OIL DEMAND WILL UP: 2020

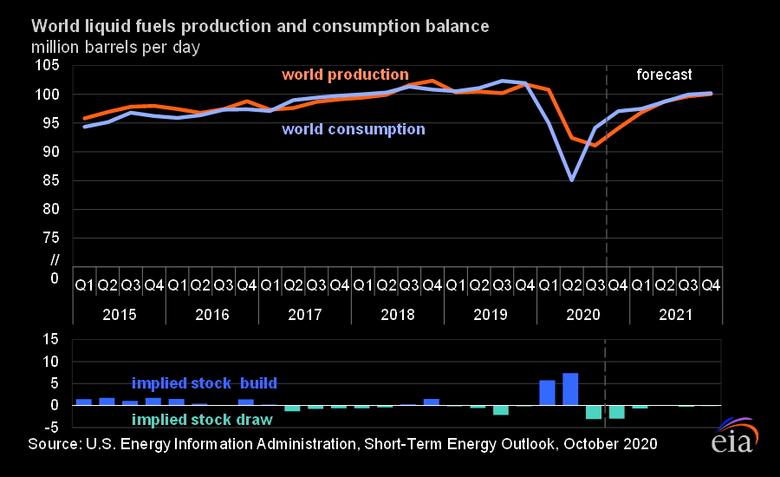

PLATTS - 13 Oct 2020 - OPEC raised its global oil demand forecast for 2020 by 60,000 b/d from last month to 90.29 million b/d on Oct. 13 as it sees an improvement in China's demand for most oil products except for jet fuel.

This is the first increase in its 2020 demand forecast in three months.

"China so far appears to be the only country globally moving steadily on the path to recovery based on gradually improving economic indicators, particularly in industrial production, which are rising from month to month," OPEC said in its latest monthly oil market report released Oct. 13. "Oil demand is projected to be in line with these positive developments and trends."

The bloc produced 24.11 million b/d in September, the report found, with the Q3 average at 23.8 million b/d, or 600,000 b/d lower than demand for its crude, indicating room for OPEC and its partners to maintain their relaxed quotas going into 2021. Its output had been above demand for its crude in Q1 and Q2, it said.

OPEC and its allies, including Russia, are in the midst of a historic supply accord enacted during the depths of the coronavirus market meltdown and have to decide how long to maintain their current 7.7 million b/d production cuts, which are scheduled to taper to 5.8 million b/d for 2021 through April 2022.

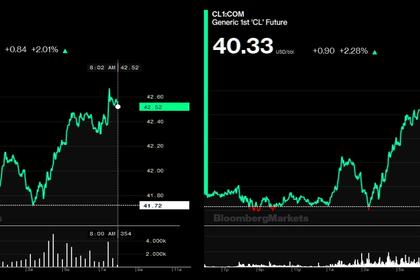

Oil prices have wobbled around $40-$45/b since June due to the economic uncertainty over rising infection rates in many countries, and speculation is rife on whether the OPEC+ alliance will tighten its quotas.

The nine-country Joint Ministerial Monitoring Committee, co-chaired by Saudi Arabia and Russia, meets monthly to recommend any changes to output levels, if needed. The committee will next meet on Oct. 19.

In the most recent JMMC meeting on Sept. 17, Saudi energy minister Prince Abdulaziz bin Salman said he's secured commitments from OPEC+ compliance laggards to make good on their pledged crude production cuts by the end of December.

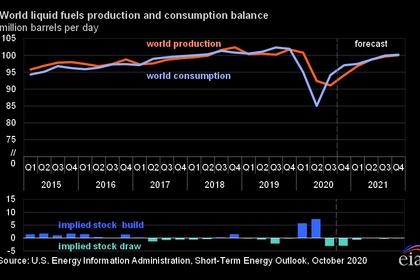

Oil demand, hit hard by the coronavirus pandemic, will shrink 9.5 million b/d in 2020, and rebound by 6.5 million b/d next year to 96.84 million b/d, according to the latest report, which is slightly lower than 96.86 million b/d from last month's report.

Meanwhile, non-OPEC supply was revised higher slightly to 62.8 million b/d for 2020, a drop of 2.4 million b/d from 2019.

Global oil inventories declined in August to 3.204 billion barrels, about 219 million barrels above the five-year average that the OPEC+ alliance has said it is targeting, according to the report. The Americas and Europe contributed to the stock decline, it said.

-----

Earlier: