LNG: CHALLENGES & OPPORTUNITIES

MCKINSEY - September 2020 - The future of liquefied natural gas: Opportunities for growth

The COVID-19 pandemic has accelerated LNG market trends that were already underway. LNG players must pursue improvement in five areas to adapt to new conditions and seize opportunities for growth.

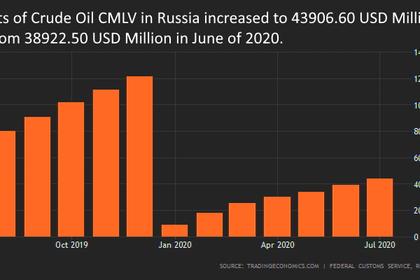

The liquefied natural gas (LNG) industry is experiencing low prices and oversupply. Even before the COVID-19 pandemic, the LNG market was set for oversupply in 2020 and 2021 as new projects continued to grow capacity well beyond steady demand growth. Reduced gas demand because of the pandemic has added to excess supply, creating market volatility. And a sustained period of lower oil prices and increased competition among gas supply sources as new supply reaches the market have combined to erode margins, putting pressure on gas and LNG producers.

The long-term outlook for LNG, however, is brighter than that of other fossil fuels because of its comparatively lower cost and lower emissions from production and combustion. But to find a true competitive advantage amid a volatile market, the LNG industry must move beyond what were once winning strategies (control of gas resources, reliability of supply). Instead, LNG players should focus their efforts in five areas: capital efficiency, supply-chain optimization, downstream market development, decarbonization, and digital and advanced analytics. If done successfully, LNG could ride out an unpredictable market and find opportunities for faster growth.

Challenges today and tomorrow

A sustained period of lower oil prices has reduced gas prices directly through oil-indexed contracts (which remain the norm in many Asian markets)

and indirectly by decreasing the financial incentive for consumers of oil-based fuels to switch to natural gas.

At the same time, the emergence of large-scale North American LNG exports has made it easier for low-cost US gas to reach Asia's LNG importing markets. And consecutive waves of new LNG supply capacity from Australia, Russia, and the United States have pushed the market into persistent oversupply. In this competitive market, gas importers can negotiate lower gas prices even relative to low oil prices.

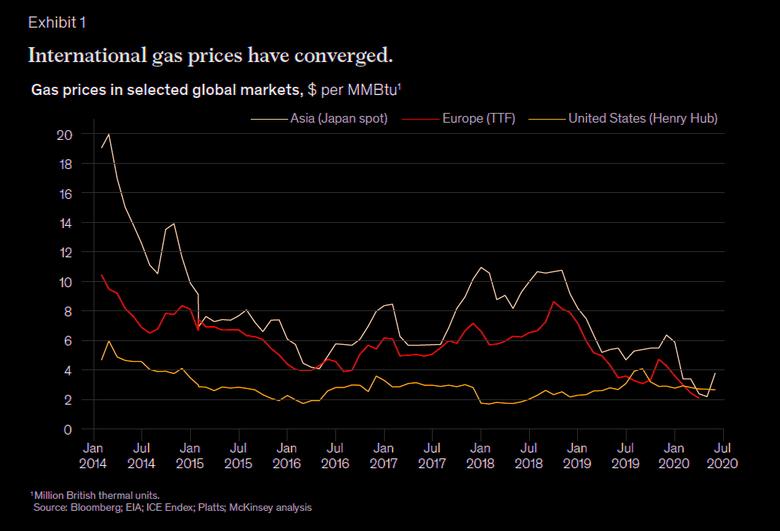

COVID-19 has added to the severity of oversupply. Country-wide lockdowns and the suspension of industrial activity diminished demand in the second quarter of 2020. Depending on how COVID-19 affects importing markets, 2020 gas demand could fall by 4 to 7 percent—by far the largest demand shock in more than 50 years. As a result, spot gas prices have fallen sharply since the beginning of 2020, creating almost complete convergence between Asian, European, and US prices (Exhibit 1).

LNG exporters have cancelled cargoes (more than 100 US shipments were canceled per month for June and July) as the spot price in Asian and European markets no longer covers the cash cost of US gas supply, liquefaction, and shipping. Despite these low prices, however, many US LNG shipments are continuing because of long-term contractual commitments and inflexible supply chains. As of June 30, 2020, global LNG supply was up 5 percent year-on-year while piped gas flows have decreased because of lower demand.

Further challenges remain on the horizon for gas. In most developed economies, gas has a decreasing role in baseload power generation (power that is almost always online). In some countries, electrification is also reducing the role of gas in household and commercial heating and cooking. Finally, a rapid decline in the cost of battery technologies could make energy supply from renewable power less intermittent over time, challenging the role of gas as a peaking power generator (providing power only at peak demand times).

Opportunities for LNG

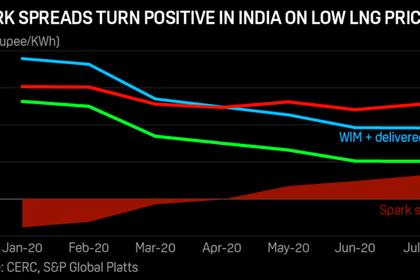

The same trend that contributes to LNG's challenges also creates an opportune landscape. Lower wholesale gas prices in end-use markets, for instance, mean the economics of gas use are increasingly favorable when compared with alternatives such as oil. Recent investments in terminals and pipelines to connect gas to consumers have also increased gas availability.

Whether taken in combination or on their own, these and other factors create an opportunity for accelerated demand growth, particularly in Asia.

Improved economics

The economics of LNG relative to oil and coal in consuming countries have improved markedly over the past decade. From 2000 to 2018, LNG was priced at a small discount relative to oil—values varied between contracts, but savings of 10 to 20 percent were typical. That discount has roughly doubled for contracts signed during the past two to three years, and short-term LNG supplies available in the spot markets in 2020 have offered as much as 50 to 70 percent savings relative to the prevailing oil price. As the price discount relative to oil increases, consumers are incentivized to make the switch from oil and oil products to gas where practical. Industrial consumers have the biggest incentive, given their scale, but gas is competing with oil products even within the road- and marine-transport sectors. When compared with coal, LNG prices were typically much higher; from 2000 to 2018, LNG averaged more than three times its coal price equivalent. This premium forced policy akers to make the difficult trade-off between high costs or high emissions. Recently, LNG spot prices are almost equal to coal, eliminating the trade-off—at least in the short term.

LNG prices may recover somewhat over the next three to five years, though market fundamentals suggest its discount relative to oil will persist and its premium over coal may be smaller than in the past. Wider use of carbon pricing could improve LNG's competitive position compared with coal and oil. In the United Kingdom, for example, a carbon price floor of £18 ($23) per tonne led to switching from coal to gas-fired power over the past five years. Carbon prices of $25 to $50 per tonne can tip the balance of economic incentives on new-build power plants from coal to gas. And China is set to introduce a national carbon-trading scheme by the end of 2020.

Greater role of gas in the power mix

While most power systems can accommodate a small amount of intermittent generation, renewable power—which makes up a significant share of energy supply—still requires firming capacity. In most markets, gas is by far the cheapest source of firming capacity in the power system. Coal-fired power plants are ill-suited to provide flexible energy, as their thermal efficiency decreases and maintenance costs increase when they operate in a flexible peaking role. Furthermore, higher carbon emissions from coal-fired plants cancel out the main benefit of renewable power: clean energy.

Batteries can absorb hour-to-hour variations in demand, but they are two to three times more expensive than gas-fired generation. While this cost may decrease over time, it is unlikely that batteries will become an economically viable option to balance week-to-week, month-to-month, or season-to-season differences in supply and demand. Technologies that can manage long-duration demand variations are being developed, but they are likely at least ten years from being deployed at scale.

Improved air quality

According to the World Health Organization, ambient air pollution accounts for an estimated 4.2 million deaths a year, with the greatest death toll in Asia.

Coal-fired power and liquid fuels for road and marine transport both produce major air pollutants: particulate matter, sulfur dioxide (SO2), and nitrogen oxides (NOx). A switch to gas can significantly reduce air pollution—gas consumption typically produces negligible particulates and SO2. In addition, switching from coal- to gas-fired power reduces NOx emissions by roughly 50 percent, while switching from oil to gas in the transport sector reduces NOx emissions by roughly 80 percent.

Better access to LNG

A decade ago, only 23 countries had access to LNG. Costly import terminals that took years to build and inflexible supply contracts complicated the widespread adoption of gas—despite the attractive near-term economics. Concerns about the geopolitical risks of LNG dependence also stunted demand growth from existing importers, even when few other supply options were available. (For more on how the LNG business model is likely to transform, see sidebar, "Changing the liquefied natural gas commercial model.")

In most markets, gas is by far the cheapest source of firming capacity in the power system.

Changing the liquefied natural gas commercial model

The LNG commercial model was built to provide a steady flow of point-to-point supply to meet stable, predictable consumer demand with little exposure to gas market dynamics. LNG contracts reflect this approach with multidecade durations that offer limited flexibility to adjust volumes or redirect them and with contract prices that link to an oil index more often than to gas markets. However, this commercial model is under

pressure on many fronts. On the buyer side, demand is less predictable as markets liberalize and the global share of renewable power

grows. In response, buyers are attempting to reduce their risk through shorter contract durations, additional contractual flexibility, and pricing linked to local markets.

Suppliers have adapted to these needs as more amenable US LNG players entered the market, some long-term contracts expired, and larger producers began to provide more flexible LNG supply with alternative price mechanisms from their portfolios. But change has been slow. From 2015 to 2019, for example, the volume of LNG contracted on a long-term basis decreased from 73 to 66 percent, while the total volume of oillinked LNG dropped from 66 to 59 percent.

The pandemic will likely accelerate the move to a more flexible business model as lower demand releases additional liquidity into spot and short-term markets. Consequently, buyers are more confident that their needs can be met through these markets. McKinsey's 2020 LNG Buyers Survey indicates that buyers aim for contracts longer than five years to make up a little more than 40 percent of their future supply mix, with the remainder met by spot and short-term contracts. Meanwhile, indexation of contracts will become more diverse—only 34 percent of LNG buyers prefer oil-indexed contracts (Exhibit 1).

Buyer preferences will likely be met as the increased oversupply of LNG strengthens their negotiating power and as sellers adopt a "no reasonable offer refused" mindset. Once the shift to shorter-duration contracts, increased flexibility, and diversified indices occurs, it will be hard to reverse—even if the market rebalances.

The pandemic may also be a catalyst to uncover new demand. After previous sharp falls in the LNG price during 2009 and 2015, we saw the rate of LNG demand growth triple in the following three years compared with the three years before the price drop (Exhibit 2). Low gas prices today,

combined with more diverse supply options, could accelerate the switch to a more gasbased economy.

Today's market is very different. In 2019, the number of LNG importing countries reached 43. Rising competition among suppliers and increasing liquidity in traded markets created more room to cater to individual buyer needs for contract duration, size, and flexibility. And the development of floating storage and regasification unit (FSRU) technology means LNG supply capacity can respond quickly to changes in local gas demand and supply. Indeed, FSRUs allow any country with a coastline to access LNG supply within two years.

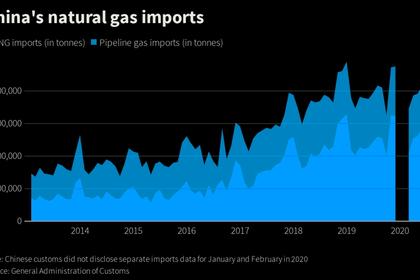

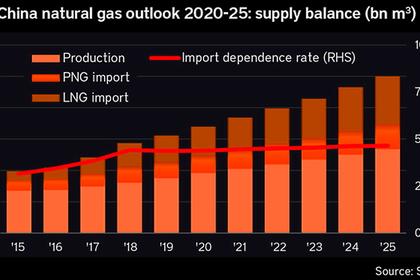

Accelerated demand growth in Asia

As the gas price premium over coal narrows, and the firming and emissions advantages of gas over coal become clearer, markets (especially in Asia) can rebalance the energy mix toward gas. Asia is the world's largest energy consuming region and is also the most dependent on coal. Coal meets 47 percent of Asia's energy consumption; as a comparison, the next highest coal-consuming region is Africa, with coal meeting 23 percent of its energy consumption (Exhibit 2). Meanwhile, gas provides just 12 percent of primary energy consumption in Asia but more than 20 percent consumption in every other global region. Increasing Asia's share of gas energy consumption to 20 percent would add the equivalent of more than 400 million tonnes of LNG to annual gas demand, doubling the size of the LNG market. However, with limited gas-fired power generation capacity across many Asian countries, the transition from coal to gas will take time. Increased load factors on gas-fired generation can happen almost immediately but it would only close about 10 percent of the gap. Closing the remaining 90 percent requires investment in new gas-fired power generation capacity, which typically takes about three to four years to permit and construct.

Beyond power generation, gas could replace oil in the transport sector. In China, the transport sector accounts for more than 10 percent of current gas demand and it is the fastest-growing demand segment globally. If the rest of Asia were to use gas for transport as extensively as China does, it would add annual gas demand equivalent to 40 million tonnes of LNG.

How to win in the new LNG environment

To capture the growth potential of LNG in an increasingly competitive market, most companies need to shift how they conduct business, particularly by focusing their efforts in five areas. While these actions differ from those that supported success in the old commercial model—gaining control of gas resources, building strong customer relationships—executing them well will be key to navigating a volatile market.

Realize capital efficiency

Margins in upstream LNG are unlikely to return to the levels common in the early 2010s. Lower long-term oil prices effectively cap LNG contract prices while ever-more complex and remote LNG projects have amplified costs. Moreover, the large number of proposed but undeveloped LNG projects with similar breakeven prices create intense price competition, leading to narrower margins.

Reducing the capital cost of developing LNG projects could improve margins, however. The cost of LNG projects rose from less than $500 per tonne of capacity at the turn of the century to more than $2,000 per tonne in 2012. In 2017, costs came down to an average of around $900 but could fall further. We have found improved design and execution of greenfield LNG projects can realize savings of 30 to 40 percent, bringing capital costs back into a range of $500 to $600 per tonne.

Modularization and low-cost floating LNG3 could be important parts of the solution. Instead of developing one or two custom-designed trains, installing many smaller modular trains could make projects more scalable, accelerate installation times, and reduce cost. Venture Global estimates that its Calcasieu Pass project, which consists of 18 modular trains, will cost less than $600 per tonne. And in 2018 Golar built the Hilli Episeyo LNG vessel for $500 per tonne by converting an LNG tanker. Golar is currently converting another vessel for BP's Tortue LNG development at $520 per tonne. Megaprojects such as Qatar's North Field East Project can combine standardized designs across many large trains, achieving efficiency at scale.

Optimize the supply chain

Despite its growing size and liquidity, the LNG market is far from an ideal "efficient" commodity market. Most LNG flows reflect long-term contract commitments and are unresponsive to short-term price signals. Likewise, the sequence and timing of deliveries tend to reflect long-term plans rather than market needs, thus cargoes often flow to set markets even when another could offer a better price or lower transport costs. As traded markets develop, supply chains will still be affected by inefficiencies that include contract inflexibility, barriers to infrastructure access, high cost of LNG storage and transport, and differences in product specification.

To realize transportation cost savings and higher LNG prices, companies can assemble a diversified and flexible portfolio of LNG supply and offtake positions as well as secure trading and optimization capabilities. A McKinsey optimization model that explores the value potential of different portfolios indicates many could achieve additional margins of $0.30 to $0.50 per one million British thermal unit.

Invest in downstream market development

An acceleration of LNG demand growth requires LNG producers to make significant investments in new downstream infrastructure, including import terminals, pipelines, and power plants. Much of the potential demand growth, however, is in developing markets where utilities' capital is often constrained, and companies may lack the capacity and capabilities to complete large-scale gas infrastructure projects.

Thus, companies that can fill the capital, capacity, and capability gaps of downstream consumers can grow quickly and achieve higher prices in end-user gas markets where competition is often less intense. Total, for example, recently partnered with Adani in India to build a five-million-tonne-per-annum LNG import terminal and a distribution network that supplies six million households and 1,500 compressed-natural-gas fuel stations. And AES is building Vietnam's first LNG import terminal in parallel with a 2.2 GW gas-fired power plant.

For LNG producers, identifying, prioritizing, and developing such a diverse range of opportunities requires new capabilities. Passive LNG marketing, for instance, should be replaced with systematic business development where potential opportunities are managed and tracked through a progression pipeline. Producers should also manage risks associated with local energy-market dynamics and regulation.

Decarbonize supply

A switch from more carbon-intensive fuels to gas can mean significant carbon abatement. In the United States, for example, the switch from coal- to gas-fired power (facilitated by lower gas prices since 2008) abated more carbon emissions than all of the renewable power capacity ever installed in the country.

There are significant variations in carbon intensity between gas supply chains, however, because of the different technologies used for gas production, liquefaction, and shipping. LNG buyers are increasingly concerned about these differences: 33 percent believe that emissions-intensity clauses will be standard within two to three years.

The LNG industry therefore has a strategic imperative to reduce emissions to sustain its role in decarbonizing the energy sector. Using more energy-efficient equipment and reducing gas leaks are just some of the ways LNG players can decarbonize.

Individual producers also have an incentive to seek the lowest-emission options to protect their competitive position. Shell, for example, differentiates itself from competitors by offering carbon-neutral LNG cargoes, where emissions across the entire supply chain are offset by credits from carbon reduction initiatives.

LNG producers can begin by quantifying their emissions in comparison to competitors and exploring the best options to reduce them. In many cases decreasing emissions and costs can go hand in hand by, for example, making energy-efficiency improvements. Plant electrification and renewable power supply typically have modest costs. And while emission offsets or carbon capture generally have higher costs, they may be justified by customer demand.

Companies across the supply chain must also test their exposure to future environmental regulation and pricing scenarios. Understanding how these situations could affect their enterprises, whether positively or negatively, will inform how they pursue portfolio composition, project design, and risk management.

Exposure to climate risk can also affect operations. Given its placement on the coasts, LNG infrastructure may be affected by rising sea levels and more frequent severe storms; some locations may also face risks from drought, extreme temperature, or flooding. By addressing these issues alongside their decarbonization efforts, LNG players can further strengthen their businesses.

Build digital and advanced analytics capabilities

LNG producers can apply digital and advanced analytic techniques to realize significant hidden value potential. One company, for example, used advanced analytics algorithms to model the relationship between input variables, ambient conditions, and production capacity; the insights helped the company increase its revenue by $50 million to $100 million per year. Another algorithm could predict 60 percent of required trips to a plant ten days in advance by modeling the signatures of equipment failures. The advance warning means operators can act early to avoid or reduce impact on throughput. Additional opportunities exist to use digital tools to increase the flexibility and responsiveness of LNG production to market conditions, allowing additional sales at higher prices.

The opportunity is not confined to upstream activities, however. Gas transmission and distribution companies can increasingly rely on technology to optimize network operation, prioritize maintenance activities, and reduce the cost of their field force. Italgas, for example, improved maintenance execution by providing its field force with augmented reality devices. And Cadent in the United Kingdom is using remote-controlled robots to repair and upgrade pipes.

The pandemic represents a rare shock to the global gas market, accelerating many of the trends that were already changing the dynamics of the LNG industry. These disruptions, however, also provide an exceptional opportunity for change. Industry leaders should take a critical look at their fundamental operations and processes, identifying opportunities for improvement and growth. By taking bold actions over the next three to five years, LNG can play a significant role in meeting the world's need for reliable, low-carbon, and low-cost energy supplies.

-----

Earlier: