U.S. OIL SLOWDOWN

REUTERS - JANUARY 14, 2020 - U.S. oil output growth is expected to slow over the next five years, likely prompting oil majors to "gobble up" smaller shale oil producers, Mark Papa, shale pioneer and non-executive chairman of Schlumberger, told Reuters.

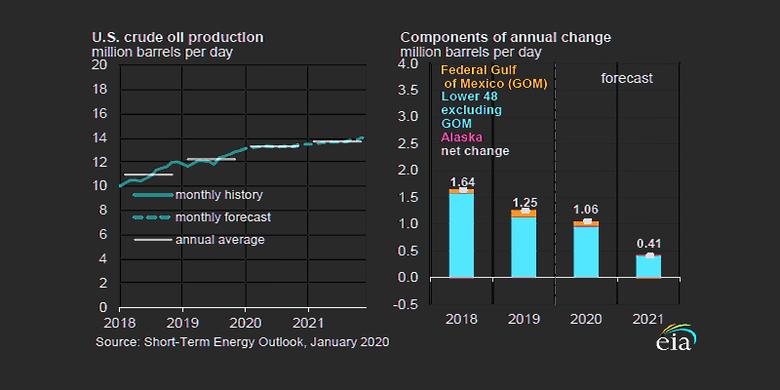

U.S. output surged to nearly 13 million bpd last year, making it the world's largest producer.

The Energy Information Administration (EIA) has forecast U.S. oil production growth at 1 million barrels per day (bpd) in 2020, with shale accounting for most of the increase.

But Papa, boss of the world's largest oilfield services company, expects U.S. output to grow by just 400,000 bpd in 2020 and by 100,000-500,000 bpd per year through 2025, depending on future oil prices.

"What we are seeing is that there has been a kind of inflection in the growth path for U.S. oil production, mainly due to inflection in shale oil growth," Papa said in an interview in Saudi Arabia.

He cited the shorter life and high decline rates of shale reservoirs such as the Bakken in North Dakota and the Eagle Ford in Texas.

"I'm not saying that the U.S. shale oil will go away but I'm saying it will become a less powerful force as we go through the 2020s than it was in the previous decade," he said.

Global demand is seen to grow by about 1 million bpd a year over the next five years, but that growth in demand would be met more by OPEC oil producers, he said.

Over the last decade, the shale revolution turned the United States into a major force in energy exports, however, it failed to boost profits, which has discouraged investors.

The shale industry was squeezed by an OPEC price war that began in 2014, sending U.S. crude prices below $30 per barrel at one point.

That drove shale companies to cut costs and become more efficient.

Now, with investor returns flagging, the industry no longer believes in drilling its way to success even at higher prices and financing for new production has been sharply limited.

Analysts believe that even if oil prices were to remain above $60 a barrel this year, it will not spur another production spurt because of the pressure for returns.

Papa said U.S. shale crude producers need a price of $55 per barrel to break even, above which they can achieve an adequate return on investment.

Over the last couple of years oil prices have generally been lower, what has reduced the amount of capital available to the industry.

"What is likely to happen over the next 5 to 10 years is that some of the smaller companies will get consolidated... get gobbled up by the majors," Papa said.

"Today Exxon Mobil, Chevron and even BP are becoming bigger in the shale oil business and probably five years from now those three companies will be even bigger and there will be less of the small companies."

Papa also expects the rise in gas flaring and venting in the Permian Basin in Texas to end by mid-2020 helped by a slowdown in the drilling of new wells and an increase in gas pipeline capacity.

-----

Earlier: