RUSSIA, ASIA TIES

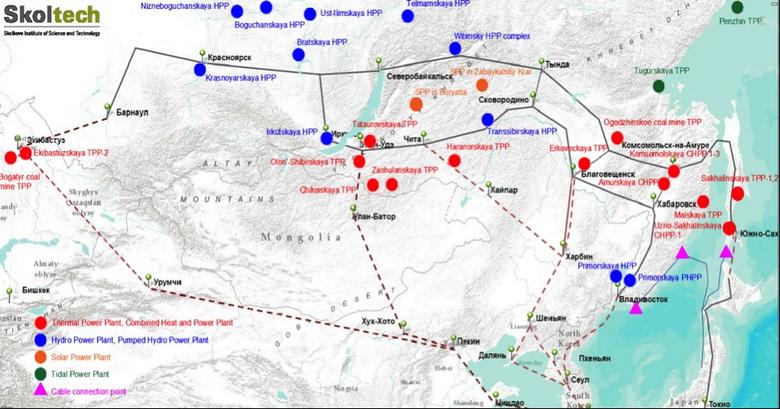

PLATTS - Russian and Asian leaders and energy officials are set to discuss cooperation at the Eastern Economic Forum in the Russian Far Eastern city of Vladivostok this week, at a time when Russia continues to seek closer ties with its Eastern partners.

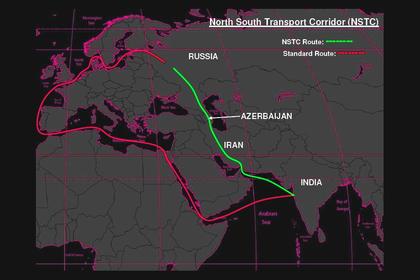

Discussions are likely to cover bilateral energy projects and developing regional energy cooperation, in light of recent trade tensions between the US and China, and the impact of Western sanctions against Russia and Iran.

Over the last year, these two geopolitical factors have added to Russia's already growing interest in capitalizing on its vast energy resources and strategic location to supply lucrative Asian markets and access new sources of financing in the Far East.

"Western sanctions have helped deepen Russia-China energy links as Chinese entities have emerged as a source of capital, which in turn has facilitated Chinese financing of the Yamal LNG project as well as the conclusion of the Power of Siberia pipeline," Dr Michal Meidan, director of the China Energy Program at the Oxford Institute for Energy Studies, said.

In addition to energy company talks, Russian president Vladimir Putin will meet Indian prime minister Narendra Modi and Japanese prime minister Shinzo Abe Thursday.

"The US-China trade tensions are further reinforcing China's energy relations with Russia as supplies from Russia represent a geopolitical hedge as well as a land-based supply route, as Beijing fears become overly dependent on waterborne routes," she added.

In recent months, Russia has signed new LNG cooperation deals with Asian partners, including selling 10% stakes in Novatek's Arctic LNG 2 project to CNPC subsidiary China National Oil and Gas Exploration and Development Company, and CNOOC. Japan's Mitsui and JOGMEC have also agreed to take a 10% stake in the 19.8 million mt/year project.

A final investment decision on the project is expected to be signed in the coming days. Novatek said previously that it expects to send around 80% of production from the project to the Asia-Pacific region.

The company also signed a preliminary deal to create a joint venture with China's Sinopec and Gazprombank to market LNG and gas to end-users in China earlier this year.

Natural gas links are also growing: Gazprom plans to launch the 38Bcm/year Power of Siberia line to China on December 1 and it is in talks over increasing gas supplies to China. Gazprom officials have said they are considering adding more capacity to the project, and are also considering another 30 Bcm/year supply route to China.

George Voloshin, head of the Paris branch of Aperio Intelligence, said that in light of China ramping up duty on LNG imports from the US, this is an area where Russia arguably has most to gain in its energy relationship with China.

"Apart from this new market opening up to Russia, there are few advantages. Oil and natural gas supplies to China under long-term contracts have long been agreed and do not depend on the state of US-China trade," he added.

LONGER-TERM TIES

Overall, analysts expect Russian energy ties to continue to expand with key trading partners China, Japan, South Korea and India over the next few years.

"Energy ties are expected to grow, mainly in terms of gas trade. Over the next five years, Russia's exports to China are set to increase to 38 Bcm (the Power of Siberia pipeline) though this will be a gradual ramp up," Meidan said.

The extent to which new gas projects can be agreed is less clear, however.

"An additional 10-20 Bcm is conceivable over the course of the decade but given the fraught history of Sino-Russian pipeline negotiations, assuming that all the discussed pipelines (including the Western routes etc) get built is over optimistic," she added.

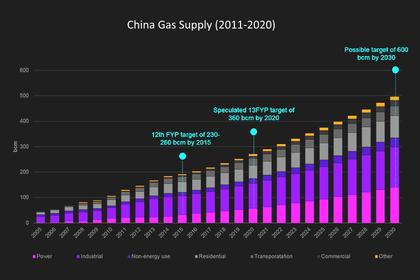

She also pointed to uncertainty over Chinese gas demand growth, which may rise by closer to 8-10%/year rather than the 16%/year seen in recent years.

"China will still want to diversify supply sources to include Central Asian gas and even other sources of imported LNG," she said.

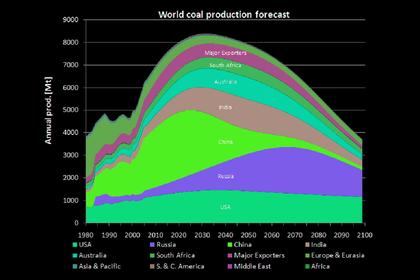

Russia's bid to develop further energy cooperation with Asian partners could also be negatively impacted if fears of a global recession come to fruition and the US moves to introduce harsher sanctions against Russia.

"Presently, tensions in the Russian-Western relationship, more specifically between Russia and the US, represent a serious impediment to further Russian-Asian energy cooperation," Voloshin said.

He pointed to US sanctions as jeopardizing Asian investment in Arctic projects as a particular challenge, as this is an area where foreign investment and know-how is necessary if projects are to be successful.

INTEREST IN DE-DOLLARIZATION GROWING

Another consequence of rising geopolitical tension is increasing interest in Russia and China in de-dollarization.

In June 2019, Russia and China signed an agreement to de-dollarize their bilateral trade, starting with contracts funded by VTB Bank on the Russian side and China Merchants Bank on the opposing side.

"The more active US policy of economic sanctions and trade wars under Donald Trump has encouraged Russia and some of its Asian partners, first and foremost China, to consider other currency options for bilateral trade," Voloshin said.

"US sanctions on a growing number of countries are certainly supporting a move toward other currencies, notably the RMB, so the use of RMB in commodity trading is set to develop over time but this will likely be a very slow process," Meidan added.

Significant forex risks and the energy sector's heavy reliance on the US dollar are likely to continue to slow progress in this area, unless international trade relations deteriorate to the point where continuing to use the US dollar is more dangerous than these traditional risks.

-----

Earlier: