INDIA'S ENERGY DEMAND COULD DOUBLE

IEA - India 2020 Energy policy review

Executive summary

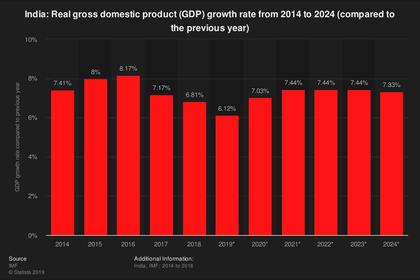

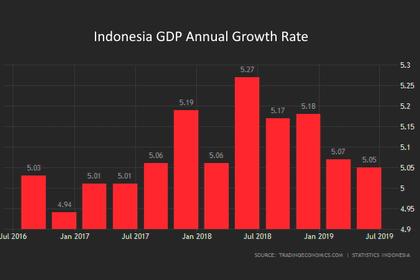

With a population of 1.4 billion and one of the world's fastest-growing major economies, India will be vital for the future of the global energy markets. The Government of India has made impressive progress in recent years in increasing citizens' access to electricity and clean cooking. It has also successfully implemented a range of energy market reforms and carried out a huge amount of renewable electricity deployment, notably in solar energy.

Ensuring Indian citizens have access to electricity and clean cooking has been at the top of the country's political agenda. Around 700 million people in India gained access to electricity between 2000 and 2018, reflecting strong and effective policy implementation. The IEA highly commends the Government of India for this outstanding result and supports its efforts to shift the focus towards reaching isolated areas and ensuring round-the-clock reliability of electricity supply.

The government of India has also made significant progress in reducing the use of traditional biomass in cooking, the chief cause of indoor air pollution that particularly affects women and children. The government has encouraged clean cooking with liquefied petroleum gas. India continues to promote cleaner cooking and off-grid electrification solutions, including a shift toward using solar photovoltaics (PV) for cooking and charging batteries.

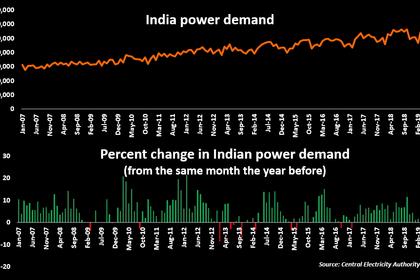

India's electricity security has improved markedly through the creation of a single national power system and major investments in thermal and renewable capacity. India's power system is currently experiencing a major shift to higher shares of variable renewable energy, which is making system integration and flexibility priority issues. The Government of India has supported greater interconnections across the country and now requires the existing coal fleet to operate more flexibly. It is also promoting affordable battery storage.

International experience suggests that a diverse mix of flexibility investments is needed for the successful system integration of wind and solar PV. This flexibility is available not only from the coal fleet – it can also come from natural gas capacity, variable renewables themselves, energy storage, demand-side response and power grids. Many of these solutions are not yet fully utilised in India. To fully activate a diverse set of flexibility options, it is critical for the government to put in place electricity market reforms that enable the appropriate price signals and create a robust regulatory framework.

India's coal supply has increased rapidly since the early 2000s, and coal continues to be the largest domestic source of energy supply and electricity generation. Amid more stringent air pollution regulations, new coal power plants that are more efficient, flexible and relatively lower in emissions will be better positioned for their economic viability. By contrast, old and inefficient plants, which require expensive retrofits to comply with environmental standards, are in a difficult position. The government is identifying those plants that can and will need to run more flexibly in the system. It is also examining changes to market design to improve the remuneration of the system services they can provide. An efficient coal sector is critically important not only for electricity generation, but also for industrial development in areas such as steel, cement and fertilisers.

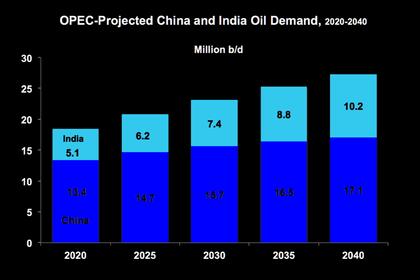

India is the world's third‑largest consumer of oil, the fourth‑largest oil refiner and a net exporter of refined products. The rate of growth of India's oil consumption is expected to surpass that of the People's Republic of China in the mid-2020s, making India a very attractive market for refinery investment. To maintain India's position as refining hub, the government is pursuing a very ambitious long-term roadmap to expand its refining capacity in line with the country's projected demand growth through 2040. As proven oil reserves are limited compared with domestic needs, India's import dependency (above 80% in 2018) is going to increase significantly in the coming decades.

To improve oil security, the government has prioritised reducing oil imports, increasing domestic upstream activities, diversifying its sources of supply and increasing Indian investments in overseas oil fields in the Middle East and Africa. Commendably, India is promoting domestic production with a major upstream reform, the Hydrocarbon Exploration and Licencing Policy (HELP), and is progressively building up dedicated emergency oil stocks. India's strategic petroleum reserve supplements the commercial storage available at refineries. India's current strategic reserve capacity of 40 million barrels can cover just over 10 days of current net imports. However, given the expected growth in oil consumption, the same volume may cover only four days of net imports in 2040. Therefore, it is important that the government pursue the second phase of its strategic stockholding policy, which would add an additional 50 million barrels, and also prepares subsequent phases. The IEA welcomes the government's efforts to intensify discussions with potential investors and supports India's collaboration with countries that have varied and comprehensive experience in stockholding and response capabilities.

The government aims to increase the share of natural gas in the country's energy mix to 15% by 2030, from 6% today. The IEA welcomes this ambition, which would allow India to improve the environmental sustainability and flexibility of its energy system. Increasing domestic gas production has been a key government priority, as output has unexpectedly come in below forecast levels over the past few years. India has five operating terminals for liquefied natural gas. Projects under construction could result in up to 11 additional terminals over the next seven years.

The role of gas has grown in India's residential and transport sectors but fallen in power generation, where imported natural gas remains squeezed by cheap renewables and coal. The government is committed to further liberalising the country's natural gas market. Strengthening regulatory supervision of upstream, midstream and downstream activities should be part of the market reforms, as it is likely to bring greater efficiency and drive up demand for gas and investment in gas transport infrastructure. A liquid and well-functioning domestic gas market would be a strong pillar for India's security of gas supply.

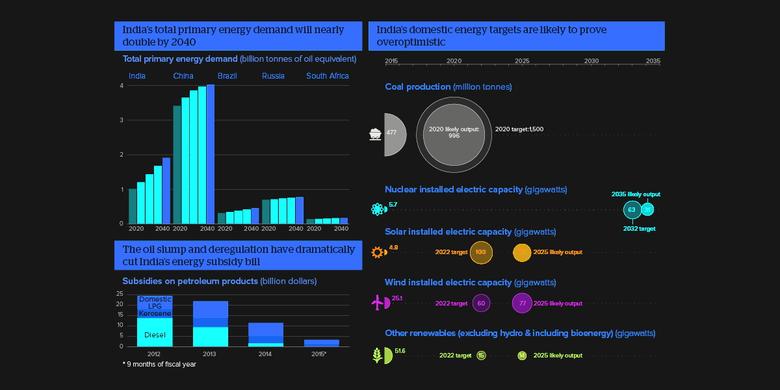

Based on current policies, India's energy demand could double by 2040, with electricity demand potentially tripling as a result of increased appliance ownership and cooling needs. Without significant improvements in energy efficiency, India will need to add massive amounts of power generation capacity to meet demand from the 1 billion air-conditioning units the country is expected to have by 2050. By raising the level of its energy efficiency ambition, India could save some USD 190 billion per year in energy imports by 2040 and avoid electricity generation of 875 terawatt hours per year, almost half of India's current annual power generation.

Recent IEA analysis shows that in 2018, India's investment in solar PV was greater than in all fossil fuel sources of electricity generation together. Large-scale auctions have contributed to swift renewable energy development at rapidly decreasing prices. By December 2019, India had deployed a total of 84 GW of grid-connected renewable electricity capacity. By comparison, India's total generating capacity reached 366 GW in 2019. India is making progress towards its target of 175 GW of renewables by 2022. In September 2019, the prime minister of India, Shri Narendra Modi, announced that India's electricity mix would eventually include 450 GW of renewable energy capacity. Progress towards these targets will require a focus on unlocking the flexibility needed for effective system integration. This can potentially be achieved by improving the design of renewables auctions, with clear trajectories and criteria to reflect quality, location and system value, along with measures to foster grid expansion and demand-side response across India.

-----

Earlier: