OIL PRICE: NEAR $41 ANEW

REUTERS - OCTOBER 27, 2020 - Oil rose on Tuesday towards $41 a barrel as oil companies shut down some U.S. Gulf of Mexico oil output due to a hurricane, although surging coronavirus infections and rising Libyan supply limited gains.

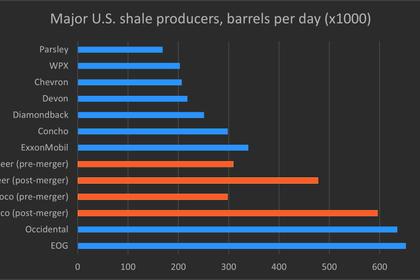

Companies including BP BP.L, Chevron CVX.N and Equinor ASA EQNR.OL evacuated rigs, and so far producers have shut 16%, or 293,656 barrels per day (bpd) of oil output due to Hurricane Zeta.

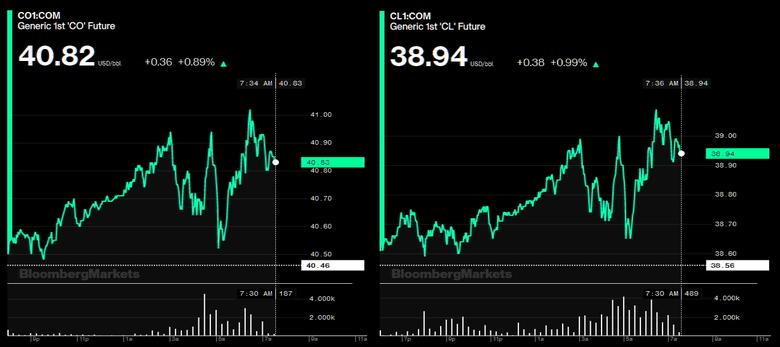

Brent crude LCOc1 was up 52 cents, or 1.3%, at $40.98 a barrel by 1028 GMT. U.S. oil CLc1 gained 38 cents, or 1%, to $38.94. Both contracts fell more than 3% on Monday.

“Whilst Hurricane Zeta could provide a price relief under the current circumstances, it will be very brief,” said Tamas Varga of oil broker PVM. “The mood is, indeed, souring.”

Oil has declined because of rising coronavirus infections globally and a lack of progress on agreeing a U.S. coronavirus relief package. Still, U.S. House of Representatives Speaker Nancy Pelosi is hopeful a deal can be reached before the Nov. 3 election.

“The outlook for road fuels demand is souring on rising COVID-19 infections,” said analysts at JBC Energy.

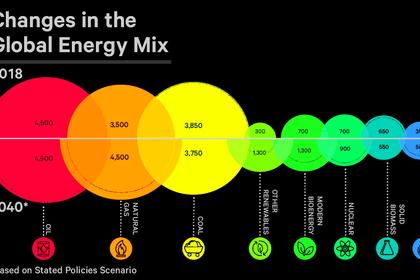

Libyan production is expected to reach 1 million bpd in coming weeks, the country’s national oil company said on Friday, a quicker return than many analysts had predicted, complicating efforts by other OPEC members and allies to restrict output.

The Organization of the Petroleum Exporting Countries and allies, known as OPEC+, are planning to increase production by 2 million bpd from January after record output cuts this year.

But Russian President Vladimir Putin, speaking last Thursday, did not rule out extending the cuts for longer.

The latest round of U.S. inventory figures due later on Tuesday and on Wednesday are expected to show rising supplies. Analysts expect crude stocks to rise by about 1.1 million barrels.

-----

Earlier: