OIL, GAS WILL BE HALF

EXXONMOBIL - Oct. 21, 2020 - Darren Woods discusses future of industry and company with employees

A message from Darren Woods – Employee Forum

As you may know, today we held an employee forum at our campus in Houston. Unfortunately the pandemic limited the number of people who could attend and, given the time differences of our businesses around the world, I thought it might be useful to summarize the key points for you to read at your convenience.

A recording of the forum is available on EMformation and will be on Inside ExxonMobil shortly.

In the presentation, I discussed the current state of our industry, how we are managing through this difficult period, where we are heading as a company, and finally how I remain incredibly optimistic about our future, despite these challenging times.

Strategy reconnect

We started by looking at the changes we made over the past few years to the functional businesses that were formed at the time of the Exxon and Mobil merger to get the best of both companies. That structure served us well, but to compete in the current marketplace we needed an end-to-end view of the business, greater customer understanding, and more rapid translation of competitive advantages to wins.

So, as you know, we initiated strategies for each of our businesses focused on improving competitiveness and growing total shareholder returns. These strategies defined how we would increase competitive focus, drive efficiencies and effectiveness, and improve earnings power and cash-flow generation. We reorganized the Downstream and Upstream along value chains, created the Global Projects organization, updated the leadership framework, revitalized our performance assessment process and developed an industry-leading investment portfolio.

We were making good progress on executing our strategy when the pandemic hit.

Demand destruction

It's difficult to overstate the devastating impact of the pandemic on businesses big and small, in every community and country around the world. The impact has been especially severe on our industry as energy consumption contracted when economies shut down.

Oil demand dropped about 20 percent – to 78 million barrels per day in April vs 101 million barrels a day in December.

Global automobile production dropped 60 percent in April versus the previous year, which impacts sales of chemical products and lubricants.

Commercial airplane flights were down 70 percent during the same time period, dramatically reducing sales of aviation fuel.

Resilience in response

All of this economic loss only intensified the worry, stress and pain many of you faced with the health of loved ones threatened by Covid. Despite this, the women and men of ExxonMobil rose to the challenges of the pandemic by taking care of themselves and their families, helping their communities and delivering on business objectives.

We made contributions to those in need of our products – from sanitizers, to specialty medical materials, to fuel for first responders. But what sometimes gets less attention are the heroic efforts and sacrifices our people made to keep our businesses running and initiatives on track.

We kept operations going around the world 24/7. That required working and living at refineries and chemical plants, on offshore platforms or in fabrication yards, with added Covid safeguards beyond our extensive safety protocols. It meant months at work, quarantined and isolated from families. Office workers were impacted too. You worked long hours from home – many of you without space or privacy. You completed critical work to keep businesses running and financial books accurate, balancing the needs of work with evolving personal challenges.

The business response was equally resilient and aided by the reorganizations of the Upstream and Downstream, increased visibility across markets and coordination along value chains. That led to quicker and more informed decisions regarding production volumes, refining and chemical operations, and other key parts of our business that just wouldn't have been possible previously.

Strong performance

Despite the unprecedented demand destruction -- and with all the distractions you faced -- this year you have delivered excellent operating results, which is a testament to your commitment and dedication.

We are delivering record safety and environmental performance across the organization and are on track to significantly beat targets to reduce methane emissions and flaring. Facility reliability has improved despite operating in very dynamic conditions and managing different operating circumstances.

And crucially important, we are exceeding the targeted reductions in spending that we committed to in March, deferring more than $10 billion in capital and cutting 15 percent of cash operating expenses.

You all should take pride in this. I am extremely proud of what you have accomplished. Thank you – for your hard work, your personal sacrifices, and for demonstrating the characteristics that make this company great.

More to do

I wish I could say we were finished, but we are not. We still have some significant headwinds, more work to do and, unfortunately, further reductions are necessary.

Our plan is to continue to stage project execution and spending, and preserve the value of investments while offsetting inefficiencies and costs associated with deferrals. Plans are leveraging the new organizational structures and better line of sight to the business to eliminate lower value work, redesign work processes and improve cost competitiveness.

Making the organization more efficient and more nimble will reduce the number of required positions and, unfortunately, reduce the number of people we need.

We all recognize the consequences of these difficult decisions and the impacts they have, which is why we're focused on getting it right by undertaking thorough and thoughtful assessments by business and by country. We believe a bottom-up assessment is the right approach for our business and employees.

Unfortunately, these assessments take time, which can cause additional anxiety. Organizations are being informed of the impacts as soon as work is completed, which you've seen with recent announcements in Australia and Europe.

We are very close to completing study work in the U.S. and Canada and other parts of the world.

For the U.S., as we complete our reviews, we will share an update with the Board, and you can expect to hear details from your line leadership shortly thereafter.

As difficult as this is, I hope you understand it is critically important for the future of our company.

Fundamentals

This brings me to a discussion of what the future holds for our industry and for our company.

Some believe the dramatic drop in demand resulting from the corona virus reflects an accelerating response to the risk of climate change and suggest that our industry won't recover. But as we look closely at the facts and the various expert assessments, we conclude that the needs of society will drive more energy use in the years ahead – and an ongoing need for the products we produce.

Energy is essential for human progress and, as people's lives improve, their consumption of energy increases. Billions of people are aspiring to and working for an improved standard of living for themselves and their families.

Energy disparity

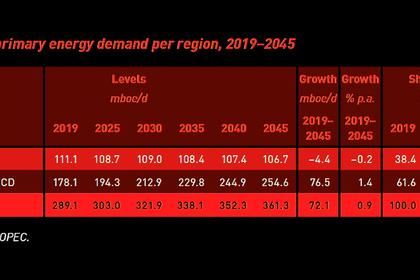

Today, only 15 percent of the world's population lives in high-income, OECD economies. The rest live in non-OECD countries where Gross National Income is about 25 percent of that of OECD countries.

As economies grow and quality of life improves so will the non-OECD per capita consumption of energy, which is now only one-third what the people in the OECD countries consume.

These examples put that into perspective:

It takes the same amount of electricity to run a refrigerator-freezer in the U.S. as an average person in a non-OECD country consumes in one year.

Average energy usage per person in India and Africa is 10 percent of usage by someone in the U.S.

In 2018, about 800 million people lacked access to electricity.

Access to reliable, cost-effective energy is critical to the growth and development for these countries and their people.

We often talk of companies having a higher purpose. Well, I can think of no higher purpose than helping people and communities around the world grow in prosperity and achieve their aspirations for a better life through affordable energy.

The dual challenge, that we talk about frequently, involves meeting that need for energy while managing the associated environmental impacts, including the risks of climate change.

Let me now turn to that challenge – managing the risks of climate change and more specifically, managing global emissions.

Source of emissions

About two thirds of global greenhouse gas emissions come from energy; other major sources are agriculture, forestry and land use.

Of the energy-related CO2 emissions, about 80 percent are from three sectors: power generation, industrial and commercial transportation. It's also important to remember that two-thirds of today's energy emissions come from non-OECD countries, which are forecast to increase with energy use.

To solve the world's greenhouse gas emissions challenge, new solutions will be needed for these sectors. And to work in non-OECD nations, solutions need to be affordable.

Energy diversity

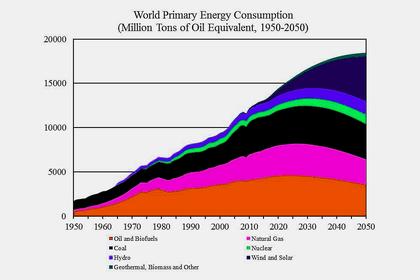

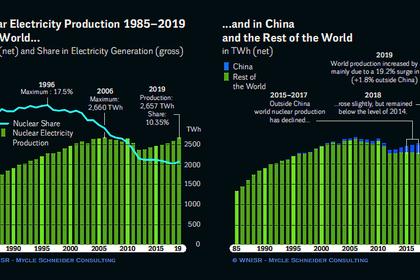

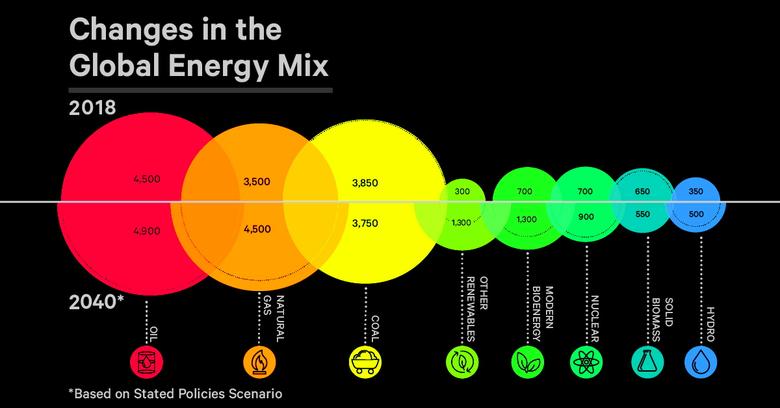

Today, oil and gas make up about 60 percent of the global energy mix.

In 2040, despite increasing investments in renewables and concerns with emissions, oil and gas are still projected to make up about 50 percent of the global energy mix. This is a view held by major third-party sources.

Today's alternatives don't consistently offer the energy density, scale, transportability, availability - and most importantly - the affordability required to be widely accepted.

Advances in technology are necessary. Unfortunately, only 7 of 46 important technologies and sectors needed to reach the Paris Agreement goals are on track, according to the International Energy Agency (IEA), an authoritative advisory body made up of energy ministers and senior representatives from 30 member countries.

Deployment of current technologies is not enough to solve the problem.

So, while society will move towards lower-carbon sources of energy as technology improves, oil and gas will continue to play an important role in the long-term energy mix.

In fact, the IEA published new projections last week that oil and gas are expected to remain at 53 percent of the global energy mix in 2040, under their Stated Policies Scenario.

In a scenario developed by the IEA that would meet the Paris Agreement's 2 degree Celsius case, oil and gas will be about 46 percent of the energy mix, while renewables grow to 18 percent.

Energy mix slow to change

The transition of the energy system will take a long time because of its size, complexity and amount of infrastructure required to keep it running efficiently. It took roughly 100 years for oil to replace coal as the world's dominant form of energy.

This understanding underpins our approach to addressing the dual challenge.

Addressing dual challenge

In the near term, we work to mitigate emissions from our own operations, which we do by investing in cogeneration, energy efficiency, and efforts to reduce flaring and methane emissions. We help consumers reduce their emissions with products that improve their efficiency, such as light-weight plastics and fuel-efficiency efforts, and by expanding the supply of cleaner burning natural gas, which is especially important in power generation.

For the longer term, we are deploying our competencies in breakthrough technology development. We are pursuing advances in the high-emission sectors - power generation, commercial transportation and industrial - where current technologies are insufficient to achieve deep emission reductions.

Breakthroughs in these areas are critical to reducing emissions and would make a meaningful contribution to achieving the goals of the Paris Agreement, which we support.

We are partnering with academia, government and industry to research technologies that experts involved in the Intergovernmental Panel on Climate Change say will be needed, such as biofuels, direct air capture, and reducing the cost of carbon capture, usage and storage.

Global oil demand

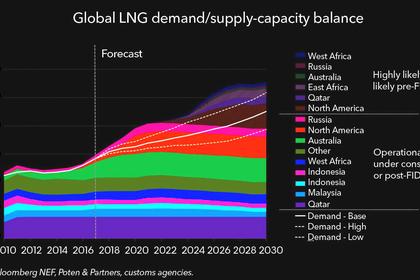

Our outlook projects oil demand to grow at 0.6 percent a year and gas demand to grow by 1.3 percent. With depletion rates, new oil production needs to increase by nearly 8 percent per year and natural gas by 6 percent.

Under any demand scenario, depletion supports the need for significant investments.

The IEA estimates that between $12 trillion and $17 trillion of additional industry investments are needed by 2040.

Even accounting for the short-term demand impact of Covid-19, the investment case is still clear.

There is a direct link between energy consumption and a growing and more prosperous population. As people become more prosperous, society will need more energy. The available alternatives for our existing energy system is incomplete, and - given the size, complexity and existing infrastructure – the energy transition will require significant time.

This is a compelling investment case for the industry and our company - and is foundational to our long term strategies and plans.

Near term

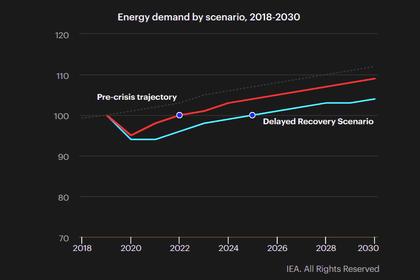

Let me conclude by returning to the near term. We know that the industry impact of the pandemic is unprecedented. Reduced demand was roughly five times the decline seen with the 2008 financial crisis.

We also know the current situation is temporary - but with an uncertain path and pace of recovery.

Our plans account for this but we will have to stay nimble and respond to evolving market conditions. Irrespective of short-term volatility, we must stay safe, maintain the integrity of our operations, drive efficiencies and continue investing.

Core values

These are difficult times. We are making tough decisions, some of which will result in friends and colleagues leaving the company.

Our core values have never been more important. We will maintain our focus on doing what is right.

We will continue to care for the well-being of our communities and our people - and providing appropriate support for our colleagues who leave our organization.

Remember the important role we play in meeting the needs of society - particularly those who are disadvantaged. In these trying times, remember the lives saved by the millions of medical masks and gowns and bottles of sanitizer created from our products, and the emergency vehicles fueled from our refineries.

The pandemic's short term impact on our industry puts additional importance on our strategy and projects as industry under-investment today will increase the need for our products in the near future.

Staying committed to our strategies, while adjusting the pace of our investments and positioning the company to more effectively compete – will serve us and society well in the near term. Continuing the search for new technologies required to address climate change will do the same - longer term.

We must act with conviction and take personal ownership for the success of our company; be thoughtful, thorough and maintain our standards - and continue to be resilient.

I have tremendous confidence in our plans, our people and our future.

Thank you for all you do.

-----

Earlier: