INDIA GAS CONSUMPTION UP

PE - 24 October 2020 - India appears set to overtake China as having the world's largest residential market for LPG by 2030, due to the combined effect of a range of government measures to promote the uptake of cleaner burning fuels.

“LPG demand in the residential sector will continue to see sustainable growth at a cumulative annual growth rate of 3.3pc, reaching 34mn t in 2030 as households' dependence on solid biomass diminishes in the long run supported by rising average household incomes and urban population,” a recent report by consultancy Wood Mackenzie projects.

Motivated by environmental and health concerns around burning biomass for domestic energy consumption, New Delhi has been promoting use of LPG among lower-income families, especially in rural areas. Government support has taken the form of the Direct Benefit Transfer of LPG, a financial subsidy, and free LPG stoves for those under the poverty line.

In addition, the successful introduction of biometric Aadhaar ID cards from just over a decade ago, which are linked to bank accounts and incomes, has been instrumental in ensuring that subsidies are well-targeted and financial leakages plugged.

In urban areas, New Delhi has also been pushing for increased penetration of piped natural gas (PNG) among households. PNG demand in India's residential sector will grow annually at 12.7pc, reaching 2.5bn m3 by 2030 from its current 0.8bn m3, Wood Mackenzie projects while affirming the impact of New Delhi’s efforts to promote gas as a cleaner alternative fuel.

Import concern

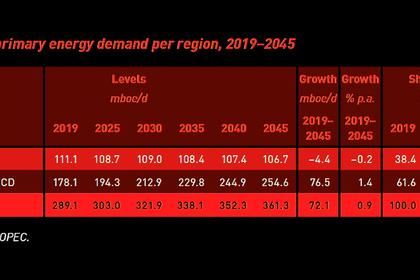

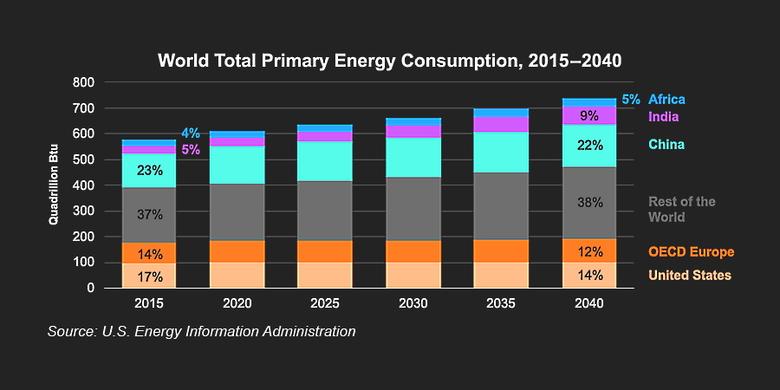

Gas accounts for little over 6pc of India’s primary energy consumption mix, which is far below the global average. New Delhi has set a target to raise this to 15pc by 2030, with demand expected to be driven by the fertiliser, power, household cooking and steel sectors. Promoting compressed natural gas is aimed at reducing the overwhelming dependence on imported gasoline and diesel in the auto sector.

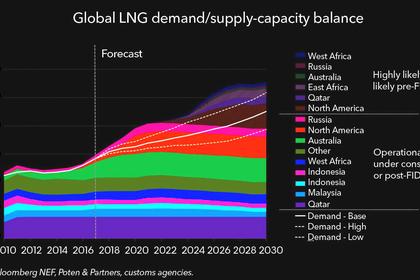

The creation of downstream infrastructure and a fiscal paradigm to promote gas usage are undoubtedly a positive for India. However, as has happened in the case of crude oil, it is bringing with it concern that the absence of upstream exploration success is resulting in a rising dependence on imports, whether as LPG or LNG.

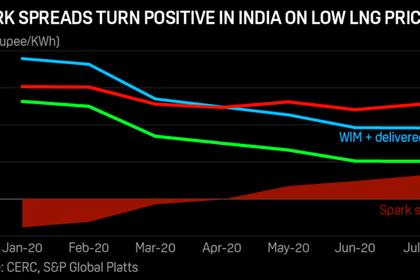

India meets about half of its daily 160-170mn m3/d of gas consumption via imports. The high cost of importing gas is the one big reason that 24GW of gas-based power capacity, created in the expectation of availabile cheap domestic gas supplies, is now unviable.

There have been many unsuccessful attempts to revive these power plants, the latest being a proposal to allow them to put in pooled bids with renewable energy projects. New Delhi has also made several attempts to kickstart upstream activity, including streamlining regulations.

However, success with big overseas players has been limited—the exception being the UK’s BP, which is the only significant investor in the gas exploration space in India.

New Delhi conceded to a long-standing demand of stakeholders in early October by permitting a market price discovery mechanism for domestic gas. “The decision will help increase domestic gas production by an additional 40mn m3/d from the current 80mn m3/d,” India’s petroleum and natural gas minister, Dharmendra Pradhan, said at the time.

India’s domestic gas price is pegged to a weighted average of major international gas supply hubs. Investors say this internationally discovered price formula makes production unviable as it does not reflect local costs as well as the market reality that India usually imports LNG at much higher prices.

Domestic natural gas prices were quoted at $1.79/mn Btu in India at the time of writing, the lowest ever under the peg. Price deregulation for the entire domestic gas sector is key to increasing the share of gas in the energy mix, ratings agency ICRA says. Indeed, government action, though belated, is a welcome step in the right direction, though much more will need to be done to pull up both gas output and usage.

-----

Earlier: