CHINA'S CNOOC INVESTMENT $13 BLN

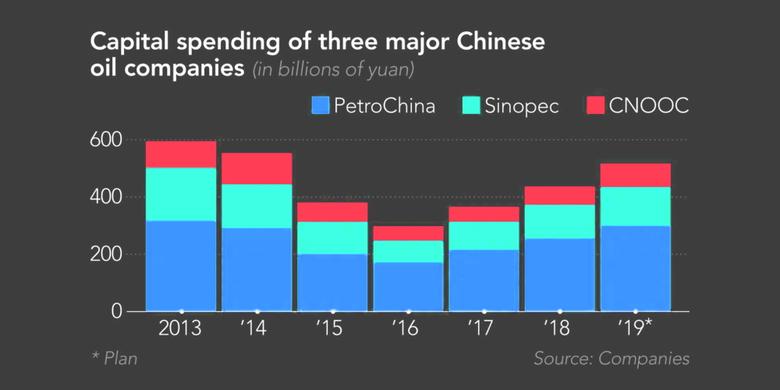

REUTERS - JANUARY 13, 2020 - Chinese offshore oil and gas major CNOOC plans to lift capital spending to the highest level since 2014, it said on Monday, as it sharpens its focus on domestic drilling.

CNOOC, one of the industry's lowest-cost explorers and producers, will maintain its cost competitiveness after record low costs in 2019, finance chief Xie Weizhi told a media briefing.

The increase in spending to between 85 billion and 95 billion yuan ($12.34 billion to $13.79 billion) compares with 2019 capital expenditure estimated at 80.2 billion yuan, slightly more than previous expectations.

CNOOC's strategy is in light of its expectations that global oil prices will be influenced more by Saudi Arabia-led producers rather than geopolitical factors such as the U.S.-China trade war or the worsening Iran-U.S. relations, said Xie.

The state-owned company is targeting total net oil and gas output of 520-530 million barrels of oil equivalent (boe) this year, up from last year's estimated 503 million boe.

Its latest estimate of 2019 production was well above a previous target at 480 million to 490 million boe.

Production from offshore China will account for about 64% of the 2020 target and overseas operations 36%, the same split as 2019, the company said.

CNOOC also estimates that net production will reach about 555 million boe in 2021 and 590 million boe in 2022.

It expects to bring on stream 10 new projects in 2020, mostly in Chinese offshore fields, but also in Guyana and the United Kingdom's Buzzard field. Its Guyana deepwater Liza field has begun operating ahead of schedule, the company added.

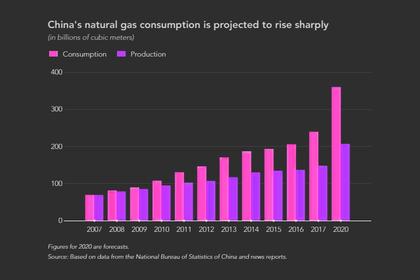

CNOOC will also step up investment in cleaner fuels, such as natural gas and renewables that will largely focus on offshore wind power.

"We'll increasingly focus on an orderly development of our natural gas business and also increase the ratio of offshore wind power (in our portfolio) to prepare for energy transformation in the future," Chief Executive Xu Keqiang told reporters.

The company plans to use 3-5% of its total annual spending on offshore wind power, with a focus on developing wind resources in coastal provinces such as Guangdong, Jiangsu, Fujian and Shandong, Xu said.

In December CNOOC started drilling at Lingshui 17-2 in the South China Sea, its first major deepwater gas field.

-----

Earlier: