EUROPEAN SHARES UP

МИНЭНЕРГО РОССИИ - 22.10.2020 - Распоряжением Правительства Российской Федерации от 12 октября 2020 г. № 2634-р утвержден план мероприятий («дорожная карта») по развитию водородной энергетики в Российской Федерации до 2024 года, направленный на увеличение производства и расширение сферы применения водорода в качестве экологически чистого энергоносителя, а также вхождение страны в число мировых лидеров по его производству и экспорту.

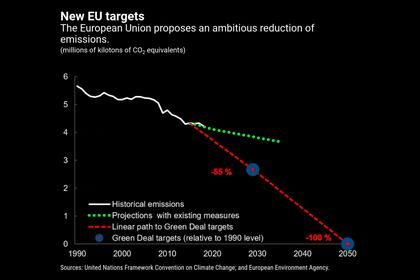

По оценкам экспертов, к 2050 году доля водорода в мировом энергетическом балансе может увеличиться в разы. Во многом это связано с развивающимся в мире трендом на декарбонизацию экономики и снижение антропогенного воздействия на окружающую среду. Водородная энергетика рассматривается как одно из ключевых направлений достижения углеродной нейтральности, поскольку водород можно получать из низкоуглеродных источников, а его использование в качестве энергоносителя не приводит к выбросам парниковых газов.

В России задача по развитию водородной энергетики закреплена в ключевом отраслевом документе стратегического планирования – актуализированной Энергетической стратегии Российской Федерации на период до 2035 года.

Уже сегодня Россия обладает важными конкурентными преимуществами по развитию водородной энергетики: наличием значительного энергетического потенциала и ресурсной базы,наличием недозагруженных генерирующих мощностей, географической близостью к потенциальным потребителям водорода, научным заделом в сфере производства, транспортировки и хранения водорода, а также наличием действующей транспортной инфраструктуры. Это может позволить России в перспективе занять место лидера в сфере производства и поставок водорода на глобальный рынок.

Для реализации имеющегося в стране потенциала и достижения заложенных в Энергетической стратегии целей планом мероприятий («дорожной картой») по развитию водородной энергетики предусмотрены следующие основные направления работ:

− разработка отечественных низкоуглеродныхтехнологий производства водорода методами конверсии, пиролиза метана, электролиза и других технологий, в том числе с возможностью локализации зарубежных технологий;

− увеличение масштабов производства водорода из природного газа, а также с использованием возобновляемых источников энергии (ВИЭ), атомной энергии;

− обеспечение законодательной поддержки производства водорода;

− разработка и реализация мер государственной поддержки создания инфраструктуры транспортировки и потребления водорода и энергетических смесей на его основе;

− стимулирование спроса на внутреннем рынке на топливные элементы на водороде в российском транспорте, а также на использование водорода и энергетических смесей на его основе в качестве накопителей и преобразователей энергии для повышения эффективности централизованных систем энергоснабжения;

− создание нормативной базы в области безопасности водородной энергетики; интенсификация международного сотрудничества в области развития водородной энергетики и выход на зарубежные рынки.

В соответствии с «дорожной картой» к 2024 году предусмотрена реализация ряда пилотных проектов в области водородной энергетики, направленных, в том числе, на создание, производство и применение пилотных установок производства водорода без выбросов углекислого газа, разработку, изготовление и проведение испытаний газовых турбин на метано-водородном топливе, создание опытного образца железнодорожного транспорта на водороде и опытных полигонов низкоуглеродного производства водорода на объектах переработки углеводородного сырья или объектах добычи природного газа, производство водорода с использованием атомных электрических станций.

«Реализация утвержденного плана мероприятий позволит создать в России принципиально новую индустрию низкоуглеродного производства, хранения и транспортировки водорода, его использования в энергетике, транспорте и промышленности, а также выйти на зарубежные рынки с новыми компетенциями. Водород, используемый сегодня в основном в химической и нефтехимической промышленности, в перспективе способен стать одним из драйверов развития энергетики и базой для формирования в стране водородной экономики», – прокомментировал Министр энергетики Российской Федерации Александр Новак.

Вместе с тем он отметил, что развитие российского ТЭК должно быть сбалансированным: с одной стороны государство должно оказывать содействие развитию в стране водородных технологических компетенций, а с другой – стремиться сохранить позиции Российской Федерации на традиционных энергетических рынках.

Первоочередной задачей на 2020-2021 годы в рамках реализации плана мероприятий является разработка Концепции развития водородной энергетики в Российской Федерации. В ней будут произведены оценки текущего состояния производства и потребления водорода, а также дана оценка ресурсному и технологическому потенциалу России на перспективном рынке водородных энергоносителей. Кроме того, в документе предполагается сформулировать приоритеты развития водородной энергетики с определением краткосрочных, среднесрочных и долгосрочных целей.

В качестве системы управления реализацией стратегических задач будут созданы межведомственнаярабочая группа по развитию водородной энергетики под председательством Министра энергетики Российской Федерации и проектный офис на базе ФГБУ «Российское энергетическое агентство» Минэнерго России, обеспечивающий информационно-аналитическое сопровождение реализации «дорожной карты».

План мероприятий («дорожная карта») по развитию водородной энергетики в Российской Федерации до 2024 года разработан Минэнерго России совместно с ФГБУ «Российское энергетическое агентство» Минэнерго России, Минпромторгом России, Минэконмразвития России, Минобрнауки России, Минтрансом России, Минприроды России, отраслевыми компаниями (ГК «Росатом», ПАО «Газпром»), представителями научного, включая Санкт-Петербургский горный университет, и экспертного сообщества.

План мероприятий по развитию водородной энергетики в Российской Федерации до 2024 года PDF версия

-----

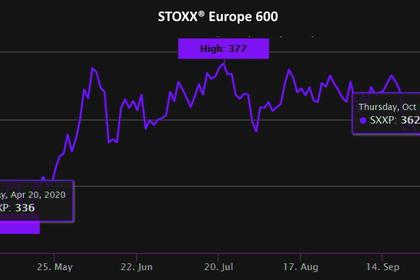

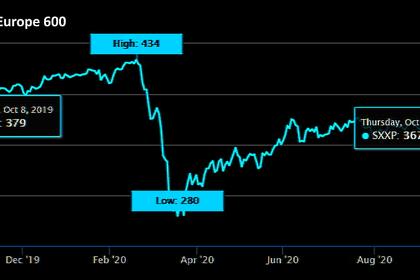

EUROPEAN SHARES UP

REUTERS - OCTOBER 23, 2020 - European stocks rose on Friday, boosted by positive earnings updates from Barclays and carmakers, but nagging worries about the economic impact of surging COVID-19 cases put markets on course for their biggest weekly decline in a month.

The pan-European STOXX 600 index .STOXX advanced 0.9%, with London's FTSE 100 .FTSE outperforming its European peers after Barclays BARC.L jumped 5.6% on strong results.

Carmaker Daimler DAIGn.DE rose 2.3% as it raised its 2020 profit outlook after a 24% jump in demand for luxury cars in China in the third quarter.

Sectors considered more economically sensitive such as banks .SX7P, automakers .SXAP and oil & gas .SXEP found favour. European lenders were on course for their best monthly performance in over a year.

“Opposite forces are in play at the moment,” said Emmanuel Cau, head of European equity strategy at Barclays. “Globally you’ve these two main sources of growth - U.S. and China - that are still recovering, so part of European market will still benefit from the strength outside of Europe.”

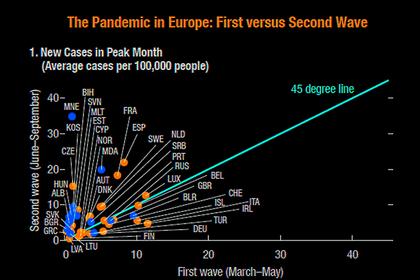

“But the domestic part of the market exposed to mobility and restrictions are impacted by the second wave.”

Indicating this trend, IHS Markit’s survey of purchasing managers showed German manufacturing sector expanded at a faster rate in October, but services activity shrank, suggesting Europe’s largest economy is operating at two speeds.

The broader euro zone economic activity slipped back into decline this month.

Meanwhile, the mood in global markets was that of caution with less than two weeks to go before the U.S. presidential election.

France looked set to widen a curfew to more than two-thirds of its population after the country set an all-time daily high of new coronavirus cases on Thursday.

Finance Minister Bruno Le Maire said the GDP will likely contract in the fourth quarter, adding that curfew measures would cost around two billion euros ($2.36 billion).

France's Renault RENA.PA gained 2.3% after saying it should have positive cash flow from cars by the end of 2020 as sales recovered.

Luxury group Kering PRTP.PA fell 2% as its star Gucci brand underperformed rivals.

Holiday Inn-owner InterContinental Hotels IHG.L slipped 0.7% as it posted a 53.4% fall in quarterly revenue per available room.

-----