LIBYAN OIL RECOVERY

PLATTS - 26 Oct 2020 - All of Libya's key oil fields and terminals are gearing up for a full reboot, with almost 500,000 b/d more of Libyan light sweet crude set to hit the market in the next few weeks.

This comes a few days after the country's two warring factions -- the UN-backed Government of National Accord and the self-styled Libyan National Army -- signed a permanent ceasefire mediated by the UN.

Shipping and trading sources said a flurry of exports from the newly opened terminals of Es Sider and Ras Lanuf will be taking place this week, as the OPEC producer seeks to almost double output to over 1 million b/d within four weeks.

Libya's crude and condensate output has more than quintupled over the past month, averaging just close to 600,000 b/d on Oct. 26 as more oil fields in the southwest and southeast have restarted operations, sources added.

Flurry of fixtures

Libya's state-owned National Oil Corp. lifted force majeure on operations at the 70,000 b/d El Feel, or Elephant, oil field on Oct. 26. On Oct. 23, NOC also lifted force majeure on crude loadings out of the 300,000 b/d Es Sider and 250,000 b/d Ras Lanuf terminals.

Three Aframaxes Nissos Serifos, Seagrace and Sea Loyalty, and one Suezmax will load from Es Sider this week, sources said. There will also be one Aframax loadings from Ras Lanuf on Oct. 27.

Demand for Libya's light sweet crude has been very strong despite low refining margins and a fairly well supplied sweet crude market.

Sources said European refiners prefer Libyan crude as it is cheaper than some other light sweet barrels.

"There is enough Libyan crude in order not to care about Urals crude. All these barrels are very prompt and [pretty much] all of them are going to Europe," a crude oil trader said.

Libyan crude exports have also climbed since mid-Sep, when the LNA lifted an eight-month loping oil blockade.

Libya will export more than 600,000 b/d next month, according to shipping data seen by S&P Global Platts. The OPEC member exported 180,000 b/d in September, its highest monthly volume since January, data from intelligence firm Kpler showed. But exports are forecast to rise to 356,000 b/d in October, according to Kpler.

Waha restart

Production at the oil fields operated by the Waha Oil Company, will also reopen in the coming days. Crude from these fields are exported through the Es Sider oil terminal.

A media official at the Waha Oil Company, confirmed that it has implemented the instruction from the NOC to make arrangements to restart all the oil fields, and also resume oil flows on the pipeline between the Samah, Waha, Dahra fields to the port of Es Sider.

The Waha oil fields have had work carried out on them to maintain the production and service facilities while they were offline.

The Waha oil fields in the Sirte Basin have the capacity to pump around 300,000 b/d. Waha Oil Company is a subsidiary of state-owned National Oil Corp.

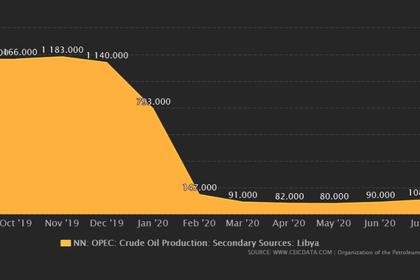

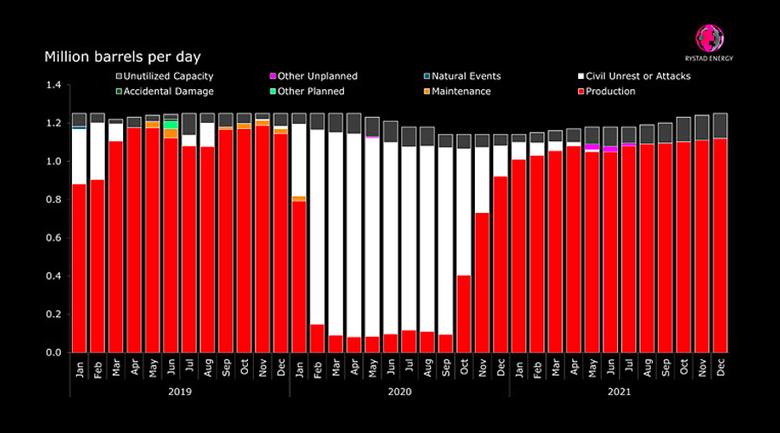

On Jan. 18, eastern tribes, supported by the LNA, halted exports from five key oil terminals, which reduced the country's crude production to the lowest since the 2011 civil war. Libya's oil production had fallen to as low as 70,000 b/d in recent months from around 1.1 million b/d before the blockade in January.

Fast rebound

On Oct. 23, NOC said Libyan oil output would reach 800,000 b/d in two weeks and it will exceed 1 million b/d within four weeks.

This has surprised many in the market who were expecting Libyan production to resume gradually.

But the signing of a permanent truce, means oil will be back faster than previously expected though some volatility is expected.

The rise in Libyan oil supply is also coinciding with fading demand growth, which will make it tricky for OPEC+ as it mulls its next move.

S&P Global Platts Analytics now expects Libyan crude supply to reach 900,000 b/d by year-end

"Libya's fast rebound aligns with our view that global supply risks are skewed to the upside," Platts Analytics in a recent research note said.

"With faltering demand and bloated inventories, OPEC+ may find it increasingly difficult to taper cuts as scheduled in 2021. Next month's OPEC+ meeting will likely prove decisive."

Libya holds Africa's largest proven reserves of oil, and its main light sweet Es Sider and Sharara export crudes are sought after for their gasoline and middle distillate yields by refineries in the Mediterranean and Northwest Europe.

-----

Earlier: