U.S. GAS FOR INDIA

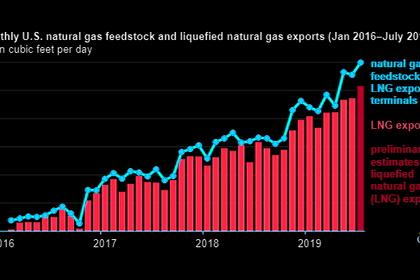

PLATTS - India's Petronet LNG is eyeing stakes in gas projects in the US and other countries in an effort to strengthen its grip on the supply sources as it expects India's import demand to grow sharply, CEO Prabhat Singh told S&P Global Platts in an interview.

Owning the entire value chain would help the company ship in gas at more competitive prices to India, he added.

"We are looking right up to the field. The moment I get my hand on well-head gas, it will help us to get gas at the cost price. We are also keen to take part in pipelines and liquefaction terminals -- so that we can become owners of the complete chain," Singh said.

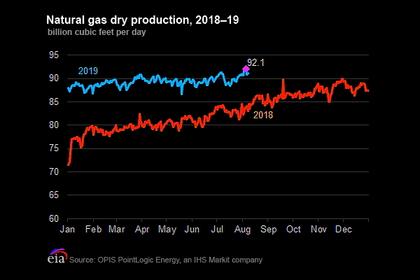

"The US is a very positive country because of the business environment and the free market forces. But at the same time, we are also looking at the entire globe," the CEO said.

Formed as a joint venture by the Indian government and state-run oil companies to import LNG and set up LNG terminals in the country, Petronet has been leading efforts to boost LNG infrastructure to help increase gas consumption in the country.

It set up the country's first and largest LNG receiving terminal at Dahej in the western state of Gujarat and another terminal at Kochi in the southern state of Kerala. While the Dahej terminal's capacity was expanded to 17.5 million mt/year from 15 million mt/year earlier this year, the 5 million mt/year Kochi terminal has been heavily underutilized since it was commissioned in 2013 because of a lack of pipeline infrastructure.

"What is stopping us now from getting gas to the burner tip of our consumers is the infrastructure in between. We are speeding up plans to boost our infrastructure," Singh said, adding, "Gas will be our mainstay for the next three to four decades."

Petronet LNG currently imports about 10 million mt of LNG annually on the basis of term contracts, while it ships in another one to two million mt from the spot market, Singh said.

DOMESTIC AND OVERSEAS PROJECTS

Petronet LNG's April-June regasification volumes inched 1.4% higher year on year as it was able to utilize the expanded capacity at its flagship Dahej terminal for a few days during the quarter.

The terminal's imported volumes rose to 217 trillion Btu (6.1 billion cubic meters) in the first quarter of the current fiscal year ending March 2020. It operated at 112% capacity during the period. The Dahej terminal's expanded capacity came into operation June 26.

"After the first phase expansion at Dahej terminal, we are now trying to put a jetty in Dahej and two more tanks. That will help to set the stage to expand the capacity of the terminal to 20 million mt/year in the next stage," Singh said.

Singh added that Petronet was aiming to set up another LNG terminal at Gopalpur in the eastern coast of India. It would initially have a capacity of 1 million mt/year but would eventually rise to 4 million mt/year.

"The detailed feasibility study has already been done for this project and it's looking very promising. In a way, this project has already taken off. Construction should start in a year's time," he added.

He said the company was also aiming to set up a LNG regasification terminal in Colombo, Sri Lanka. Petronet would own nearly 50% of the project.

"We have done all the homework and submitted all details. We are now in the process of negotiating the contracts," Singh said.

Singh added that the company also plans to set up a small terminal in Mauritius with a capacity of 0.5 million mt/year. Construction is expected to start in the next six to eight months.

And in Bangladesh, Petronet is eyeing to play a big role in a 7.5 million mt/year terminal, which is currently in the planning stage. "There's a bidding process there and we have submitted the bids," Singh said.

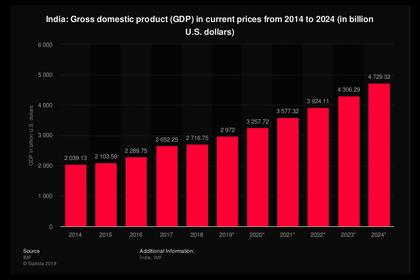

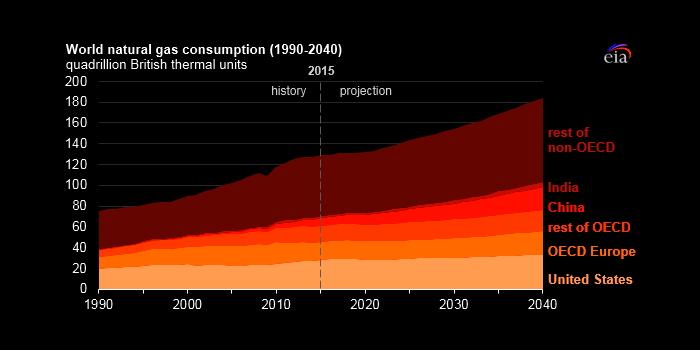

Given the growing role of gas in India's rising energy consumption, Singh said the country's regasification volumes would likely rise to 250-260 million cu m/day by 2030 -- the equivalent of nearly 70 million mt/year -- from about 150-160 million cu m/d at present. "And if there's any optimism that runs along with it, it could grow to 325 million cu m/d," he added.

India's share of gas in its overall energy mix is only 6%, much lower than the global average of more than 20%. New Delhi is stepping up efforts to raise that share to 15% by 2030, but consumption growth faces hurdles because of infrastructure and pricing issues.

"To achieve that, we have to be active and upbeat. Gas use will have to expand in all sectors -- fertilizer plants, power plants, industrial and household sectors," Singh said.

-----

Earlier: