CHINA'S LNG DEMAND UPDOWN

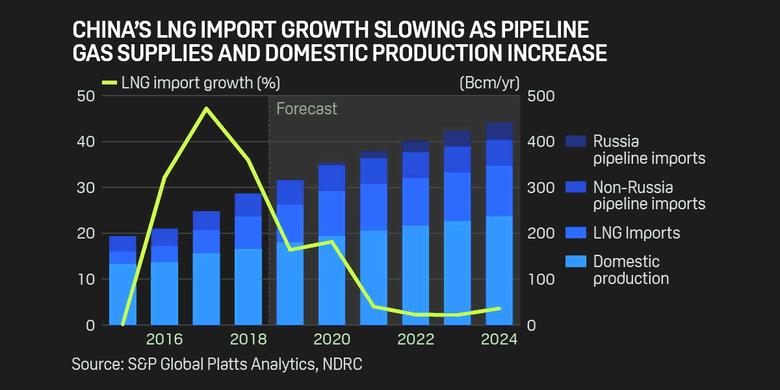

PE - Nothing lasts forever—and that includes the spectacular growth of Chinese LNG demand. LNG imports in the 2017-18 fiscal year grew by a staggering 51pc, up by 21bn m³ to reach 62bn m³. In 2018-19, growth was still eye-watering, with LNG imports up 17bn m³ to reach 79bn m³.

But this means that the growth rate has almost halved to 27pc for 2018-19 and the signs are that growth is continuing to decelerate. LNG imports were 20.5bn m³ in Q3 2019—higher than the corresponding quarter in 2018 by just 15pc.

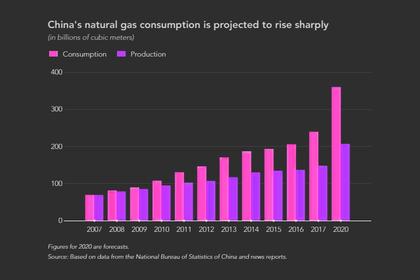

The main reason for slowing LNG demand growth is the total demand for gas. Total gas demand continues to grow, expected to be around 9pc in calendar year 2019 but this is only half of the 18pc growth of 2018. While 9pc is strong growth compared with most other gas markets, it is the slowest rate of growth in China since 2016.

Urbanisation and rising standards of living have driven the trend towards the use of gas in China. But, added to this, Beijing's campaign to use natural gas instead of coal for heating to combat chronic winter air pollution drove a surge in LNG imports in 2016-17 and 2017-18. Pipeline gas imports also increased, but was unable to keep pace with LNG.

The policy was relaxed in July 2019 to allow cities to choose the most accessible form of energy to guarantee winter supply. This was partly done to avoid shortages that previously drove inland trucked LNG prices to as much as $25/mn Btu in winter, twice the price of landed seaborne gas. According to a Reuters on 4 November 2019, more than half of the 5.24mn households due to ditch coal this year are expected to switch to non-gas heating—including solar PV and alcohol-based fuel systems.

Trade tensions

Gas is now also feeling the effects of the slowdown in the Chinese economy. Industry is a major gas user, more important than the power and heating sectors, and this means that any slowdown in economic growth directly impacts on gas demand.

While China is still growing faster than any other major economy, it is now growing at the slowest rate in almost three decades. The economy grew at an annualised rate of 6pc in the third quarter, the bottom end of the official full-year target. China's economy is now twice the size it was about a decade ago, making it increasingly difficult to sustain rapid growth.

The trade dispute with the US exacerbates its economic difficulties. At the end of 2019, there was optimism that a deal will be reached but, even if that happens, China would still be in a worse position than it could have been.

As a result of the economic downturn, to lower costs for industry the government is not enforcing its coal-to-gas push as strictly as previously. This is supporting coal consumption; China's coal imports are expected to grow by 10pc this year, countering earlier expectations that shipments would be capped at the same level as 2018.

A major impediment to the use of gas by industry—especially during an economic downturn—is that gas is still considerably more expensive than coal. For winter heating, LNG import prices would have to be $4.50-5.70mn Btu to compete with coal at its current prices of $85-114/t, Platts estimated in November 2019. While average Chinese LNG import prices in September 2019 were down by 11pc on prices in 2018, they were still almost double the coal price at $8.85mn Btu.

Rising supply

On the supply side, China's own gas production is growing. According to National Bureau of Statistics of China, the country produced 128bn m³ of natural gas in the first three quarters of 2019, up 10pc year-on-year. This follows production increases of 8pc in 2018.

Further pipeline competition with LNG is also on the way. The Power of Siberia Pipeline from Russia is complete and expected to commence supply to China from 1 December 2019. It is only expected to supply around 5bn m³ in its first year—but full capacity of 38bn m³ per annum is expected to be reached by 2022-23.

The Chinese government aims to increase gas to 8.3pc-10pc of primary energy consumption by 2020 and appears to be on-track to achieve this. According to BP, the share of gas in 2018 was 7.4pc. The government is making important market-oriented reforms, including establishing a national pipeline company to own major gas infrastructure and facilitate open access.

However, the government is also promoting cleaner coal, renewable energy and energy efficiency so gas needs to earn its place in the total energy mix. It is also likely to be wary of overreliance on imports from both an energy security and economic perspective. China is much less reliant on imports of coal than gas; in 2018, China imported 122bn m³ of gas in 2018, 43pc of demand.

All told, Chinese LNG buyers may well be over-contracted and looking to cut down their offtake commitments in 2020.

-----

Earlier: