GLOBAL OIL DEMAND PEAK: 2040

PLATTS - 15 Oct 2020 - Global oil demand is forecast to peak by around 2040 because transport-fuel demand will decline steeply and economic growth will slow in the post-coronavirus world, the Institute of Energy Economics, Japan, said in its annual IEEJ Outlook 2021 on Oct. 15.

"In the post-coronavirus era, we expect demand for transport fuels will be curbed significantly," Shigeru Suehiro, senior economist and manager at IEEJ's econometric and statistical analysis group, told an online press briefing.

"We see oil demand peaking in around 2040 as a result of a slowing economy, together with less fuel demand for cars, aircraft and ships."

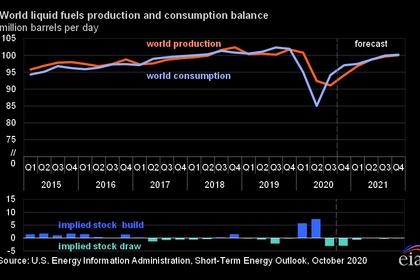

In its post-pandemic scenario, the IEEJ forecasts global oil demand will peak at 106 million b/d in 2040 and fall further to 102 million b/d in 2050 mainly due to dwindling demand for cars, Suehiro said.

"In such a world, oil exporting countries such as those in the Middle East may suffer a major impact, and it will be critically important for them to diversify their economies," Suehiro said.

Stressing that oil demand would remain strong after having peaked, upstream investment would be vital to preventing a supply crunch and the destabilization of the oil market in the future, he said.

The IEEJ, an affiliate of the Ministry of Economy, Trade and Industry, releases its global energy outlook until 2050 on an annual basis.

Growth scenario

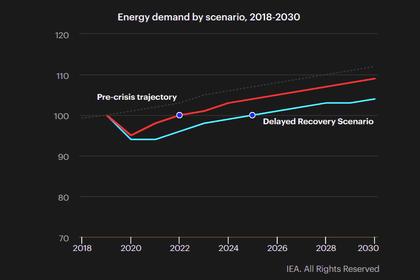

In its reference scenario, under which it assumes the impact of the pandemic on global energy demand will dissipate in few years, the IEEJ expects energy demand will increase toward 2050 due to the growth in Asian demand, Suehiro said.

The reference scenario is based on assumptions that current energy and environmental policies will be maintained without the introduction of radical decarbonization policies.

The IEEJ forecasts oil demand will increase to 116 million b/d in 2050 mainly due to growing demand for transport fuel and petrochemical feedstocks based on its reference scenario, Suehiro said.

Roughly half of the oil demand growth of about 20 million b/d by 2050 will be met by OPEC producers in the Middle East because of their abundant reserves and low production costs in the IEEJ reference scenario.

"In Asia, we expect to see a major change in the landscape. The significant growth in Asian energy demand has been led mainly by China's increased energy demand [in recent years]," Suehiro said. "In the next 30 years, India and ASEAN will be the main drivers of demand growth rather than China."

By 2050, India will account for over a third of the increase in global energy demand as Chinese demand will peak in the late 2030s, under the IEEJ reference scenario.

Advanced technologies, CCE scenarios

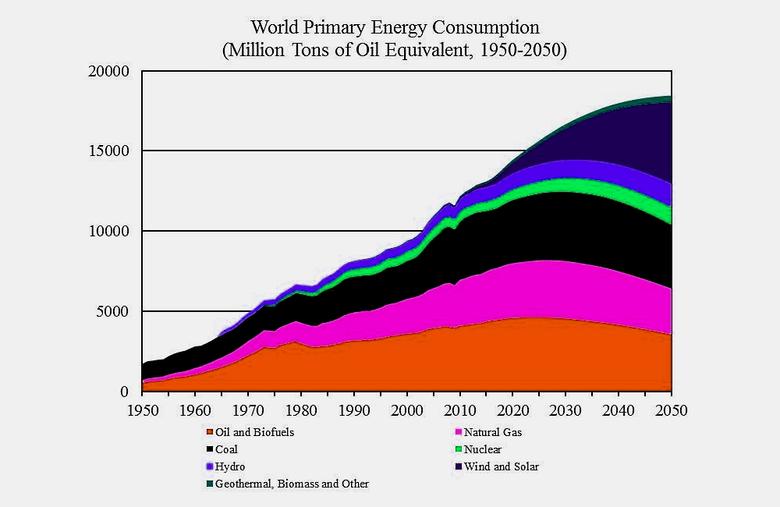

While the IEEJ forecasts fossil fuels will account for 80% of global energy demand in 2050 under its reference scenario, in its advanced technologies scenario it puts it at 67%, with demand for oil, coal and natural gas having peaked by then.

The advanced technologies scenario is based on assumptions that the maximum amount of innovative technologies have been introduced as countries enforce strict energy and environmental policies to combat climate change.

In its latest outlook, the IEEJ has introduced a Circular Carbon Economy scenario, under which it looks at how countries around the world could pursue both using fossil fuels and reducing carbon dioxide emissions by advancing Reduce, Reuse, Remove and Recycle, or 4Rs technologies.

CCE is among key agenda to be discussed during the Saudi Arabia-hosted G20 summit in November.

The CCE scenario assumes the same 67% share of fossil fuels in energy demand in 2050 as in the advanced technologies scenario, but CO2 emissions will be reduced by another 5 billion mt.

"By maximizing the utilization of decarbonization technology, CO2 emissions could be significantly reduced even though the share of fossil fuels in the energy mix remains unchanged," senior economist at IEEJ's planning & administration unit, Yoshikazu Kobayashi, said at the briefing.

"In other words, the use of fossil fuels and a reduction in CO2 emissions can be pursued at the same time by maximizing the use of decarbonization technologies," Kobayashi said.

The IEEJ expects introduction of hydrogen to replace some of coal-fired power generation and replace some oil products in transport to be among the possible options to reduce CO2 significantly, Kobayashi said.

Hydrogen is forecast to account for 5% of the 2050 global energy mix for power generation in the IEEJ's CCE scenario.

-----

Earlier: