EUROPEAN ECONOMY WILL DOWN BY 7%

IMF - Regional Economic Outlook: Europe October 2020

Executive Summary

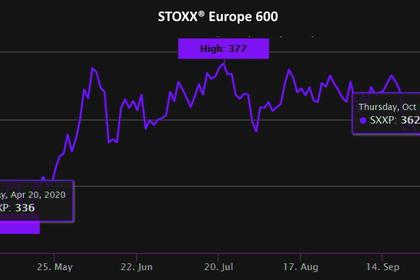

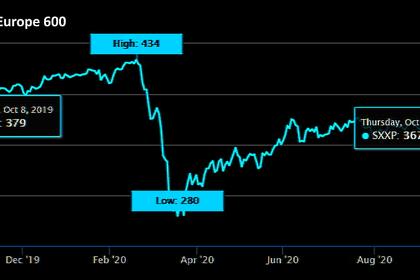

The coronavirus disease (COVID-19) pandemic is exacting a severe social and economic toll on Europe. By mid-October 2020, more than 240,000 people have lost their lives in Europe, while nearly 7 million people are estimated to have been infected with the virus. Early spring lockdowns, voluntary social distancing, and associated disruptions in supply chains and lower demand led to a record collapse in economic activity. Real GDP fell by about 40 percent in the second quarter of 2020 (annualized quarter-over-quarter), with deeper contraction in advanced Europe, where the virus spread first, relative to emerging Europe.

The pandemic's toll on Europe could have been much larger without the unprecedentedly strong and multifaceted response to the crisis. Across Europe, governments deployed large fiscal packages to support households and firms, with job retention programs preserving at least 54 million jobs. Central banks embarked on substantial monetary easing through both conventional and unconventional means, to support the flow of credit and prevent financial market disruptions. Macroprudential measures were also eased to cushion the impact of the crisis on both banks and borrowers. The European Union relaxed existing rules to accommodate increasing fiscal deficits and support to households and firms. In a strong display of solidarity, it is also mobilizing supranational resources to finance new anti-pandemic facilities and complement national fiscal policies.

Nevertheless, the outlook for 2020 remains bleak and the recovery will be protracted and uneven. The European economy is projected to contract by 7 percent in 2020 and rebound by 4.7 percent in 2021. Headline inflation is projected to soften to 2 percent in 2020—1 percentage point below its 2019 level—before edging up to 2.4 percent in 2021.

The outlook is exceptionally uncertain. The ongoing resurgence of infections across Europe presents perhaps the greatest downside risk at this stage. A no-deal Brexit would also imply an additional and potentially sizable shock to activity amid the pandemic.

A key challenge facing policy makers in the near term will be to calibrate containment measures to minimize the immediate social and economic damage. It will be imperative to maintain policy support until the recovery is fully entrenched. A premature scaling back of supportive policies could drag countries back into recession, undoing much of what has been achieved so far. Support to viable jobs and businesses should be maintained, including through job retention programs. Continuation of accommodative monetary policies is warranted by the muted inflation outlook and considerable economic slack. Banking supervision authorities should continue to exercise prudential flexibility in order not to jeopardize the flow of credit.

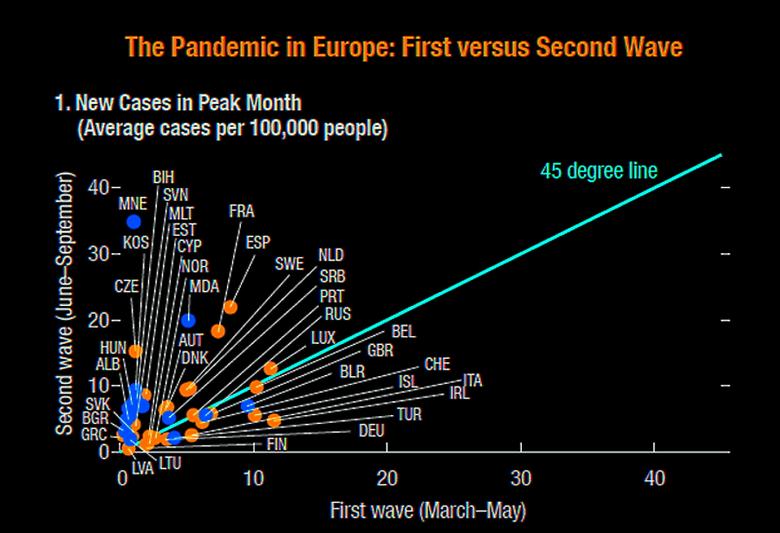

Chapter 2 explores how differences in reopening policies among European countries affected economic activity and subsequent infections. In countries that started reopening earlier on the infection curve or that opened all sectors at a fast pace in a relatively short time, the reopening is associated with a higher wave of infections. However, the recent increase in infections has been associated with lower fatality rates than the first wave.

Chapter 3 seeks to quantify the potential impact of the coronavirus crisis on corporate liquidity and solvency risks in Europe and examine the extent to which announced policy measures could dampen these risks in 2020. The combination of job-retention programs, debt moratoria, grants, and loan guarantees can be effective in addressing corporate liquidity needs, especially in advanced European economies. At the same time, the ability of the announced policy measures to curb the increase in solvency risks appears more limited. The chapter concludes that careful policy calibration will be needed to better support companies that are deemed viable in the longer term and to facilitate the orderly exit of firms that are unlikely to succeed in the post-pandemic economy.

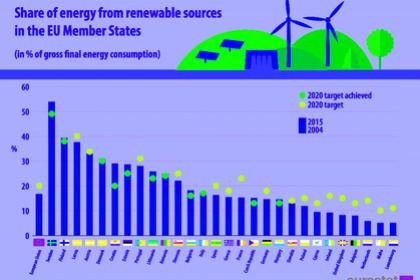

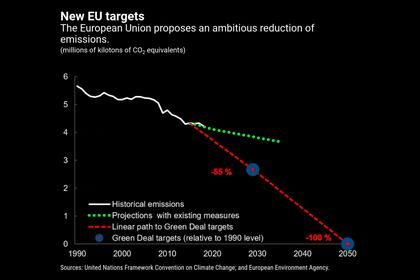

Policies should also attend to medium-term challenges, as economies move from recession to recovery. This crisis has compounded pre-existing challenges and created new ones. Challenges that predate the pandemic include low productivity growth, climate change, the digital transition, ageing and increasing inequality. In addition, the crisis brought about damage to supply potential, the buildup of debt, and a setback to human capital accumulation. It is imperative that policies address all these challenges, thereby facilitating recovery, reducing medium-term scars of the crisis, and helping Europe transform into a more resilient, green, and smart economy in the post-pandemic future.

-----

Earlier: