INDIA'S FISCAL PAINS

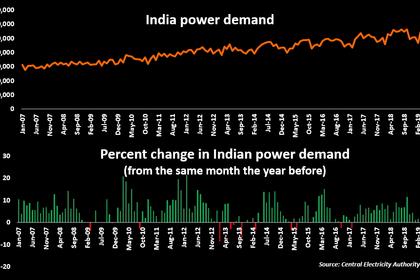

PLATTS - The dramatic escalation of Middle East tensions and the risk of higher oil prices will likely prevent a quick recovery in India's oil products appetite, which is already at multiyear lows, as well as add to its fiscal pains at a time when the economy is witnessing feeble economic growth.

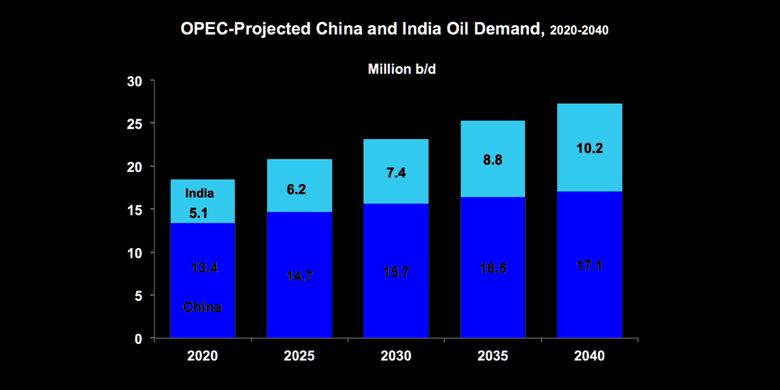

It remains to be seen to what extent higher oil prices will impact domestic oil products demand and prevent an anticipated consumption recovery. But given the intensity of the situation, analysts said India needs to remain prepared with an alternative crude supply plan to cushion any potential disruption from the Middle East, which supplies roughly 65% of its crude imports.

S&P Global Platts Analytics expects India's oil demand to grow by 170,000 b/d in 2020, up from 155,000 b/in 2019.

"But there are headwinds ahead, particularly with higher fuel prices," said Lim Jit Yang, oil markets adviser at Platts Analytics, who added: "The situation is not helped by rising instability in the Middle East after a US strike killed Iranian General Qassem Soleimani."

The US President Donald Trump has threatened to target 52 Iranian sites if Tehran retaliates for killing Soleimani.

"A significant attack in retaliation can cause a prolonged disruption to oil infrastructure. It's a risk that could send prices higher, dampening India's oil demand and having a direct bearing on its economic outlook," Lim said.

India's overall oil products demand stood at 5.06 million b/d in 2019, a growth of 3.2% over the 2018 level of 4.90 million b/d, making it the lowest year-on-year growth since 2013, according to Platts Analytics.

Domestic prices of key transport fuels hit one-year highs this week following a rise in global crude prices. While gasoline was sold around Rupees 75.69/l in New Delhi, diesel had climbed to Rupees 68.68/l.

And from April onward, India's motorists are also expected to pay a quality premium for their transport fuel with Euro 6 equivalent specifications. This comes at a time the auto sector is staring at many quarters of weak growth.

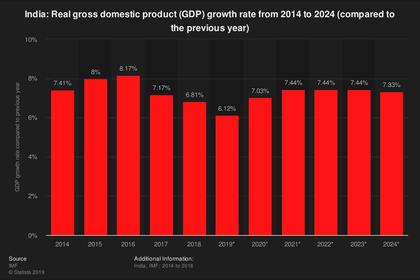

"Any rise in oil prices will impact the fiscal deficit situation of the country, put pressure on the currency, increase cost of operations for airlines, refineries, inflate retail fuel prices, and raise inflation concerns. India's GDP rate is already declining for quite some time and this will further deteriorate the situation," said Sumit Pokharna, oil and gas analyst, at Kotak Securities.

PRICES, TRADE FLOWS

Kang Wu, head of Asia Analytics at Platts said the chances of a full-scale conflict in the Middle East stands at "50/50" and Dated Brent prices would be likely capped at $70 a barrel.

"For India, the problem from rising oil prices will depend on to what extent they will rise and how long that will continue," said Dharmakirti Joshi, chief economist at CRISIL, a unit of S&P Global.

Joshi added: "The macroeconomic parameters are already under stress. Higher oil prices will put more stress on growth, inflation and the fiscal situation, although I would say $70 a barrel is not an unduly worrisome number for India."

Senthil Kumaran, a consultant at Facts Global Energy, said the impact of higher crude prices would likely be limited.

"In the past, any rise in crude prices would put tremendous pressure on the government as they were subsidizing transport fuels. Post-deregulation, the economy has adjusted well while instead became immune to global price shocks. Some impact on gasoil is possible, but gasoline growth is undeterred by macroeconomic factors," Kumaran said.

S&P Global Ratings expects India's GDP to grow by 5.1% in the financial year ending March 2020, while it expects growth to recover to 6.5% in the year ending March 2021.

"Growth continues to surprise on the downside and with core inflation falling sharply; this is clearly a substantial weakening in demand. Weakness in the real sector and stress in the financial sector are feeding into each other, pulling growth down," it said in its latest Asia-Pacific Quarterly report.

India is also speeding up plans to more than double its strategic petroleum reserve capacity to cushion the impact of any potential disruption to oil flows in case geopolitical tensions escalate.

In addition to Middle Eastern countries keen to participate in India's SPRs, the country is now seeing interest from the US, HPS Ahuja, CEO and managing director of Indian Strategic Petroleum Reserves Ltd., told Platts late last year.

India's SPR volumes are much lower relative to its oil import needs and compared with other major Asian oil buyers.

-----

Earlier: