AUSTRALIA'S ENERGY SECURITY

PE - 1 October 2020 - The Australian energy generation market displays some similarities with a Quentin Tarantino film. Indeed, energy policy has been the ruthless 'Mr Blonde' of the Australian political economy with investors 'smoked' left and right and the political lives of three prime ministers abruptly ended attempting to put in place a long-term regulatory framework.

Beyond the policy framework, development risks have also been increasing. The most important of these are the risks arising from system strength issues exposed by the large number of renewable projects seeking to connect to the grid in locations where there has been an excellent resource but weak transmission infrastructure. This has resulted in volatile loss factors, connection delays, curtailments and consequential real reductions in investor returns.

In a similar vein, in 2018 a leading contractor became insolvent, largely because it bore the risk of the connection delays caused by the transmission system issues on a number of projects it was constructing simultaneously. While the turnover is now stabilising, this insolvency precipitated the exit of a number of other contractors from the Australian market, the entry of many new participants and the development of alternative contract models with a resultant realignment of risk allocations and bankability issues.

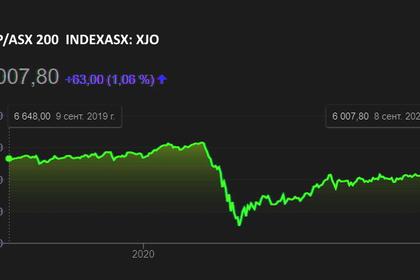

Covid-19 has exacerbated these risks, and access to capital has tightened in response. Projects that did not have advanced project financing, or sponsors with strong track-records and established relationships, before March 2020 are now struggling to reach financial close. As development timelines extend, developers need additional pre-financial-close capital which has resulted in some transactional activity.

Australian fund managers, and some superannuation funds’ direct investment teams, have been actively acquiring projects at or near financial close. However, international institutional investors that are the long-term owners of generation assets in other markets have generally been cautious about acquiring renewable assets in Australia, perceiving the risk/reward balance to be inferior to other investment opportunities. Some sales of projects or portfolios over the last 6-12 months have been delayed or needed restructuring to exclude fewer desirable assets.

In this context, the Australian government, together with energy market regulatory agencies, have announced, or are developing, a number of significant pieces of work. These include the Australian Energy Market Operator’s Integrated System Plan, the Energy Security Board’s review of reliability and security and the government’s recently announced Technology Road Map identifying five priority technologies to support the energy transition and lower emissions.

Taken together, these are intended to provide pathways to increase market certainty, fix system constraints and reliability, and look to the blue-sky opportunity of Australia becoming a ‘renewable energy superpower’.

We see a number of key themes that will emerge from this fundamental market redesign.

- Generation assets will increasingly be developed and owned by long-term holders. The Australian renewable energy market is relatively disaggregated, with a significant proportion of the development being undertaken by smaller developers. These are often capital constrained and are struggling to bring the resources (financial and expertise) needed to manage the development risks including the system strength, contractor risk and access to project finance, which are unlikely to be completely solved in the short to medium term.

This trend is likely to be reinforced by net-zero emission targets of traditional oil and gas investors, and many institutional investors that will drive investment into the sector.

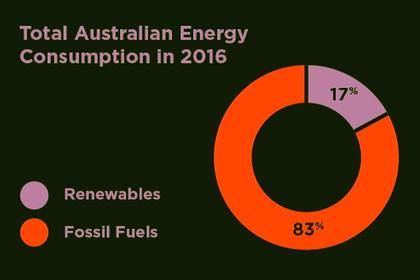

- Security of energy supply is a key driver of government energy policy and the shape of the market. This has a number of potential aspects.

First, Australia needs to replace 15GW of coal-fired generation that will reach the end of its technical life and likely retire by 2040. The government has indicated that it may seek to utlilise its ownership of a generation company, Snowy Hydro, to build a new gas-fired power station if, in its view, insufficient ‘despatchable’ power is brought into the system to compensate for the imminent closure of a 1GW coal-fired plant in New South Wales. Whether this happens or not, it is clear that, at least in the short to medium term, the retirement of ageing coal-fired generators will drive government to prioritise the development of firm generation, which it identifies as being gas-fired rather than from renewables.

Second, Australia is moving on a number of fronts to tighten its foreign investment laws. A key component of this is likely to be the designation of most electricity generation as ‘critical infrastructure’ to which a range of new national security powers will apply. It is likely that from 1 January 2021 essentially all investment in the sector will require foreign investment screening regardless of investment size. The government is also proposing a ‘last resort power’, which will allow it to force divestment of assets. How this plays out in terms of the investment market—beyond clearly making it more difficult for Chinese investment—is an interesting unknown.

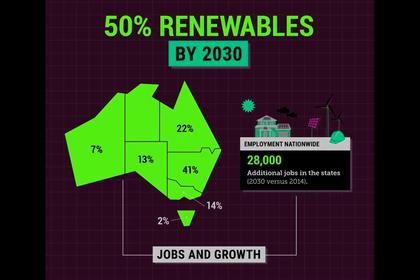

- The scale and complexity of renewable energy projects is increasing. The introduction of ‘renewable energy zones’ in some Australian jurisdictions to coordinate development and the associated investment in transmission infrastructure to help solve system strength issues is likely to result in larger projects, with co-located technologies and an increased geographic concentration of projects within those zones.

In addition, at least two megaprojects in Australia’s north (the 11GW Pilbara Asia Renewable Energy Hub and the similar-sized Sun Cable project) are under development with a view to exporting electricity to Asia. These megaprojects are clearly well suited to international energy companies that have access to capital, project development skills and offtake relationships with Asian utilities.

- There will be a diversification of the technologies used to achieve the energy transition. The government recently identified five priority technologies on which the key funding agencies for emerging technologies (ARENA and the Clean Energy Finance Corporation) will be required to focus. These include clean (but not necessarily renewable) energy, hydrogen, carbon capture and storage, energy storage, soil carbon, and low carbon steel and aluminium. Wind and solar (together with gas and coal) have been identified as mature technologies not requiring government support. While it is likely that future governments will have different priorities, the theme of the energy transition being pursued through development of a range of technologies is likely to remain.

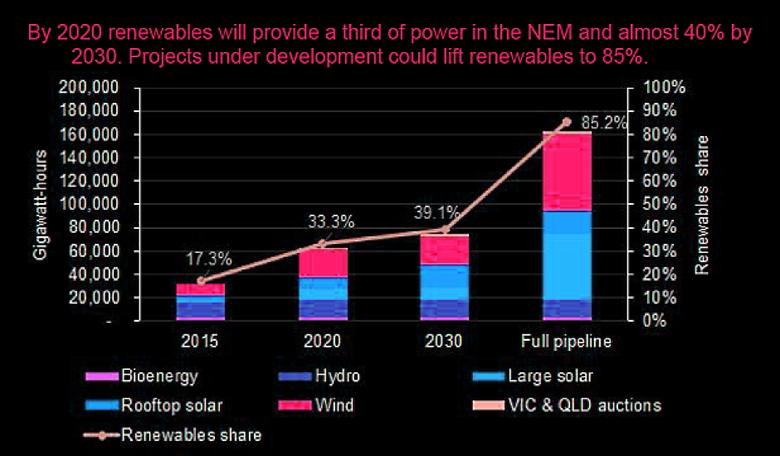

The Australian energy transition has been fascinating to watch. For all the challenges, the proportion of electricity generation from non-fossil fuels has increased to over 20pc, a relative success given the historic reliance on coal-fired generation.

The broad themes mentioned here point to a market that is not only working towards solving the identified problems but also innovating and providing tremendous opportunities for investors with the capital and expertise to take advantage of them.

It is possible that politics will continue to cast a shadow. Many of the recent initiatives are contested and some require legislation that is not guaranteed to pass given numbers in the current parliament. However, there is momentum and a consensus that, like some Tarantino films, the carnage has gone on way too long.

-----

Earlier: