2020-01-15 12:50:00

OIL PRICES 2020-21: $65-$68

U.S. EIA - January 14, 2020 - SHORT-TERM ENERGY OUTLOOK

Forecast Highlights

- This edition of the Short-Term Energy Outlook is the first to include forecasts for 2021.

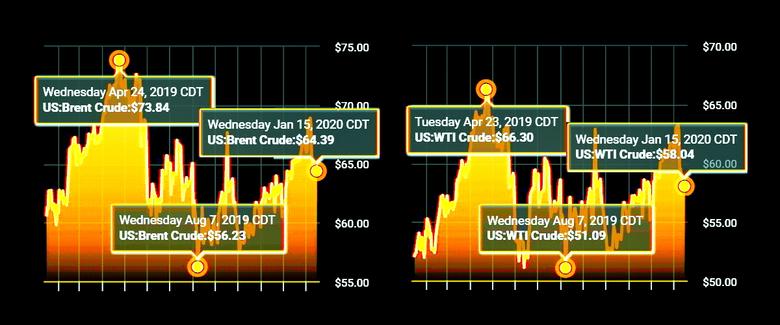

- EIA forecasts Brent crude oil spot prices will average $65 per barrel (b) in 2020 and $68/b in 2021, compared with an average of $64/b in 2019. EIA expects West Texas Intermediate (WTI) crude oil prices will average about $5.50/b lower than Brent prices through 2020 and 2021, compared with an average WTI discount of about $7.35/b in 2019.

- Global liquid fuels inventories were mostly unchanged in 2019, and EIA expects they will grow by 0.3 million b/d in 2020 and then decline by 0.2 million b/d in 2021.

- On January 1, 2020, the International Maritime Organization (IMO) enacted Annex VI of the International Convention for the Prevention of Pollution from Ships (MARPOL Convention), which lowers the maximum sulfur content of marine fuel oil used in ocean-going vessels from 3.5% of weight to 0.5%. EIA expects this regulation will encourage global refiners to increase refinery runs and maximize upgrading of high-sulfur heavy fuel oil into low-sulfur distillate fuel to create compliant bunker fuels. EIA forecasts that U.S. refinery runs will rise by 3% from 2019 to a record level of 17.5 million b/d in 2020, resulting in refinery utilization rates that average 93% in 2020. EIA expects one of the most significant effects of the regulation will be on diesel wholesale margins, which will rise from an average of 43 cents per gallon (gal) in 2019 to a forecast peak of 53 cents/gal in March 2020 and an annual average of 50 cents/gal in 2020. EIA expects diesel margins to decline to 49 cents/gal in 2021.

- U.S. regular gasoline retail prices averaged $2.60/gal in 2019, and EIA forecasts that they will average $2.63/gal in both 2020 and 2021.

- EIA estimates that U.S. crude oil production averaged 12.2 million b/d in 2019, up 1.3 million b/d from 2018. EIA forecasts U.S. crude oil production will average 13.3 million b/d in 2020 and 13.7 million b/d in 2021. Most of the production growth in the forecast occurs in the Permian region of Texas and New Mexico.

- U.S. net imports of crude oil and petroleum product fell from an average of 2.3 million b/d in 2018 to an average of 0.5 million b/d in 2019, and EIA estimates the United States has exported more total crude oil and petroleum products than it has imported since September. EIA forecasts that the United States will be a net exporter of total crude oil and petroleum products by 0.8 million b/d in 2020 and by 1.4 million b/d in 2021.

- U.S. dry natural gas production set a new record in 2019, averaging 92.0 billion cubic feet per day (Bcf/d). EIA forecasts dry natural gas production will rise to 94.7 Bcf/d in 2020 and then decline to 94.1 Bcf/d in 2021. Production in the Appalachian region drives the forecast as it shifts from growth in 2020 to declining production in 2021.

- EIA forecasts that Henry Hub natural gas spot prices will average $2.33 per million British thermal units (MMBtu) in 2020, down from $2.57/MMBtu in 2019. EIA expects that natural gas prices will then increase in 2021, reaching an annual average of $2.54/MMBtu.

- EIA forecasts that U.S. coal production will total 597 million short tons (MMst) in 2020, down 93 MMst (14%) from 2019, as a result of declining domestic demand for coal in the electric power sector and lower demand for U.S. exports. EIA expects that coal production will again fall by 16 MMst (3%) in 2021 as export demand stabilizes and declines in U.S. power sector demand slow.

- EIA expects the share of U.S. total utility-scale electricity generation from natural gas-fired power plants will remain relatively steady, it was 37% in 2019, and we forecast it will be 38% in 2020 and 37% in 2021. Electricity generation from renewable energy sources rises from a share of 17% last year to 19% in 2020 and 22% in 2021. The increase in the renewables share is the result of expected additions to wind and solar generating capacity. Coal’s forecast share of electricity generation falls from 24% in 2019 to 21% in both 2020 and 2021. The nuclear share of generation, which averaged slightly more than 20% in 2019 will be slightly less than 20% by 2021, consistent with upcoming reactor retirements.

- After decreasing by 2.1% in 2019, EIA forecasts that energy-related carbon dioxide (CO2) emissions will decrease by 2.0% in 2020 and by 1.5% in 2021. Declining emissions reflect forecast declines in total U.S. energy consumption combined with assumptions of relatively normal weather. Energy-related CO2 emissions are sensitive to changes in weather, economic growth, energy prices, and fuel mix.

-----

Earlier:

2020, January, 13, 15:50:00

OIL MARKET WILL STABLE

Saudi Arabia, the world's biggest oil exporter, is in the midst of an OPEC+ agreement to cut 1.7 million b/d of crude from the market in Jan through to March.

2020, January, 10, 11:55:00

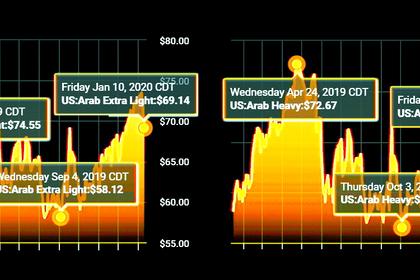

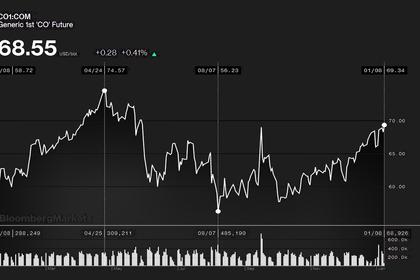

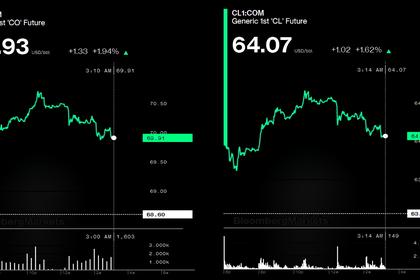

OIL PRICE: ABOVE $65

Brent were up 26 cents, or 0.38%, to $68.53, WTI gained 10 cents, or 0.16%, to $62.80 a barrel.

2020, January, 8, 14:45:00

OIL PRICE: NEAR $69

Brent were up 26 cents, or 0.38%, to $68.53, WTI gained 10 cents, or 0.16%, to $62.80 a barrel.

2020, January, 8, 14:25:00

OIL MARKET IS WELL-SUPPLIED

"The market is well-supplied," Suhail Mazrouei said in Abu Dhabi. "I would say now we are not forecasting a shortage of supply unless we have a catastrophic escalation which we don't see."

2020, January, 6, 11:25:00

OIL PRICE: NEAR $70

Brent soared to a high of $70.74 a barrel, WTI was at $64.15 a barrel,

2020, January, 6, 11:00:00

OIL GAS CAPEX DOWN 9%

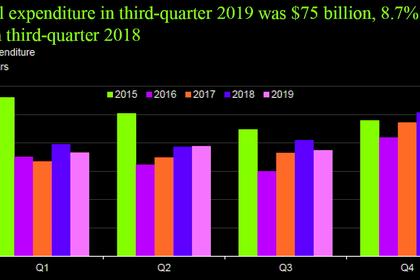

Capital expenditures were $75 billion in third-quarter 2019, 9% lower than in third-quarter 2018.