U.S. LNG PRODUCTION UP TO 9 BCFD

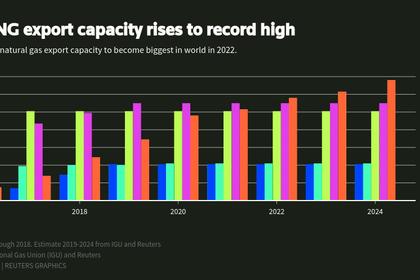

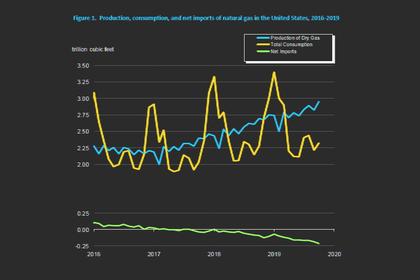

PLATTS - 21 Jan 2020 - Gas deliveries to US liquefaction facilities topped 9 Bcf/d for the first time over the holiday weekend and hit a new record Tuesday as exporters seemed unfazed by weak prices in Asia and below-zero netbacks to the Gulf Coast from Europe.

They were likely taking advantage of winter spreads, which were considerably higher at the end of 2019, when loading schedules and hedges would have been locked in. The high utilization at the six major US LNG export facilities was being supporting by long-term contracts underpinning the bulk of the capacity.

The forward markets indicate that spreads will remain below $1/MMBtu through the end of the summer, but market momentum has been decidedly bearish, which could threaten the production economics of marginal LNG producers, S&P Global Platts Analytics data show.

Total US LNG feedgas volumes reached a new all-time high of 9.4 Bcf/d Tuesday, after exceeding 9 Bcf/d for the first time on January 19.

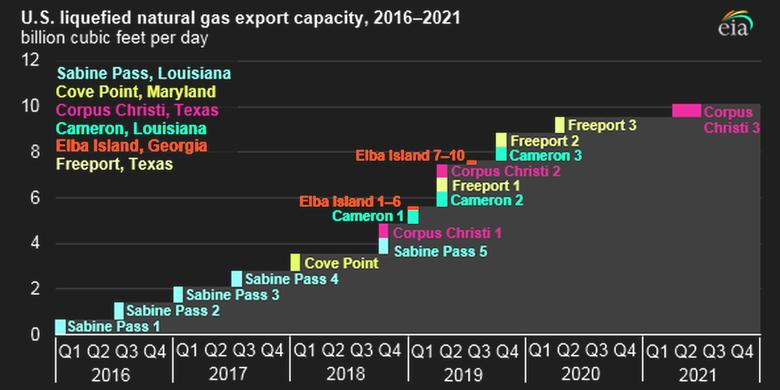

The surge in feedgas deliveries was driven by a ramp-up at Freeport LNG in Texas and Sempra Energy's Cameron LNG and Cheniere Energy's Sabine Pass terminals in Louisiana. The second liquefaction train at Freeport LNG is now in service, while Train 2 at Cameron LNG is continuing commissioning activities toward an expected in-service later this quarter. Meanwhile at Sabine Pass, dense fog that weakened feedgas volumes last week cleared, allowing volumes to return to a robust level.

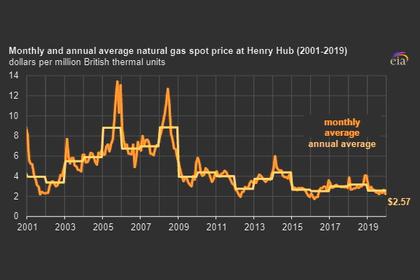

US Gulf Coast LNG netbacks have averaged just 88 cents/MMBtu this year to date, down roughly 70% compared with last year and more than 85% lower than during the same period in 2018, Platts Analytics data show.

As of Tuesday, the Platts JKM, the benchmark price for spot-traded LNG in Northeast Asia, continued to see selling pressure outpace buyers, which pushed the US Gulf Coast LNG netback from the JKM to a low of 36 cents/MMBtu, while the Platts-calculated US Gulf Coast LNG netback from the Dutch Title Transfer index, or TTF, was estimated at minus 11 cents/MMBtu. Platts Analytics' calculations are based on destination market price minus the variable costs of transportation and supply.

Besides Freeport LNG, Cameron LNG and Sabine Pass, Cheniere operates an LNG export facility near Corpus Christi, Texas, while Dominion Energy operates Cove Point in Maryland and Kinder Morgan operates Elba Liquefaction in Georgia.

CONTRACTOR BANKRUPTCY

One potential snag: McDermott International, a lead construction contractor on the Freeport LNG and Cameron LNG projects, announced plans Tuesday to file for bankruptcy. Under a prepackaged plan of reorganization, it said it expected through the process to eliminate over $4.6 billion of debt.

At both of the LNG facilities, the third liquefaction trains remain under construction. McDermott said that during the bankruptcy process, it does not expect any change in its operations, and it vowed that projects already underway would go on uninterrupted.

Asked about any impact on timing of startup of their third trains, spokeswomen for Freeport LNG and Cameron LNG said their current schedules remained on track.

-----

Earlier: