GLOBAL OIL DEMAND 2020: 100.98 MBD

OPEC - 15 January 2020 - Monthly Oil Market Report

Oil Market Highlights

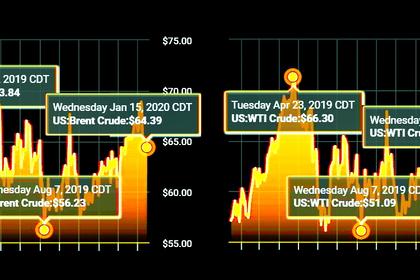

Crude Oil Price Movements

The OPEC Reference Basket (ORB) value rose by $3.54, or 5.6%, month-on-month (m-o-m) in December, to average $66.48/b, the highest value since April 2019. Similarly, ICE Brent increased by $2.46, or 3.9%, m-o-m to average $65.17/b, while NYMEX WTI increased by $2.73, or 4.8%, m-o-m to average $59.80/b. Oil prices were supported by optimism about the outlook of oil market fundamentals, following easing trade tensions between the US and China and continued market stabilization efforts conducted under the Declaration of Cooperation (DoC). The market structure of all three crude benchmarks ICE Brent, NYMEX WTI and DME Oman remained in backwardation. Money managers increased their speculative net long positions on the back of more bullish sentiment.

World Economy

The global economic growth remains at 3.0% for 2019, but is revised up by 0.1 pp to 3.1% for 2020. US growth remains at 2.3% for 2019 and is revised up by 0.1 pp to 1.9% for 2020. Euro-zone growth remains at 1.2% for 2019 and 1.0% for 2020. Japan's growth is revised up by 0.2 pp to 1.1% for 2019, considering better-than-expected growth in the first three quarters and revised up by 0.1 pp to 0.7% for 2020. China's growth is unchanged at 6.2% for 2019 and 5.9% for 2020. Also, India's growth remains at 5.5% for 2019 and at 6.4% for 2020. Brazil's growth remains unchanged at 1.0% for 2019 and is revised up by 0.3 pp to 2.0% for 2020. Russia's growth remains unchanged at 1.1% for 2019 and is revised up by 0.2 pp to 1.5% for 2020. The services sector in the US and other important OECD economies remains an important support factor for 2020 growth, alongside a potential recovery in global manufacturing and improving global trade relations.

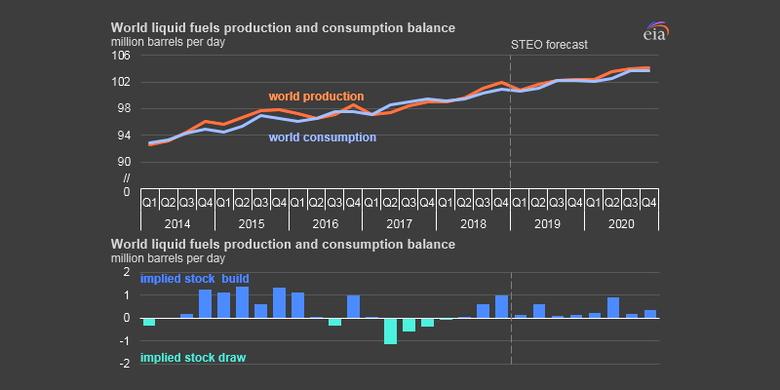

World Oil Demand

Global oil demand growth for 2019 is revised lower by 0.05 mb/d compared with the previous month's assessment, and is now estimated at 0.93 mb/d. Demand growth in OECD Americas is revised lower for 1H19 due to sluggish middle distillate demand. Slower-than-expected industrial fuel demand in OECD Asia Pacific also necessitated slight downward revisions. For 2020, oil demand growth is revised up by 0.14 mb/d from the previous month's assessment and is forecast at 1.22 mb/d, mainly reflecting an improved economic outlook for 2020. As a result, total world oil demand is projected to rise from 99.77 mb/d in 2019 to 100.98 mb/d in 2020. Oil demand growth in the OECD region is forecast to increase by 0.09 mb/d supported by OECD America, while non-OECD is expected to lead demand growth by adding 1.13 mb/d mainly in Other Asia, especially India and China.

World Oil Supply

Non-OPEC oil supply growth for 2019 is revised up by 0.04 mb/d from the previous month's assessment and is now estimated at 1.86 mb/d, for an average of 64.34 mb/d. The upward revision is led mainly by US liquids output growth, which is revised up by 46 tb/d, resulting in annual growth of about 1.66 mb/d in 2019. Non-OPEC oil supply growth in 2020 is also revised up by 0.18 mb/d from last month's assessment and is forecast at 2.35 mb/d for an average of 66.68 mb/d. The upward revisions in Norway, Mexico and Guyana are partially offset by downward revisions to the supply forecasts of the US, Russia and other OECD Europe. The US, Brazil, Canada and Australia are the key drivers for growth in 2019, and continue to lead growth in 2020, with the addition of Norway and Guyana. OPEC NGLs production in 2019 is estimated to have grown by 0.04 mb/d to average 4.80 mb/d and for 2020 is forecast to grow to average 4.83 mb/d. In December, OPEC crude oil production dropped by 161 tb/d m-o-m to average 29.44 mb/d, according to secondary sources.

Product Markets and Refining Operations

In December, product markets weakened as feedstock prices firmed and as product inventory levels rose given higher refinery intakes, and lacking winter-related support. With the IMO implementation in January 2020, the high sulphur fuel oil market showed slight gains in the US and in Singapore on the back of declining availability, while very low sulphur fuel oil (VLSFO) prices reached record high levels.

Tanker Market

The tanker market strengthened in December 2019, as freight rates in both dirty and clean segments of the market increased. On average, dirty tanker spot freight rates rose by 29% m-o-m on the back of increased tonnage requirements and high bunker prices. In the clean tanker market, increased tonnage was observed in the different routes, leading to an increase in average clean tanker spot freight rates by 18% m-o-m. Enhanced market activity was seen to drive rates higher on all routes, affecting all tanker sectors in the market. Moreover, freight rates are expected to continue this hike in 1Q20, reflecting the cost of new low sulphur bunker fuel regulations implemented January 1, 2020.

Stock Movements

Preliminary data for November showed that total OECD commercial oil stocks fell by 8.8 mb m-o-m to stand at 2,920 mb, which is 62.7 mb higher than the same time one year ago and 17.5 mb above the latest five-year average. Within the components, crude stocks declined by 0.7 mb to stand at 22.9 mb above the latest five-year average, while product stocks dropped by 8.1 mb to stand at 5.4 mb below the latest five-year average. In terms of days of forward cover, OECD commercial stocks fell by 0.4 days m-o-m in November to stand at 60.6 days, which was 0.9 days above the same period in 2018, but 0.6 days below the latest five-year average.

Balance of Supply and Demand

Demand for OPEC crude in 2019 is revised down by 0.1 mb/d from last month's report to stand at 30.6 mb/d, around 1.0 mb/d lower than the 2018 level. Demand for OPEC crude in 2020 is also revised down by 0.1 mb/d from last month's report, to stand at 29.5 mb/d, around 1.2 mb/d lower than the 2019 level.

-----

Earlier: