BAKER HUGHES NET LOSS $170 MLN

BAKER HUGHES - October 21, 2020 - Baker Hughes Company (NYSE: BKR) ("Baker Hughes" or the "Company") announced results today for the third quarter of 2020.

- Orders of $5.1 billion for the quarter, up 4% sequentially and down 34% year-over-year

- Revenue of $5.0 billion for the quarter, up 7% sequentially and down 14% year-over-year

- GAAP operating loss of $49 million for the quarter, up 6% sequentially and unfavorable year-over-year.

- Adjusted operating income (a non-GAAP measure) of $234 million for the quarter was favorable sequentially and down 45% year-over-year.

- GAAP loss per share of $(0.25) for the quarter which included $0.29 per share of adjusting items. Adjusted earnings per share (a non-GAAP measure) was $0.04.

- Cash flows generated from operating activities were $219 million for the quarter. Free cash flow (a non-GAAP measure) for the quarter was $52 million.

|

|

Three Months Ended |

|

Variance |

|||||||||

|

(in $ millions except per share amounts) |

September 30, |

June 30, |

September 30, |

|

Sequential |

Year- |

||||||

|

Orders |

$ |

5,106 |

|

$ |

4,888 |

|

$ |

7,783 |

|

|

4% |

(34)% |

|

Revenue |

5,049 |

|

4,736 |

|

5,882 |

|

|

7% |

(14)% |

|||

|

Operating income (loss) |

(49) |

|

(52) |

|

297 |

|

|

6% |

U |

|||

|

Adjusted operating income (non-GAAP) |

234 |

|

104 |

|

422 |

|

|

F |

(45)% |

|||

|

Net income (loss) attributable to Baker Hughes |

(170) |

|

(195) |

|

57 |

|

|

13% |

U |

|||

|

Adjusted net income (loss) (non-GAAP) attributable to Baker Hughes |

27 |

|

(31) |

|

114 |

|

|

F |

(76)% |

|||

|

EPS attributable to Class A shareholders |

(0.25) |

|

(0.30) |

|

0.11 |

|

|

15% |

U |

|||

|

Adjusted EPS (non-GAAP) attributable to Class A shareholders |

0.04 |

|

(0.05) |

|

0.21 |

|

|

F |

(81)% |

|||

|

Cash flow from operating activities |

219 |

|

230 |

|

360 |

|

|

(5)% |

(39)% |

|||

|

Free cash flow (non-GAAP) |

52 |

|

63 |

|

161 |

|

|

(17)% |

(68)% |

|||

"F" is used in most instances when variance is above 100%. Additionally, "U" is used in most instances when variance is below (100)%.

“Despite continued uncertainty in global oil and gas markets and the ongoing impact of the COVID-19 pandemic, we produced solid results in the third quarter of 2020. I am pleased with the continued execution on cost-out from our Oilfield Services (OFS) and Oilfield Equipment (OFE) teams, the commercial success and performance from Turbomachinery & Process Solutions (TPS) and Digital Solutions (DS), and our continued free cash flow generation during the quarter. I am proud of our employees and their continued commitment to delivering for our customers and shareholders,” said Lorenzo Simonelli, Baker Hughes Chairman and Chief Executive Officer.

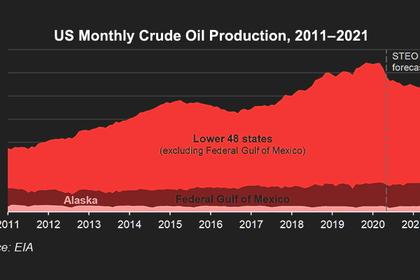

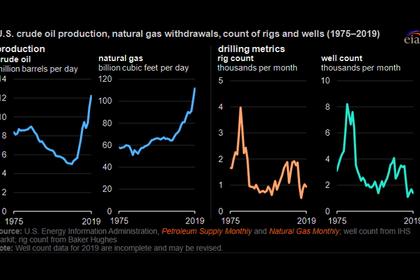

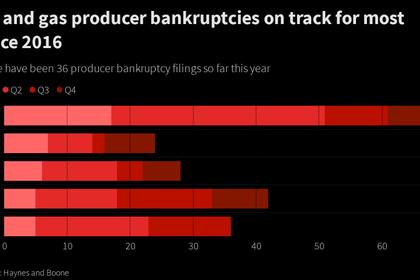

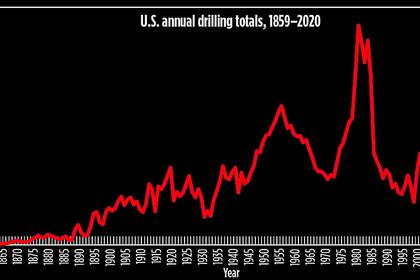

“After significant turmoil during the first half of the year, oil markets have somewhat stabilized. However, demand recovery is beginning to level off and significant excess capacity remains, which could create volatility in the future. The outlook for natural gas is slightly more optimistic as forward prices have improved with strong demand in Asia and lower expected future gas production in the U.S.

“Despite the uncertain macro environment, we are executing on the framework we laid out earlier this year. We are on track to hit our goals of right-sizing the business, generating free cash flow, and achieving $700 million in annualized cost savings by year end.

"As we move forward, we are intensely focused on improving the margin and return profile of Baker Hughes despite the near-term macro volatility, while at the same time executing on our long-term strategy to evolve our portfolio along with the energy landscape. Baker Hughes remains committed to leading the energy transition and becoming a key enabler to decarbonizing oil and gas and other industries,” concluded Simonelli.

-----

Earlier: