CHINA'S GAS DEMAND WILL TWICE

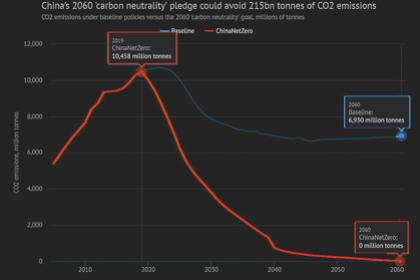

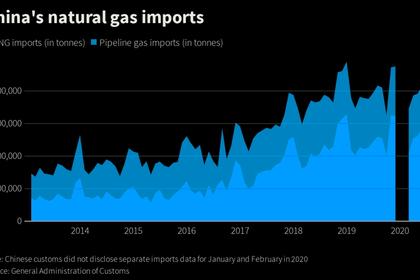

PE - 20 October 2020 - China's top natural gas supplier signalled a surprisingly bullish outlook for the fuel at an industry conference in Shanghai today. Beijing's recent landmark decision to overhaul its coal-dominated energy system puts gas on track to be the only fossil fuel that will expand its share of the Chinese energy mix.

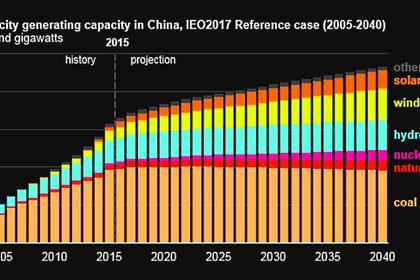

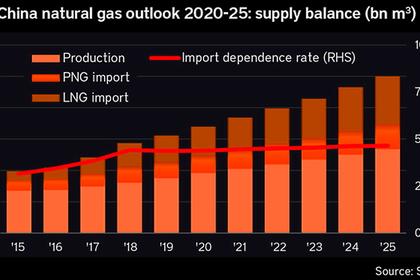

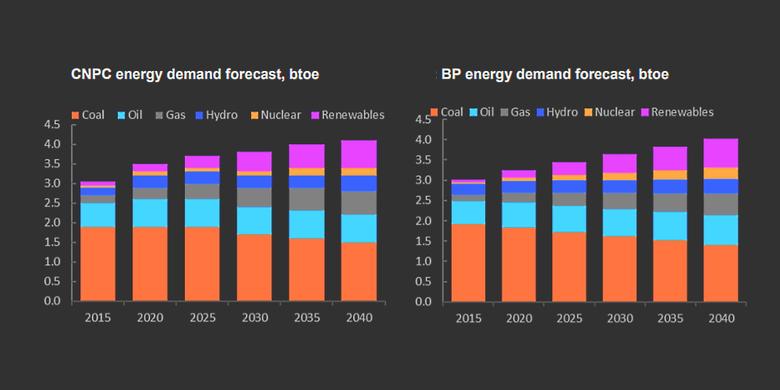

The goal of carbon-neutrality by 2060 will require China to kick its longstanding addiction to coal while building unprecedented amounts of intermittent wind and solar capacity. This opens the door for the country's annual gas demand to roughly double over the next 15 years, reaching 600bn m³/yr by 2030 and 620bn m³/yr by 2035, a representative of PetroChina Natural Gas Marketing Co. told delegates.

The extremely ambitious projections, which are considerably higher than long-term energy outlooks from the IEA and BP, highlight the rising confidence felt in the Chinese gas industry after it effectively weathered the short-term demand shock caused by Covid-19.

The industry has also been buoyed by Chinese president Xi Jinping's historic carbon-neutrality goal, announced at the UN last month, as gas will be needed as a bridge fuel during China's transition from coal to renewables.

The pledge will be the most important driver of demand growth "because in China, when the government decides, it is done", said Denis Bonhomme, vice president of LNG for Total in China, in a panel discussion at the event.

Covid recovery

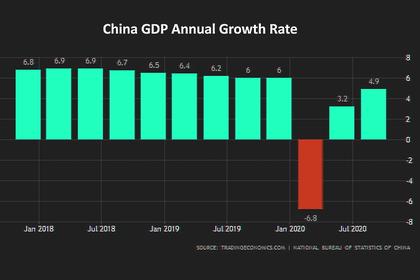

The rising confidence comes after China's gas demand bounced back quickly from the Covid-19 crisis in April as Beijing's aggressive containment of the virus helped the country emerge from lockdown earlier than other nations.

Gas took less of a hit from the pandemic than other energy sources as the fuel is typically supported by robust household demand. Apparent consumption continued to grow in the first three months of 2020—albeit by just 1.6pc year-on-year—and then picked up in April and May, rising by an average of 9pc.

The latest monthly indicators from China's central government show domestic demand expanded by 3.9pc year-on-year in August and was up by 3.2pc for the first eight months of 2020. August's figure marked an improvement from July, when consumption grew by just 0.6pc—the weakest growth rate since China restarted economic activity in late March.

Beijing weighed in recently with its latest official forecast for domestic demand this year. China is expected to consume 320bn m³ in 2020, according to the China Natural Gas Development Report jointly released by three government agencies in mid-September. This would be just 4.4pc higher than 2019, the smallest annual gain since 2015.

The report found that Chinese gas demand grew just 1.5pc in the first half of this year. This implies Beijing is betting on consumption growth to strengthen significantly this winter—when gas use typically rises to meet heating needs.

Indigenous supplies

The majority of the gas that China will consume by 2035 will be supplied domestically, according to PetroChina, raising questions about the space for more imports as Beijing sharpens its focus on energy security.

China's domestic gas supply capacity will reach 520bn m3/yr by 2035, comprising 220bn m³/yr of conventional gas, 100bn m³/yr of shale gas, 50bn m³/yr of coal-bed methane (CBM), and 150bn m³/yr of coal-derived synthetic natural gas (SNG), PetroChina says.

While the forecasts for conventional and shale output are achievable, the projections for CBM and SNG do not appear feasible. China's CBM development has been held back by several longstanding problems, including the complicated geology of domestic coalbeds and low gas prices that have made the unconventional gas uneconomical to extract. Overlapping rights between CBM acreage and coal mines have also frustrated the industry.

SNG, meanwhile, has come under fire in recent years for its relatively high cost, enormous water consumption and significant carbon emissions—which experts say could derail China's climate change efforts.

-----

Earlier: