OIL MARKET IS WELL-SUPPLIED

PLATTS - The global oil market is "well-supplied" and any decision to pump more crude in case of disruptions will be a group decision within OPEC, the UAE's oil minister said Wednesday.

"The market is well-supplied," Suhail Mazrouei said in Abu Dhabi. "I would say now we are not forecasting a shortage of supply unless we have a catastrophic escalation which we don't see."

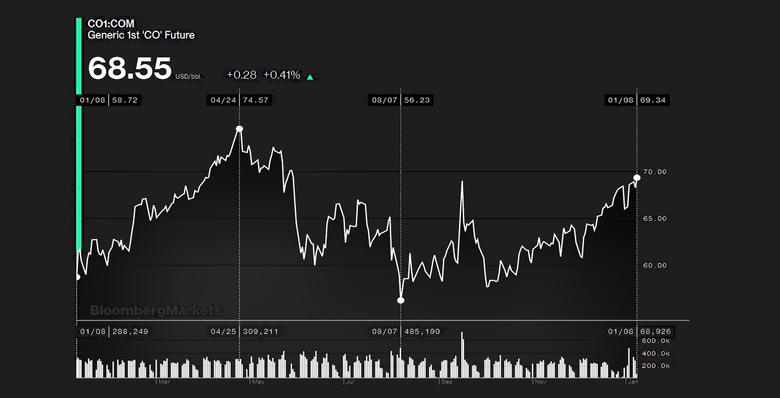

Fears of oil disruptions in the Middle East have risen after the US killing of top Iranian commander Qassem Soleimani in Baghdad last week, sending oil prices soaring to touch $70/b for the first time since September. Iran retaliated Wednesday attacking military bases with US soldiers in Iraq.

The UAE, OPEC's third largest oil producer, says any decision to make up for lost barrels will be a group decision.

"OPEC always will meet to discuss whatever necessary actions that we need to do," Marzrouei said, in response to a reporter's question if OPEC would step in to fill any gap in supplies. "It's not going to be unilateral, it will be a group decision."

OPEC and members part of the OPEC+ alliance meet next in Vienna in March to discuss their oil production cuts, which were expanded by about 500,000 b/d to 1.7 million b/d for January to March. The cut is even bigger counting Saudi Arabia's promise to cut an additional 400,000 b/d.

SPARE CAPACITY

In case of disruption, OPEC would use its spare capacity to fill any gaps, Mazrouei told a forum in Abu Dhabi.

"If necessary, we will as we always do respond because we care about the world, we care about supplying the world demand, but we have limitations as well," he said.

The UAE is boosting its production capacity to 4 million b/d this year, from 3 million b/d.

Mazrouei warned that if oil supply is cut it will send oil prices to $100/b and will have a huge impact on the global economy.

"If that supply is cut, every country in the world will be impacted," he said. "The world can't sustain another $100/b oil price and another huge spike, so no one wants that and no can handle that."

The minister said he does not expect the key choke point of Strait of Hormuz to be closed or movements through the waterway disrupted. Iran has threatened to close the waterway if war erupts in the region.

"The Strait of Hormuz is inot only mportant for us but it is important for the world economy and important to the whole supply chain and Iran understands that," he said.

Daily oil flow through the Strait of Hormuz averaged 21 million b/d or the equivalent of about 21% of global petroleum liquids consumption in 2018, according to the US Energy Information Administration.

GEOPOLITICS PLAGUE

OPEC Secretary General Mohammad Barkindo also told the Abu Dhabi forum that the OPEC+ alliance will continue to work to ensure stability in the oil market and insulate itself from geopolitics plaguing the Middle East.

The oil and financial markets have come to accept the OPEC+ agreement's intention "to ensure sustainable stability in the oil market," Barkindo said. There is a risk to spare capacity if the market is disrupted, he added. Spare capacity is 3 million to 3.5 million b/d, with two-thirds in the Persian Gulf led by Saudi Arabia, he estimated. "Yes the issue of spare capacity will come to the fore if there is risk to security of supply," he said. "It is in the interest of the global economy for this industry to continue to attract predictable investments that will not only maintain the current supply to meet current demand but also to meet the growing demand and unforeseen circumstances."

OIL DEMAND

Oil demand continues to grow and the OPEC+ agreement to trim production through March will keep supply in check, Barkindo said.

OPEC is also working with its members to improve compliance with output cuts, which for OPEC+ reached well above the target to 146% in 2019. Iraq and Nigeria have promised to improve their compliance.

"Countries lagging behind for domestic internal reasons are working to overcome their challenges," Barkindo said. "We are confident in the course of time they will be able to hit 100%."

Mazrouei said economic growth is "healthy" and supply from shale oil producers is weakening, probably because of environmental and water issues.

The US is expected to produce an average 13.2 million b/d of crude oil in 2020, an increase of 900,000 b/d from last year, according to the EIA.

Barkindo said shale oil remains important to industry growth.

"We welcome the continued role of shale oil from the US, we welcome the new status of US being the biggest producer of not only crude oil but liquids," he said. "With that comes responsibility to maintain stable oil markets. OPEC alone cannot share this responsibility. We invite the US to share in this noble role and objective."

-----

Earlier: