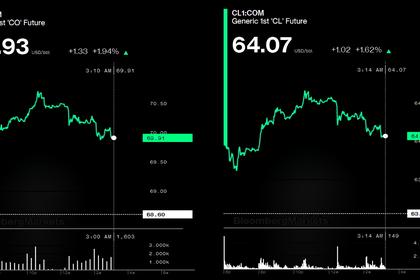

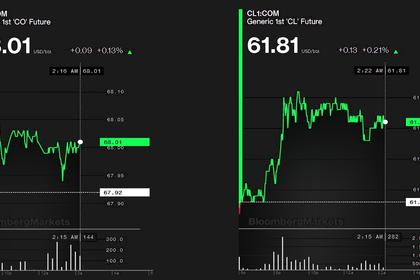

OIL PRICE: NEAR $65

REUTERS - Oil prices dipped slightly on Monday as investors shift their focus away from easing Mideast tensions to this week's scheduled signing of an initial U.S.-China trade deal whose details remain to be seen.

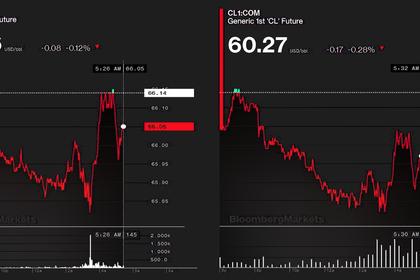

Brent crude LCOc1 was down 15 cents at $64.83 per barrel at 1150 GMT, while West Texas Intermediate (WTI) crude CLc1 was down 8 cents at $58.96 a barrel from the previous session.

Oil prices surged to their highest in almost four months after a U.S. drone strike killed an Iranian commander and Iran retaliated with missiles launched against U.S. bases in Iraq. But they slumped again as Washington and Tehran retreated from the brink of direct conflict last week.

Global benchmark Brent touched $71.75 per barrel last week before ending on Friday below $65.

"Oil is likely to keep treading water for a little while in our view with the de-escalation of U.S.-Iran tensions and consequent decline in the perception of potential future supply disruptions," global oil strategist at BNP Paribas in London Harry Tchilinguirian told the Reuters Global Oil Forum.

"While this week should see the signing of a phase 1 trade deal between the US and China, we suspect that agreement is already largely discounted in the price level, and is unlikely to provide a strong boost to oil prices."

Backwardation in Brent LCoC1-LCOc2, a market structure where prices for near-term contracts are higher than those for later contracts, is currently at 72 cents per barrel, from 84 cent a week earlier, whereas the WTI backwardation CLc1-CLc2 is at 4 cents a barrel from 23 cents last week.

Backwardation tends to reflect tightening supplies, and the narrowing of the values indicate that worries over supply disruption are receding.

"The price fall came as market players concluded that despite the significant rise in tension between the U.S. and Iran, oil production is unlikely to be affected," said oil broker PVM's Tamas Varga.

"Nerves have been greatly calmed and consequently oil prices finished the week well off the highs ... Violent rallies are not expected to last unless physical production is negatively impacted".

A U.S.-China trade deal is due to be signed in Washington on Wednesday.

The Trump administration has invited at least 200 people to a ceremony for the signing of the deal, but the two nations have not yet finalized the details of what will be signed, White House officials said on Friday.

-----

Earlier: