2019 года и до 451,0 млрд руб. (149,73 руб. на акцию), или в шесть раз, в первом полугодии 2019 года по сравнению с аналогичными периодами 2018 года. На прибыль Группы значительное влияние оказало признание в марте 2019 года прибыли от продажи 10%-ной доли участия в проекте «Арктик СПГ 2» в размере 308,6 млрд руб., а также признание в обоих отчетных периодах неденежных курсовых разниц по займам Группы и совместных предприятий, номинированным в иностранной валюте.

Без учета эффекта от выбытия долей владения в дочерних обществах и совместных предприятиях и эффекта от курсовых разниц, нормализованная прибыль, относящаяся к акционерам ПАО «НОВАТЭК», составила 64,3 млрд руб. (21,35 руб. на акцию) во втором квартале 2019 года и 130,0 млрд руб. (43,17 руб. на акцию) в первом полугодии 2019 года, увеличившись на 18,4% и 28,5% соответственно по сравнению с аналогичными периодами 2018 года.

Капитальные вложения

Денежные средства, использованные на оплату капитальных вложений, увеличились до 31,2 млрд руб., или на 41,5%, во втором квартале 2019 года и до 73,7 млрд руб., или на 132,0%, в первом полугодии 2019 года по сравнению с аналогичными периодами прошлого года. Значительная часть наших инвестиций в основные средства была направлена на развитие СПГ-проектов (проекта «Арктик СПГ 2» до марта 2019 года и проекта по созданию центра по строительству крупнотоннажных морских сооружений в Мурманской области), освоение Северо-Русского месторождения и разработку нефтяных залежей Восточно-Таркосалинского и Ярудейского месторождений.

Объем добычи и покупки углеводородов

|

II кв.

2019 г.

|

II кв.

2018 г.

|

|

1П

2019 г.

|

1П

2018 г.

|

|

149,0

|

131,8

|

Совокупная добыча углеводородов,

млн баррелей нефтяного эквивалента (млн бнэ)

|

296,1

|

264,3

|

|

1,64

|

1,45

|

Совокупная добыча (млн бнэ в сутки)

|

1,64

|

1,46

|

|

18 910

|

16 418

|

Добыча природного газа с учетом доли в

добыче совместных предприятий (млн куб. м)

|

37 570

|

32 926

|

|

9 935

|

10 562

|

Добыча природного газа в дочерних обществах

|

20 034

|

20 925

|

|

7 909

|

4 420

|

Покупка природного газа

у совместных предприятий

|

16 830

|

12 007

|

|

1 971

|

1 708

|

Прочие покупки природного газа

|

4 190

|

3 437

|

|

19 815

|

16 690

|

Итого добыча природного газа дочерних обществ и покупка (млн куб. м)

|

41 054

|

36 369

|

|

3 035

|

2 928

|

Добыча жидких углеводородов с учетом доли в добыче совместных предприятий (тыс. тонн)

|

6 022

|

5 864

|

|

1 607

|

1 650

|

Добыча жидких углеводородов

в дочерних обществах

|

3 207

|

3 278

|

|

2 366

|

2 322

|

Покупка жидких углеводородов

у совместных предприятий

|

4 679

|

4 622

|

|

51

|

56

|

Прочие покупки жидких углеводородов

|

107

|

100

|

|

4 024

|

4 028

|

Итого добыча жидких углеводородов дочерних обществ и покупка (тыс. тонн)

|

7 993

|

8 000

|

Объем добычи природного газа с учетом нашей доли в добыче совместных предприятий во втором квартале и в первом полугодии 2019 года вырос на 15,2% и 14,1% соответственно, а объем добычи жидких углеводородов увеличился на 3,7% и 2,7% соответственно по сравнению с аналогичными периодами 2018 года. Основным фактором, оказавшим положительное влияние на рост добычи, стал запуск производства СПГ на второй и третьей очередях завода «Ямала СПГ» во второй половине 2018 года.

Объем реализации углеводородов

|

II кв.

2019 г.

|

II кв.

2018 г.

|

|

1П

2019 г.

|

1П

2018 г.

|

|

18 764

|

15 149

|

Природный газ (млн куб. м)

|

40 959

|

35 412

|

|

|

|

в том числе:

|

|

|

|

15 114

|

14 496

|

Реализация в Российской Федерации

|

33 888

|

33 801

|

|

3 650

|

653

|

Реализация на международных рынках

|

7 071

|

1 611

|

|

4 130

|

4 273

|

Жидкие углеводороды (тыс. тонн)

|

8 106

|

8 050

|

|

|

|

в том числе:

|

|

|

|

1 841

|

2 028

|

Продукты переработки стабильного

газового конденсата

|

3 638

|

3 594

|

|

1 214

|

1 148

|

Сырая нефть

|

2 341

|

2 271

|

|

674

|

658

|

Сжиженный углеводородный газ

|

1 351

|

1 307

|

|

396

|

436

|

Стабильный газовый конденсат

|

768

|

872

|

|

5

|

3

|

Прочие нефтепродукты

|

8

|

6

|

Во втором квартале и в первом полугодии 2019 года объем реализации природного газа составил 18,8 млрд и 41,0 млрд куб. м, увеличившись на 23,9% и 15,7% соответственно по сравнению с аналогичными периодами 2018 года, в результате роста объемов реализации СПГ, приобретаемого у наших совместных предприятий OАO «Ямал СПГ» и OOO «Криогаз-Высоцк». По состоянию на 30 июня 2019 г. наши остатки природного газа составили 1,4 млрд куб. м по сравнению с 1,3 млрд куб. м на 30 июня 2018 г. и в основном относились к остаткам природного газа в подземных хранилищах. Остатки природного газа формируются в зависимости от потребности Группы в отборе природного газа для реализации в последующих периодах.

Во втором квартале 2019 года объем реализации жидких углеводородов уменьшился на 3,3% до 4,1 млн тонн по сравнению с 4,3 млн тонн в аналогичном периоде прошлого года главным образом за счет изменения остатков. При этом объем реализации жидких углеводородов в первом полугодии 2019 года по сравнению с первым полугодием 2018 года незначительно увеличился на 0,7%. По состоянию на 30 июня 2019 г. совокупный объем жидких углеводородов, отраженный как «Остатки готовой продукции и товары в пути», составил 852 тыс. тонн по сравнению с 806 тыс. тонн по состоянию на 30 июня 2018 г. Остатки наших жидких углеводородов изменяются от периода к периоду и, как правило, реализуются в следующем отчетном периоде.

Выборочные статьи консолидированного отчета

о финансовом положении (в миллионах рублей)

|

|

30.06.2019 г.

|

31.12.2018 г.

|

|

Активы

|

|

|

|

Долгосрочные активы

|

1 229 888

|

923 050

|

|

в т.ч. основные средства

|

455 605

|

408 201

|

|

в т.ч. инвестиции в совместные предприятия

|

451 844

|

244 500

|

|

в т.ч. долгосрочные займы выданные

и дебиторская задолженность

|

256 555

|

232 922

|

|

Текущие активы

|

381 807

|

293 320

|

|

Итого активы

|

1 611 695

|

1 216 370

|

|

ОБЯЗАТЕЛЬСТВА И КАПИТАЛ

|

|

|

|

Долгосрочные обязательства

|

219 905

|

222 752

|

|

в т.ч. долгосрочные заемные средства

|

144 777

|

170 043

|

|

Текущие обязательства

|

109 675

|

107 023

|

|

Итого обязательства

|

329 580

|

329 775

|

|

Итого капитал, относящийся

к акционерам ПАО «НОВАТЭК»

|

1 264 340

|

868 254

|

|

Доля неконтролирующих

акционеров дочерних обществ

|

17 775

|

18 341

|

|

Итого капитал

|

1 282 115

|

886 595

|

|

Итого обязательства и капитал

|

1 611 695

|

1 216 370

|

-----

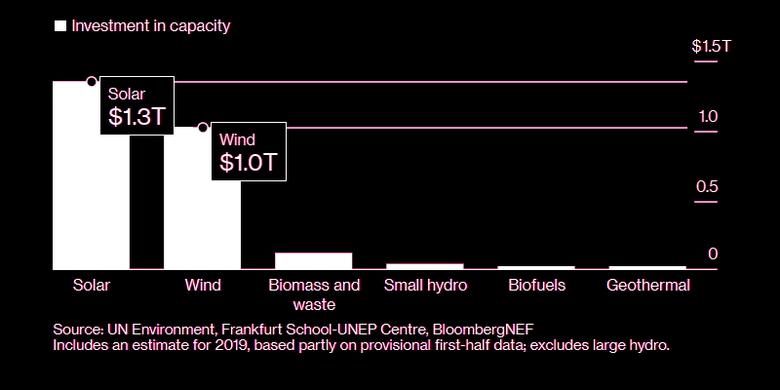

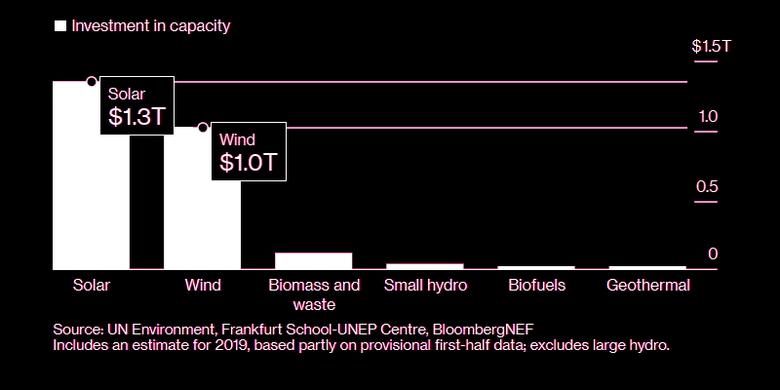

RENEWABLE ENERGY INVESTMENT $2.6 TLN

BLOOMBERG - The global energy supply is turning greener.

Investment in new renewable energy is on course to total $2.6 trillion in the years from 2010 through the end of 2019, according to a study by BloombergNEF for the United Nations Environment Program and Frankfurt School's UNEP Center published Thursday.

The boom in the capacity to generate electricity from low-carbon sources gives credibility to an effort by world leaders to slash climate-damaging greenhouse gases. Falling costs of wind and solar power plants is making more projects in new markets economically competitive with generation fed by fossil fuels.

"Investing in renewable energy is investing in a sustainable and profitable future, as the last decade of incredible growth in renewables has shown," said Inger Andersen, executive director of UNEP. "It is clear that we need to rapidly step up the pace of the global switch to renewables if we are to meet international climate and development goals."

The scale of investment going into clean energy represents a growing chunk of the money flowing into the power industry. Renewables such as wind, solar and hydro-electric plants will draw about $322 billion a year through 2025, according to separate forecasts from the International Energy Agency. That's almost triple the $116 billion a year that will go into fossil fuel plants and about the same as what will be invested in power grids.

Mega Trillions

The decade ending this year has seen $2.6 trillion invested in renewables

By far the biggest contributions to new investment have been made in solar and wind farms. Global solar power capacity increased by more than 2,500% in the decade, from 25 gigawatts at the beginning of 2010 to 663 gigawatts anticipated by the end of this year.

Still, the end of the decade showed some cracks. Funds moving into solar declined in some of the biggest markets in 2018 compared with the year prior.

Price Plunge

Costs have plummeted as investment in the sector rose

The cost of renewable technologies has fallen precipitously over the last few years. That's also helped make renewables less reliant on government support. BNEF's data shows the levelized cost of electricity is down 81% for solar photovoltaics since 2009.

"Sharp falls in the cost of electricity from wind and solar over recent years have transformed the choice facing policy makers," said Jon Moore, chief executive officer of BloombergNEF. "Now, in many countries around the world, either wind or solar is the cheapest option for electricity generation."

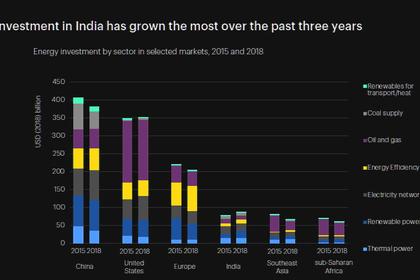

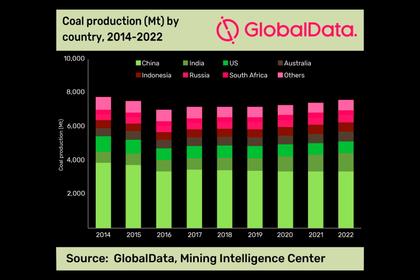

China has had by far the most investment in new renewable energy, making up nearly a third of the global total. The boom in solar hit a setback last year after the Chinese government announced restrictions on the number of new solar installations that would qualify for support. That led solar investment in China in the second half of 2018 to fall about 56% compared with the same period a year earlier.

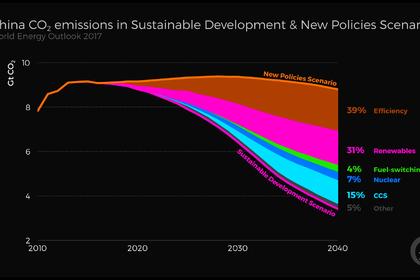

Small Slice

Renewables still make up a minority of global power generation

Despite the significant investment, renewables still makes up a relatively small proportion of global power generation. China led the way in buying wind and solar plants but also poured money into new coal power generation units.

Many more renewable projects will come online in the coming decades. Wind and solar are set to contribute 48% of generation by 2050, according to BloombergNEF.

Renewable Lead

Solar added more power generation capacity than any fossil fuel

Overall, there's been a net increase of 2.4 terawatts of installed capacity globally. While much of that has been from clean sources like wind, solar and hydro, a significant portion of that came from plants fired by coal and natural gas.

Europe and the U.S. have closed down coal plants, but that has been offset by an increase in Asia, especially in India. That's helped to increase carbon emissions from the global power industry by at least 10% from the end of 2009 through 2019.

-----