U.S. LNG NEED INVESTMENT

PLATTS - US LNG export terminal developers are stepping up their courtship of Saudi Aramco to secure investments in their projects, following the state-owned oil and gas company's IPO last month.

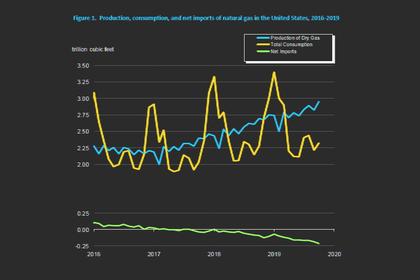

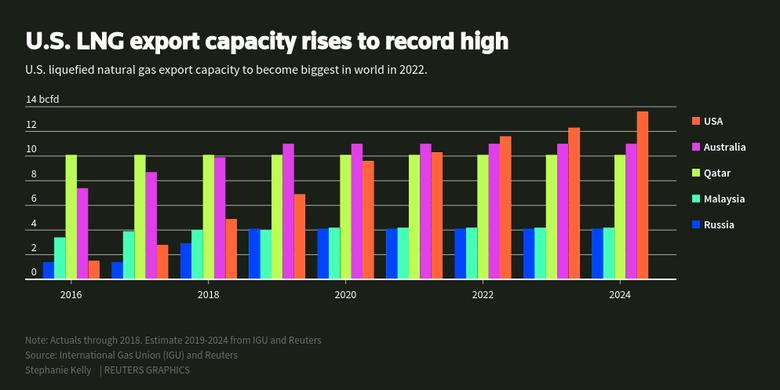

Aramco has vowed to pump almost $160 billion into growth in the natural gas sector over the next decade, with a sizable portion of that money to be designated for LNG projects overseas. Beyond the Middle East, Russia and Africa, it also has been looking intently at the US, where S&P Global Platts Analytics expects LNG export capacity to more than double to roughly 13.7 Bcf/d by 2025 versus 2019.

Seizing that opportunity, Sempra Energy's proposed Port Arthur LNG export project in Texas reached a preliminary deal in May 2019 for Aramco to take a 25% stake, including a long-term commitment for 5 million mt/year of offtake from the facility. On Monday, the two companies said they had signed what they described as an interim project participation agreement memorializing key milestones and mechanisms, though a definitive deal is still subject to further approvals and conditions. The length of time it is taking to get to a firm transaction may be a signal of a challenge convincing Aramco -- whose shares have slumped in recent days amid tensions between the US and Iran -- to reach into its deep pockets.

"Saudis still seem very non-committal on US LNG at this point, which means they're not ready yet to plunk down any cash," said Madeline Jowdy, Platts Analytics senior director, global gas and LNG.

Tellurian has had talks with Aramco about a potential equity partnership in its proposed Driftwood LNG project in Louisiana. Those talks have continued into this year, a person familiar with the discussions said Monday.

Tellurian is pitching its location, low-cost model and experienced executive team, while also noting that Aramco has a lot of money to spend, making it a candidate to invest in multiple US projects.

In an investor presentation posted on its website Monday, Tellurian said it continues to target the end of the first quarter for completing equity agreements needed to advance Driftwood to construction. Last month, CEO Meg Gentle said in an interview that Tellurian was negotiating with a large buyer to take a $2 billion partnership stake in Driftwood and give it the remaining equity it needs. She did not name the company. Monday's presentation didn't either, nor did it mention Aramco.

COMMERCIAL COMPETITION

Meanwhile, NextDecade's Rio Grande LNG, Exelon-backed Annova LNG, Texas LNG and LNG Limited's Magnolia LNG are among a dozen US projects being developed that need additional commercial agreements to be able to reach final investment decisions. Aramco could help. Officials for the developers either declined to comment or did not respond to requests for comment Monday about whether they were in active talks with Aramco.

The heads of agreement previously announced between Sempra and Aramco sketched out the prospect for Aramco to make a 25% equity investment into Port Arthur LNG's first phase, with the offtake component being discussed lasting for 20 years. The volume, if finalized, would represent almost half the capacity of phase one.

Besides the 11 million mt/year Port Arthur project, Sempra is the majority owner in a joint venture that controls Cameron LNG in Louisiana, where two trains are currently operating and a third one is under construction. Sempra has proposed expanding Cameron LNG and adding liquefaction capabilities at the site of a regasification facility in Baja California, Mexico.

As for Aramco, whatever project or projects in the US it settles on, it is making clear it has more than a passing interest in expanding its energy portfolio to include more LNG. It expects global demand for LNG to continue in the coming years, and with that it sees significant opportunities in the market, CEO Amin Nasser said in a statement Monday about the advancement of talks with Sempra at Port Arthur LNG.

-----

Earlier: