U.S. TIGHT OIL PRODUCTION UP

РЕЙТЕР -

-----

Раньше:

2018, March, 14, 11:45:00

REUTERS - U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $60.77 a barrel at 0753 GMT, up 6 cents, or 0.1 percent, from their previous settlement. Brent crude futures LCOc1 were at $64.62 per barrel, down just 2 cents from their last close.

|

2018, March, 7, 15:00:00

РЕЙТЕР - К 9.17 МСК фьючерсы на североморскую смесь Brent опустились на 0,85 процента до $65,23 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $62,07 за баррель, что на 0,85 процента ниже предыдущего закрытия.

|

2018, March, 7, 14:00:00

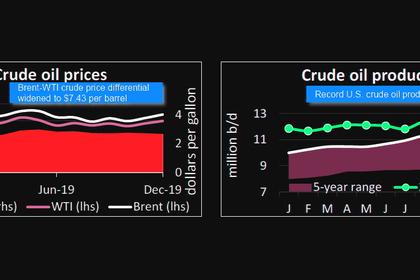

EIA - North Sea Brent crude oil spot prices averaged $65 per barrel (b) in February, a decrease of $4/b from the January level and the first month-over-month average decrease since June 2017. EIA forecasts Brent spot prices will average about $62/b in both 2018 and 2019 compared with an average of $54/b in 2017.

|

2018, March, 5, 11:35:00

РЕЙТЕР - К 9.28 МСК фьючерсы на североморскую смесь Brent поднялись на 0,33 процента до $64,58 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $61,44 за баррель, что на 0,31 процента выше предыдущего закрытия.

|

2018, March, 4, 11:30:00

МИНФИН РОССИИ - Средняя цена нефти марки Urals по итогам января – февраля 2018 года составила $ 65,99 за баррель.

|

2018, February, 27, 14:15:00

РЕЙТЕР - К 9.18 МСК фьючерсы на североморскую смесь Brent опустились на 0,15 процента до $67,40 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $63,80 за баррель, что на 0,17 процента ниже предыдущего закрытия.

|

2018, February, 27, 14:05:00

МИНФИН РОССИИ - Средняя цена на нефть Urals за период мониторинга с 15 января по 14 февраля 2018 года составила $66,26457 за баррель, или $483,7 за тонну.

|

U.S. TIGHT OIL PRODUCTION UP

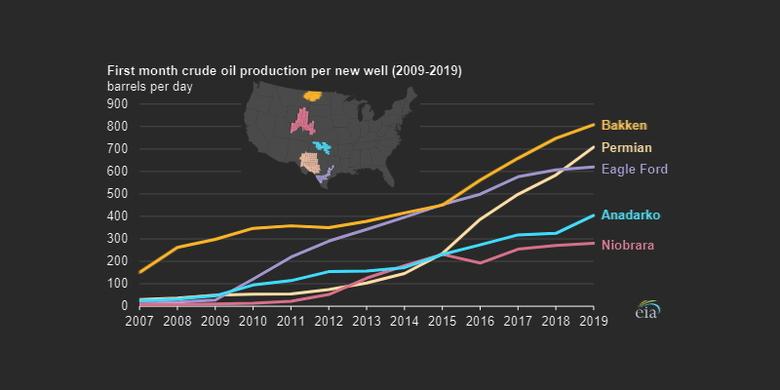

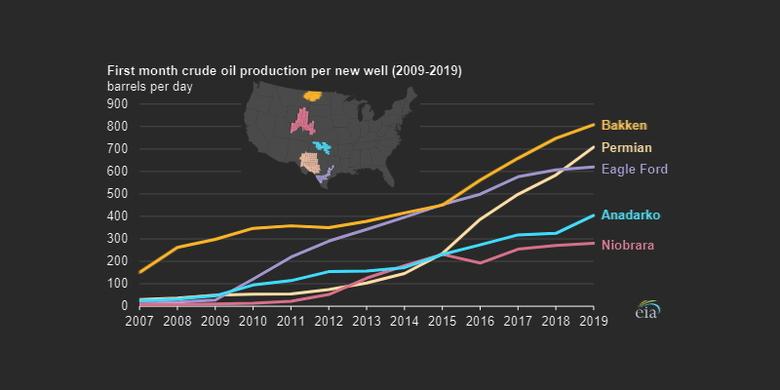

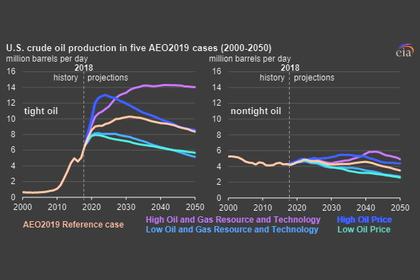

U.S. EIA - U.S. oil production from tight formations increased in 2019, accounting for 64% of total U.S. crude oil production. This share grew because of the increasing productivity of new wells that were brought online during 2019. Since 2007, the average first full month of oil production from new wells in regions tracked by the U.S. Energy Information Administration’s (EIA) Drilling Productivity Report (DPR) has increased. The growing initial production rates have helped oil production from tight formations to increase despite the slowdowns in drilling activity when oil prices fell between 2015 and 2016. Since 2017, recovering oil prices and more efficient production from new wells have helped producers cover costs of drilling, production, and the development of new technologies.

The average new well in each DPR region produced more oil in 2019 than wells drilled in previous years in those same regions. This trend has persisted for more than 10 consecutive years. More effective drilling techniques, including the increasing prevalence of hydraulic fracturing and horizontal drilling, have helped to increase these initial production rates. In particular, well productivity was improved because of the injection of more proppant during the hydraulic fracturing process and the ability to drill longer horizontal components (also known as laterals) and perforate more stages.

Increasing well productivity has supported crude oil production even in years such as 2015, when oil prices fell and rig counts dropped. In 2016, rig counts continued to decline sharply, and total U.S. crude oil production decreased for the first time in 10 years. Fewer wells were drilled; however, those that were drilled were drilled more quickly and located in more productive areas, which led to increasing per-well production.

Rig counts have fluctuated throughout 2019 in all DPR regions. The aggregate rig counts declined 16% in the first 11 months of 2019. Despite the decrease in rig count, producers are capable of drilling more efficient wells faster to keep U.S. crude oil production growing.

Oil producers have increasingly targeted the Permian region, which spans parts of western Texas and eastern New Mexico. The geological structure in the Permian region is more complicated than in other regions, and it took producers more time to advance the drilling and completion technology in the region. However, the Permian region is larger and has more potential for oil production than other regions. Total production and production per new well have increased in the Permian region for 13 consecutive years. In the other four DPR oil regions, oil production fell from 2016 to 2017 because of low oil prices. In Eagle Ford, oil production in 2019 is still lower than its peak in 2015.

-----

Earlier:

2020, January, 24, 13:35:00

U.S. OIL EXPORTS 9 MBD

U.S. petroleum exports hit a new all-time high of 9.0 million barrels per day (mb/d) in the final month of 2019

2020, January, 24, 13:25:00

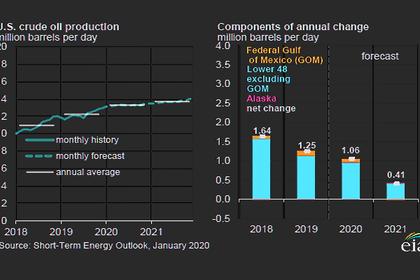

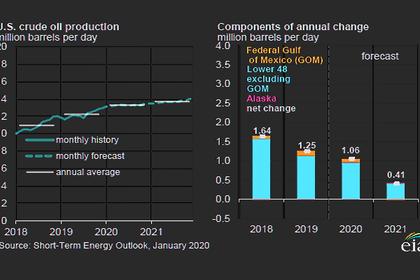

U.S. OIL PRODUCTION SLOWING

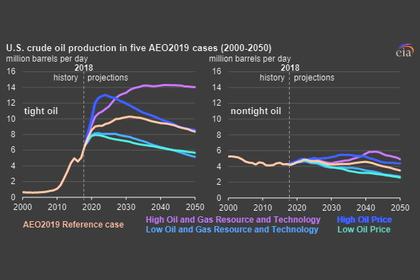

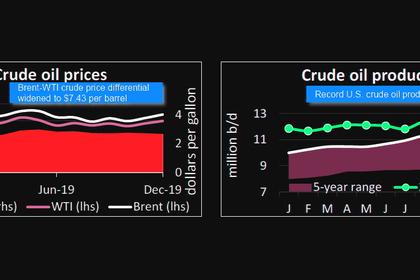

U.S. crude oil production will average 13.3 million barrels per day (b/d) in 2020, a 9% increase from 2019 production levels, and 13.7 million b/d in 2021, a 3% increase from 2020.

2020, January, 22, 12:50:00

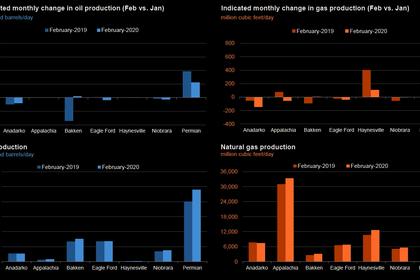

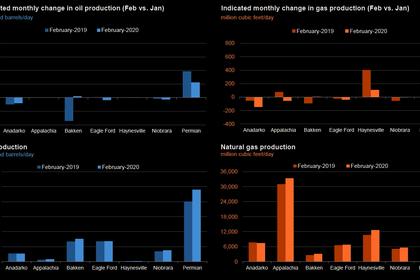

U.S. PRODUCTION: OIL + 22 TBD, GAS + 65 MCFD

Crude oil production from the major US onshore regions is forecast to increase 22,000 b/d month-over-month in January from 9,178 to 9,200 thousand barrels/day, gas production to increase 65 million cubic feet/day from 85,920 to 85,985 million cubic feet/day .

2020, January, 15, 12:45:00

U.S. OIL SLOWDOWN

But Papa, boss of the world’s largest oilfield services company, expects U.S. output to grow by just 400,000 bpd in 2020 and by 100,000-500,000 bpd per year through 2025, depending on future oil prices.

All Publications »

Tags:

USA,

OIL,

PRODUCTION