EUROPE'S SHARES DOWN

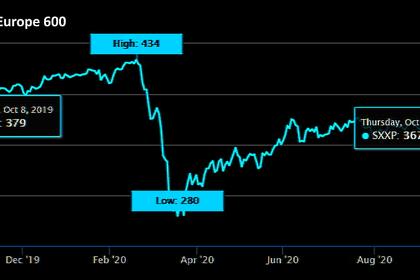

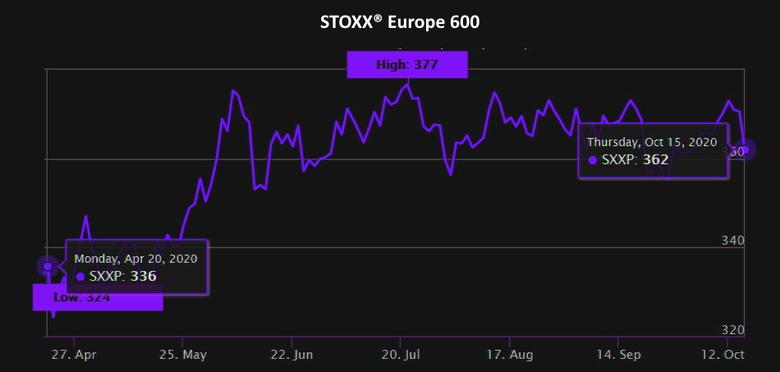

REUTERS - OCTOBER 15, 2020 - European shares sank to a near two-week low on Thursday as a resurgence in COVID-19 cases across the continent and fading hopes for more U.S. fiscal stimulus before the presidential election dented demand for equities globally.

The pan-European STOXX 600 index .STOXX was down 1.7% and on track for its worst day in more than three weeks, with travel and leisure .SXTP, autos .SXAP and energy .SXEP stocks tumbling more than 2%.

Bank shares .SX7P tracked a decline in bond yields, shrugging off signs of a pickup in M&A activity after a report said Italy's Banco BPM BAMI.MI and France's Credit Agricole CAGR.PA had signed a confidentiality agreement in a first step towards formal talks over a possible merger.

“With the prospect of an imminent U.S. stimulus plan diminishing by the day (and) rising infection rates prompting tighter restrictions across Europe, is it any wonder that investors are starting to get a little twitchy?” said Michael Hewson, market analyst at CMC Markets UK.

European stock markets have bounced from the coronavirus lows hit in March on a raft of global stimulus, but sentiment has recently taken a hit from a surge in infections as well as signs of a slowing economic rebound.

France has imposed curfews and other European nations are closing schools and cancelling surgeries in an attempt to contain the resurgence ahead of the winter season.

Bourses in France .FCHI, Italy .FTMIB, Spain .IBEX and Germany .GDAXI fell between 1.7% and 2.0%.

In the UK, ex-dividend trading weighed on the blue-chip FTSE 100 .FTSE, while investors looked for signs of progress in a Brexit trade deal with the two-day European Union summit set to kick off later in the day.

“It’s not in anyone’s interest if the UK leaves the EU without a deal and markets are so far leaning towards an 11th-hour Brexit agreement,” said Hussein Sayed, a market strategist at FXTM.

Global shares also began the day on the back foot as U.S. Treasury Secretary Steven Mnuchin said a deal on more federal aid was unlikely before the Nov. 3 election. [MKTS/GLOB]

In company news, Swiss drugmaker Roche ROG.S shed 2.5% even as it posted record revenue in its diagnostics division that offset declining drug sales and kept it on track to meet its full-year 2020 targets.

Lonza Group LONN.S was one of the few gainers on the STOXX 600 after it forecast double-digit sales growth as part of its 2023 group guidance under a new structure with four divisions.

-----

Earlier: