LIBYA'S OIL BLOCKADE: 1 MBD DOWN

PLATTS - 20 Jan 2020 - Libya's crude production is on the verge of being crippled, and could plummet to less than one-tenth of its 1.20 million production capacity in a few days if its key oil fields and export terminals remain shut as the country's political crisis deepens.

Oil exports from Libya are also down to a trickle after the self-styled Libya National Army imposed a blockade over the weekend, forcing the OPEC producer to declare force majeure on exports from five key terminals.

"When storage tanks are full in a few days, Libya's oil production will be limited to 72,000 b/d from offshore fields and Wafa oil field, from over 1.20 million b/d yesterday," a spokesman from National Oil Corporation said late Sunday.

This means more than 1 million b/d of high quality crude is temporarily off the market, which will push refiners to seek short-term replacement supplies.

Libya's oil industry has suffered from a few temporary outages since April when fighting intensified between the LNA, led by General Khalifa Haftar in the east who is backed by the UAE and Russia among other countries, and the UN-backed Government of National Accord, led by Prime Minister Fayez al-Serraj who is supported by Turkey.

Foreign powers met in Berlin on Sunday to try to forge a peace deal between the two rivals groups, but the meeting ended with pledges to maintain a truce that could be lead to a permanent ceasefire and eventually a peace process taking place.

However, for now, almost all of its crude exports remain shut-in, pushing oil prices higher on Monday.

Oil production/exports

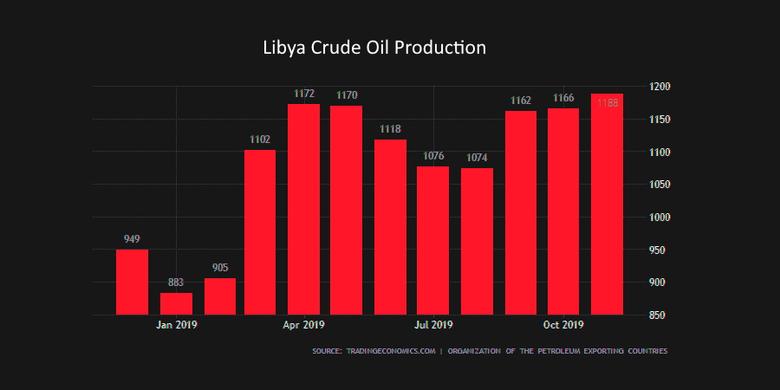

- OPEC member Libya was producing between 1.15 million and 1.20 million b/d last week before the blockade began.

- Libyan crude production averaged 1.06 million b/d in 2019, according to S&P Global Platts estimates, from 950,000 b/d in 2018 and 810,000 b/d in 2017.

- Libya has the largest proven reserves of oil in Africa, and its crude is coveted because it is light and sweet.Crude exports from the North African producer were expected to average 1.10 million b/d in January, according to shipping data seen by Platts.

- Libya has been unable to recover from the 2011 uprising, when the toppling of leader Moammar Qadhafi led to civil strife and reduced output from more than 1.6 million b/d before his ouster.

Impact on buyers

- The force majeure on key Libyan oil grades could have an impact on Mediterranean light sweet crude complex pricing, with Azerbaijan's Azeri Light, Algeria's Saharan Blend and Kazakhstan's CPC Blend likely to see a boost in values.

- Libyan crude, which is typically light, low in sulfur and yields a good amount of middle distillates and gasoline, is extremely popular among refineries in the Mediterranean and Northwest Europe.

- Demand for Libyan crude has gradually increased among Asian refiners over the past two years, with renewed interest for sweet crudes from China, Malaysia and Thailand.

- Around 20% of Libya's crude is exported to Asia, with the rest going to Europe. The US also occasionally imports some Libyan crude.

- The main crude grades include Sharara, Es Sider, Sarir/Mesla and Amna.

- Libyan crude was recently trading at a discount of more than 60 cents/b to the official selling prices set by Libya's NOC for January.

- There is always a discount applied to Libyan crude, to reflect the greater risks to supplies scheduled to load from the country, according to traders.

- "No one knows how long it will last; the good thing is that none of the infrastructure has been damaged," a Mediterranean crude trader said.

Infrastructure

- Libya's oil infrastructure has once again found itself in the midst of the country's ongoing civil conflict between the two opposing groups.

- Almost all key oil terminals and infrastructure, especially those in the east of the country, are already controlled by the LNA.

- Libya's largest oil field Sharara has been shut-in since Sunday, along with the nearby 90,000 b/d El Feel field.

- Crude from El Feel and the nearby Sharara field is also pumped to the 120,000 b/d Zawiya refinery and export terminal in northwest Libya.

- NOC on Saturday declared force majeure on oil exports out of the Brega, Ras Lanuf, Marsa el Hariga, Zueitina and Es Sider terminals.

- Foreign companies operating in Libya include Eni and Total, OMV, ConocoPhillips, Wintershall, Repsol and Tatneft.

Oil price/supply implications

- The collapse in Libyan oil production and the growing threat to the majority of its exports has already added support to global oil prices, helping to push ICE Brent briefly over $65/b Monday.

- With question marks over some 1 million b/d of Libyan exports now more acute, the producer's woes are likely to push OPEC output down even further.

- Libya, which is not formally part of the current OPEC-led output cut deal, had until recently more than doubled its oil output since early 2016.

Natural gas

- Libya is a key supplier of natural gas to Italy via the Greenstream pipeline.

- In 2019, exports averaged 15 million cu m/d and totaled 5.4 Bcm, according to data from S&P Global Platts Analytics. That is around 8% of Italy's total gas consumption of around 70 Bcm/year.

- So far in 2020, Libyan gas exports to Italy have averaged around 11 million cu m/d, according to the data.

-----

Earlier: