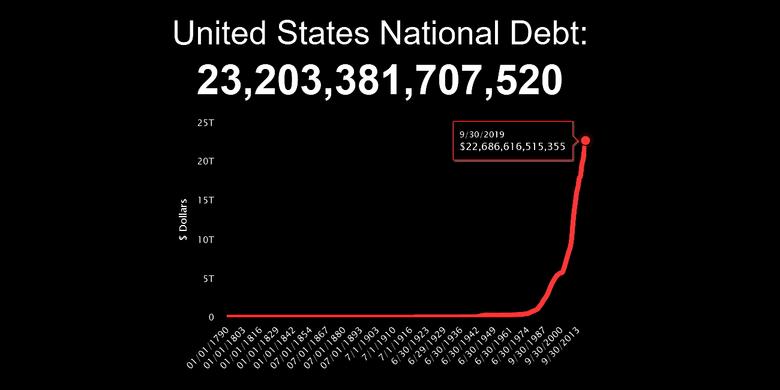

U.S. DEBT WILL RISE TO 98%

WSJ - Jan. 28, 2020 - The national debt and sustained federal budget deficits will hit the highest levels since World War II over the next decade, the Congressional Budget Office projected on Tuesday, following multiple rounds of tax cuts and continued increases in federal spending.

The government will spend $1 trillion more than it collects in 2020 and deficits will reach or exceed that threshold every year for the foreseeable future. As a share of gross domestic product, the deficit will be at least 4.3% every year through 2030. That would be the longest stretch of budget deficits exceeding 4% of GDP over the past century, according to the CBO, an nonpartisan arm of Congress.

Debt held by the public is projected to be 81% of GDP this year and to reach 98% by 2030. That stems from the combination of tax cuts and projected increases in spending—particularly on safety-net programs such as Medicare and Social Security as the population ages and health-care costs rise.

Budget deficits were larger after the 2008-09 financial crisis, but what makes the current period unusual is that the gap between taxes and spending has remained high even as the economy extends a record-long expansion.

Persistently low interest rates have provided a fiscal cushion for the U.S. and kept deficits from growing even faster.

"Not since World War II has the country seen deficits during times of low unemployment that are as large as those that we project," said CBO Director Phillip Swagel, who warned that the budget is on an unsustainable path.

Tuesday's deficit forecasts may end up being too low. The CBO's projections assume there are no changes to current spending and tax law. Deficits and debt would be larger if Congress extends individual tax cuts beyond their scheduled expiration at the end of 2025.

Congressional Republicans want to extend those tax cuts, and President Trump is preparing to propose further cuts as part of his re-election campaign.

Democratic presidential candidates, by contrast, are calling for tax increases to pay for expanded spending, and they generally say they want to avoid expanding projected deficits.

Longer-time-span deficit forecasts are even more daunting as the population ages. The federal debt is projected to hit a record 174% of GDP by 2049, 30 percentage points higher than what the CBO forecast last year.

"There's not a crisis today," Mr. Swagel said. "The longer we wait, the more difficult it gets."

During his 2016 campaign, President Trump talked about paying off the federal debt within eight years. Reality and the policies he enacted have moved in the opposite direction.

In 2017, Congress enacted tax cuts championed by the president, which are projected to increase budget deficits by more than $1 trillion over a decade. Administration officials, including Treasury Secretary Steven Mnuchin, have argued that the tax cuts will pay for themselves.

But nonpartisan estimates have contested that claim, and the CBO said in 2018 that the law would pay for less than one-quarter of itself. Mr. Swagel said Tuesday that the CBO stands by that analysis.

"President Trump's economic policies did not create a sustained boost for the economy like he has claimed," said Rep. John Yarmuth (D., Ky.), chairman of the House Budget Committee.

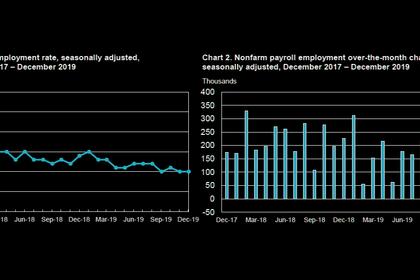

The CBO projected economic growth will gradually slow from 2.2% in 2020 to 1.7% after 2021, and unemployment will start to rise in 2022 while remaining below historical averages. The jobless rate was 3.5% in December, sustaining a 50-year low.

In the current expansion, annual economic growth averaged 2.3% through 2018, the latest year for which full-year data is available.

That compares with 2.9% during the previous expansion from late 2001 to 2007, and 3.6% in the 10-year expansion that ended in early 2001, according to the Commerce Department.

The CBO said it had lowered its projected revenue from the 2017 law by $110 billion to account for Treasury regulations that eased some international tax provisions and to reflect how businesses have changed their operations in response to the law.

In 2020, the U.S. will spend $1.28 for every $1 that it collects in revenue.

"I hope that more eyes will be opened to the stark reality we face," said Rep. Steve Womack (R., Ark.), the top Republican on the House Budget Committee. "It is imperative that we put our country on a responsible fiscal path."

For years, lawmakers and budget experts warned that budget deficits were unsustainable because federal borrowing could crowd out private borrowing, leading to interest-rate increases. But that hasn't happened, and interest rates have remained persistently low.

Those low rates have limited the government's cost of borrowing. Since the CBO's last budget forecast in August 2019, projected interest costs have declined by $441 billion over a decade, reflecting rates that are 0.3 percentage point below the previous estimate. But loss of revenue from tax cuts enacted in December 2019 exceeded those savings, and the CBO now projects budget deficits to be 1.3% larger than it did in August.

-----

Earlier: