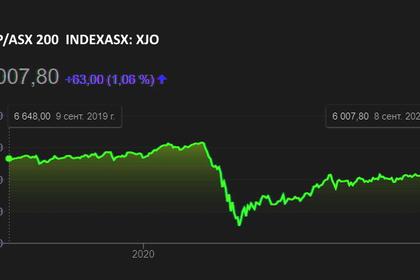

AUSTRALIA'S SHARES UP

REUTERS - OCTOBER 5, 2020 - Australian shares posted their biggest daily rise in two-and-a-half months on Monday as investors cheered U.S. President Donald Trump showing signs of recovery from COVID-19.

Positioning ahead of the Reserve Bank of Australia policy meeting and federal budget on Tuesday also lent support.

The S&P/ASX 200 index .AXJO closed 2.6% higher at 5,941.6 points, starting the week on a firm note after a 2.9% drop last week.

Stock markets around the world rose after doctors said Trump, who was flown to hospital for treatment of the novel coronavirus on Friday, was responding well and that his condition was improving. [MKTS/GLOB]

As Australian markets were the first to react to Trump testing positive on Friday, they were quick to respond to better news on that front, according to Henry Jennings, a senior analyst and portfolio manager at Marcustoday Financial Newsletter.

“We’ve also got the RBA meeting and the budget tomorrow, so there’s a possibility we’re going to see tax cuts and stimulus from the government,” Jennings said.

Australia is set to forecast a record budget deficit of around A$200 billion ($143.62 billion) for 2020/21 as the government ramps up spending to support the coronavirus-hit economy.

Jennings said possibility of a rate cut was also boosted equities. A Reuters poll predicts the central bank will hold key rates at a record low 0.25%, though an overwhelming majority expect a cut in November.

A rebound in crude oil prices pushed the energy sub-index .AXEJ 4.5% higher, with heavyweights Woodside Petroleum WPL.AX and Beach Energy BPT.AX adding 4.8% and 5.6%, respectively.[O/R]

The financials sub-index .AXFJ closed 3.7% higher with the "big four" banks gaining between 3.3% and 4.4%.

Gold stocks .AXGD closed marginally lower, while mining stocks .AXMM added 2.1%.

In New Zealand, the benchmark S&P/NZX 50 index .NZ50 closed up 0.6% at 11,898.26.

NZX-listed shares of Westpac WBC.NZ and ANZ ANZ.NZ were the top gainers, adding more than 3% each.

-----

Earlier: