ASIA PACIFIC ECONOMY WILL UP BY 6.9%

IMF - ASIA AND PACIFIC REGIONAL ECONOMIC OUTLOOK October 2020

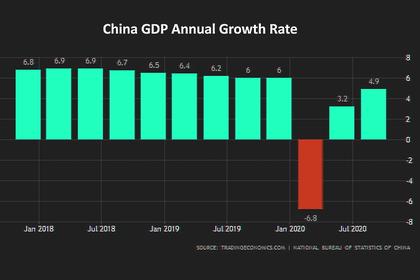

The coronavirus disease (COVID-19) pandemic is still unfolding around the globe. In Asia, as elsewhere, the virus has ebbed in some countries but surged in others. The global economy is beginning to recover after a sharp contraction in the second quarter of 2020, as nationwide lockdowns are lifted and replaced with more targeted containment measures. Global growth has been revised up since the June 2020 World Economic Outlook (WEO) Update to −4.4 percent in 2020, because of better-than-expected second quarter outturns in some major countries where activity began to improve sooner than expected after lockdowns were scaled back. In 2021 global growth is projected at 5.2 percent, a little lower than projected earlier, consistent with the expectation that social distancing persists into 2021 and fades thereafter.

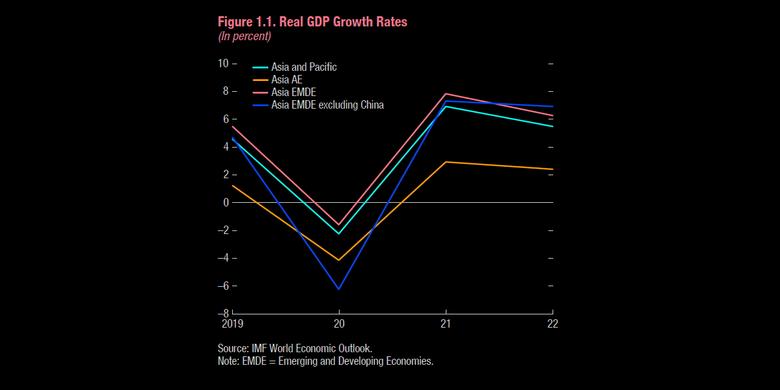

The Asia and Pacific region is also starting to recover tentatively, but at multiple speeds. Economic activity is expected to contract by −2.2 percent in 2020, due to a sharper-than-expected downturn in key emerging markets, and to grow by 6.9 percent in 2021—0.6 percentage point lower and 0.3 percentage point higher, respectively, than in the June 2020 World Economic Outlook Update (Figure 1.1).

The outlook varies by country depending on infection rates and containment measures, the scale and effectiveness of the policy response, reliance on contact-intensive activities, and reliance on external demand. In parts of Asia where virus transmission rates are low, mobility and activity could normalize faster than elsewhere. Scarring is likely, however, as labor market participation has fallen, and output is expected to remain below pre-pandemic trends over the medium term, with the most vulnerable in society likely to be hit the hardest.

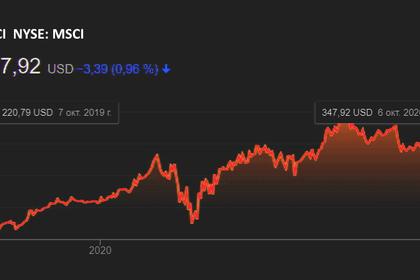

The forecasts remain highly uncertain, with significant downside risks. A resurgence of the pandemic cannot be ruled out. Geopolitical tensions—particularly US‑China—may also derail the recovery. A rise in social unrest triggered by the pandemic's disproportionate impact on the poorest and most vulnerable could compromise recent hard-won gains, or a return to risk aversion in financial markets could add to balance sheet vulnerabilities. Prospects for an early, large-scale rollout of an effective vaccine creates an upside risk.

With the pandemic seemingly far from over, policy support should be sustained and, in some cases, increased. Strong health care and containment measures are vital until the pandemic has abated. Targeted fiscal spending is needed until the recovery is entrenched. It should aim at the most vulnerable where fiscal multipliers are highest, and to jobs-oriented, inclusive, and green investment. Looking ahead, credible fiscal plans will be key to secure debt sustainability. Monetary policy should remain supportive. Elevated credit risks demand continual monitoring, especially where debt levels are high. Policymakers need to redouble efforts to keep workers connected to the labor force and solvent firms in business while allowing nonviable firms to exit, and facilitating new businesses to emerge and generate new job opportunities, and thus mitigate scarring.

This Regional Economic Outlook draws on studies analyzing the impact of COVID-19. Chapter 3 examines the effect of containment and related policy measures on health outcomes and economic activity. Fast implementation of containment measures and appropriately timed exits—supported by strong testing and contact tracing policies—have been key in stabilizing COVID-19's spread while mitigating its economic costs in many Asian economies. Fiscal support has also been critical to reduce economic costs, underpin recovery, and limit scarring. Chapter 4 warns that the crisis is having the largest impact on low-income workers, women, and youth, and so is increasing inequality. These distributional effects could be even larger in the medium term as robots displace low-skilled workers, and the resulting higher levels of inequality could undermine social cohesion. Policies should be targeted to mitigate the pandemic's adverse distributional consequences and so underpin overall economic activity and virus containment.

-----

Earlier: