OIL MARKET WILL STABLE

PLATTS - Saudi energy minister Prince Abdulaziz bin Salman pledged on Monday to help ensure the stability of the global oil market amid rising tensions in the Middle East following the US killing of a top Iranian commander in Baghdad.

"As tensions remain high in our region, the kingdom will do all it can to ensure a stable oil market," the minister told the International Petroleum Technology Conference in the Saudi city of Dhahran.

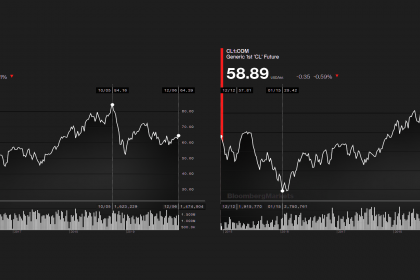

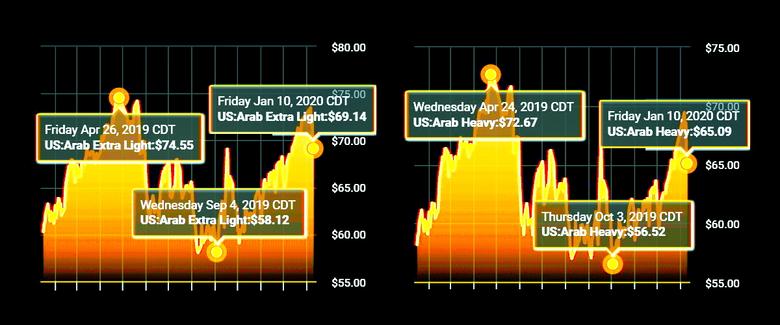

The strike that killed Qassem Soleimani helped to push oil prices up to $70/b for the first time since September, as Iran retaliated to the killing with attacks on US forces stationed in Iraq. Brent has since retreated, trading nearly unchanged at $65.03/b at 1:56 am EST time.

Saudi Arabia, the world's biggest oil exporter, is in the midst of an OPEC+ agreement to cut 1.7 million b/d of crude from the market in Jan through to March.

"The president of the United States is the president of the United States, he can do whatever he wishes, and he is certainly not accountable to me," the prince said in reply to a question on the US killing of Soleimani. "However, the US is a strategic partner. It has a big role in security."

Saudi Arabia, the world's biggest oil exporter, is in the midst of an OPEC+ agreement to cut 1.7 million b/d of crude from the market in January through to March.

Saudi Arabia's new quota is 10.145 million b/d, but the kingdom plans to produce at a maximum of 9.744 million b/d with its voluntary cut of 400,000 b/d announced at the OPEC+ meeting in December. That brings the total OPEC+ cuts to 2.1 million b/d.

"Generally we don't like volatility," the minister said. "Predictability comes with a price tag. That price tag comes with the creation of institutions such as OPEC and OPEC+."

SAUDIS CUTTING

Saudi Arabia, OPEC's largest producer, trimmed its production in December to 9.82 million b/d, according to the latest S&P Global Platts OPEC survey, after surging it in November to replenish stocks depleted in the wake of the September 14 attacks on the Abqaiq processing facility and Khurais oil field.

"We're leaving it until we meet in March," said Prince Abdulaziz when asked about the OPEC+ agreement which will be discussed at a meeting in Vienna in March. "We have made an agreement subject to review. We have to see how the situation then will be, what level inventories are. We are focused on inventories."

Prince Abdulaziz said among his goals for 2020 are "sustainable growth in terms of demand, sustainable growth in terms of supply, predictability and making sure we are focused on the challenges of the industry, which is how to produce oil in the most efficient way."

He also emphasized that growth in oil demand should not impact the environment.

Yasir Al-Rumayyan, Saudi Aramco's chairman, stressed the need to maintain a balance between transition to cleaner energy and energy security.

"A short-sighted narrative on the energy transition is [emerging] which could have strategic implication for the world's energy security," he said.

-----

Earlier: