OIL & GAS, RENEWABLES INVESTMENT

By Jonathan Schwartz Consultant Independent

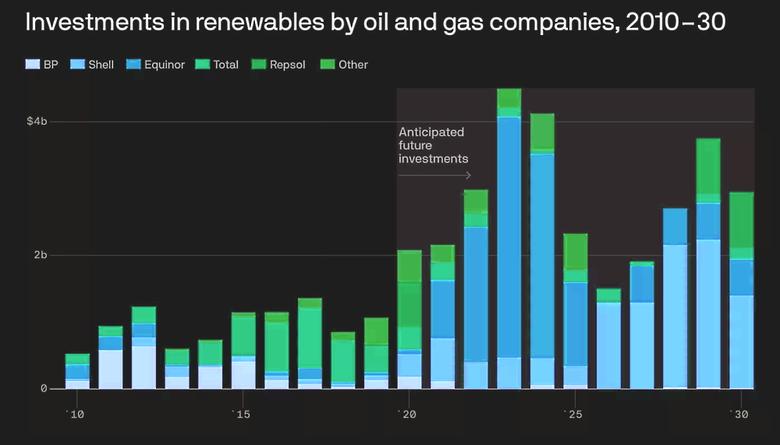

ENERGYCENTRAL - Oct 28, 2020 - With BP's recent offshore wind investment and partnership with Equinor, the O&G industry is starting to seriously invest in renewables generation. And it makes sense – in the U.S., electricity from wind is expected to double by 2030 and quadruple by 2050. Whether or not we’ve reached peak oil now or in 50 years or never, or fracking in North America remains robust or not, public opinion, governmental regulations, and most importantly, economics, are pushing the O&G industry to diversify its assets into renewables.

But the renewables industry today can't be dominated simply by throwing capital at it – there's a lot of that going around already, and supermajors’ competitors, from utilities to owner/operators to OEMs, have already been investing in renewables, continuing to optimize their portfolio performance.

So while it may not be as easy to compete as it once was, supermajors should focus on these five guidelines, investing along the energy value chain to own a piece of the ever-changing electric grid.

1. Leverage existing supply chains to improve asset run-time and performance

For renewables, minimizing downtime requires making sure spare parts are on-site when they’re needed. The impact from COVID demonstrated that there’s still a long way to go to ensure supply chains are sophisticated enough to deal with these events. Supermajors should leverage their infrastructure and expertise to ensure components and spare part logistics is optimized.

2. Utilize drilling and platform development and logistics expertise to help optimize offshore wind development and O&M activities

While Block Island is the only offshore wind farm in the U.S. in operation today, many projects are in the pipeline and there is enormous potential on both coasts. Future growth will require know-how in offshore logistics and development to streamline construction and operations and bring costs down. Supermajors should utilize their drilling and platform construction/logistics know-how and skilled employee base to develop capabilities in offshore EPC.

3. Invest in repair and refurbishment

As existing renewable assets age, OEMs are pushing owner/operators to re-power wind turbines and replace aging solar panels. Yet owner/operators would be better in many situations to continue operating existing assets before jumping to high capital investments. Repair and refurbishment of main components and spares offers an opportunity to reduce operating costs while extending the life of an asset. Supermajors can leverage their operating experience to offer repair and refurbishment solutions to enable owner/operators to optimize the life of an asset.

4. Get to scale to drive synergies

Operational and cost improvements can come from unleashing synergies across assets, technologies, and geographies. Supermajors can leverage capital to develop asset synergies, by technology or by geographic area, to drive operational efficiency and reduce costs.

5. Invest in the grid

The infrastructure we have today is not going to meet our 2030 grid needs, let alone 2050. It's not the sexiest investment – however while you can have all the utility-scale generation in the world, without a functioning grid that can manage future supply and demand, we'll face even bigger problems. While distributed generation will solve some of those problems, urban areas will require, and will be more efficiently served, with utility-scale generation and distribution. Supermajors should invest in distribution and transmission opportunities where utilities and today’s grid operators have struggled to invest.

A future energy solution is not going to come from just one technology - but contrast growth opportunity and associated risks against other technology solutions and you'd be hard pressed to justify not investing in renewables. Supermajors have the opportunity now to transform their business models to take advantage of this and set themselves up for success in a changing energy industry.

-----

This thought leadership article was originally shared with Energy Central's Energy Collective Group. The communities are a place where professionals in the power industry can share, learn and connect in a collaborative environment. Join the Energy Collective Group today and learn from others who work in the industry.

-----

Earlier: